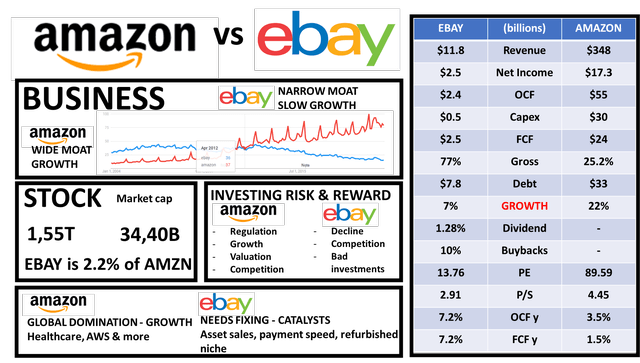

eBay stock research rationale and Amazon comparison

eBay stock vs Amazon stock - Source: Sven Carlin

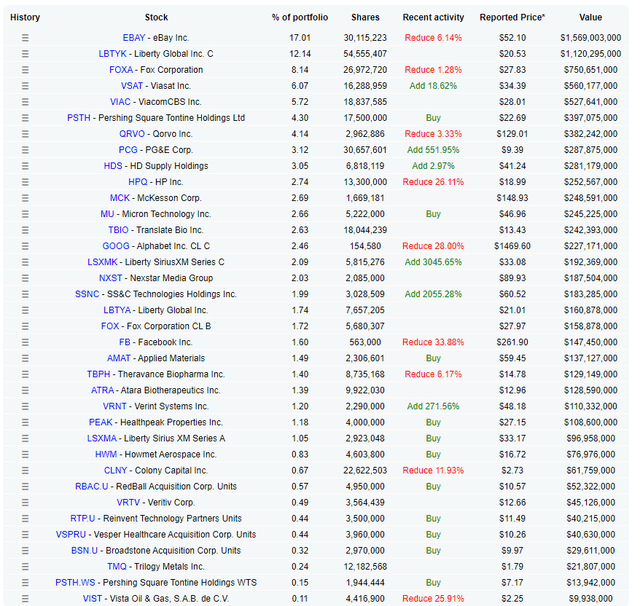

eBay (EBAY) is Seth Klarman's largest holding within the Baupost Group. As I regard Klarman as one of the best value investors out there, it is always good to take a look at his positions.

eBay is Klarman's largest position - Source: Dataroma

Further, it is always good to compare investments in order to best understand the risks and rewards of a specific investment. I've decided to compare eBay with Amazon (AMZN) due to their competitive environment and because it also gives an excellent perspective on growth and value investing.

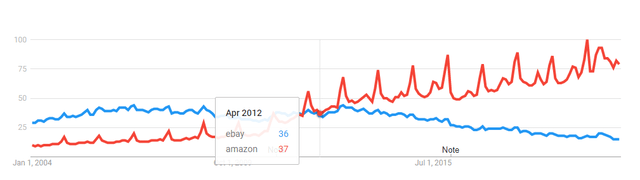

eBay and Amazon stock price analysis

Despite lagging on all fronts compared to Amazon, eBay's stock did really well over the last decade and also benefited from the Covid-19 intensification of online purchasing.

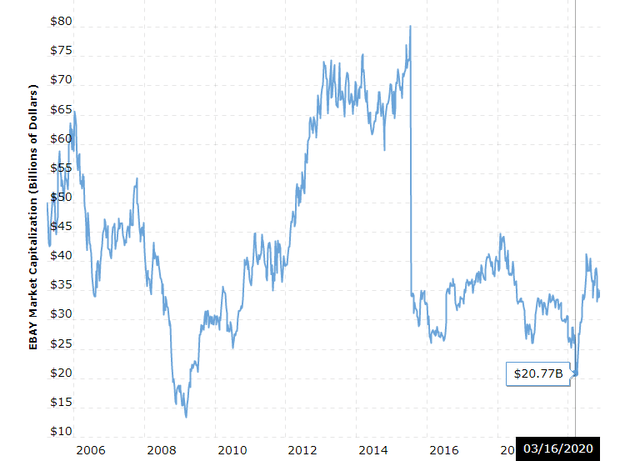

eBay stock price historical chart

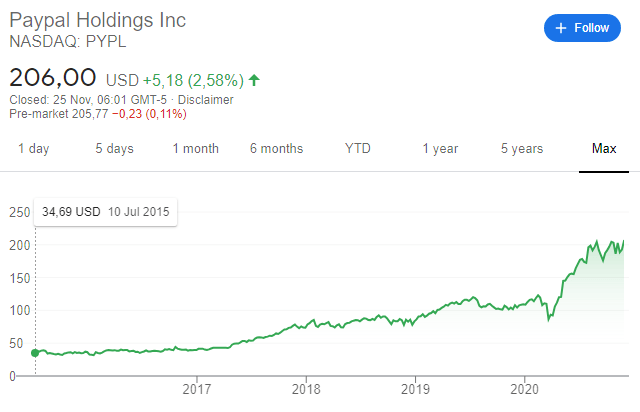

At first sight, eBay stock didn't perform as well as AMZN did, but we must not forget the PayPal spin-off in 2015.

PayPal stock price since spin-off

eBay's market capitalization didn't change much since, but PayPal's performance rewarded eBay shareholders almost equally to what Amazon did for its shareholders.

eBay's market capitalization - Source: Macrotrends

Excluding PayPal, Amazon did much better.

Amazon stock price historical chart

So, despite eBay being a declining business, shareholders have been similarly rewarded in the past. However, eBay is still in a negative trend which is significant for future investment returns while Amazon's growth is strong and steady.

eBay vs Amazon on Google trends - Amazon's huge growth starts in 2009, eBay has been declining since 2012

Despite the declining business, eBay still managed to reward shareholders as it turned into a value investment. It often happens that way; the stock suffers when the business doesn't meet exuberant growth expectations, the company needs to replace