ONEOK (NYSE:OKE) is a large, natural gas focused midstream company with a near $17 billion valuation and a 10% dividend. The company's focus on natural gas means it has additional diversity and reliability versus other companies. As we'll see throughout this article, the strong fee-based asset base and continued demand for its assets make OKE a valuable investment.

Asset Base

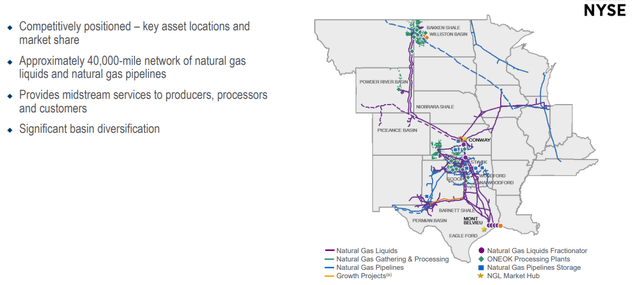

ONEOK has an impressive asset base with a well-integrated natural gas portfolio and market-leading assets.

Asset Base - Investor Presentation

The company has a competitively positioned asset base with key asset locations integrating major demand hubs like Chicago and major supply hubs like the Williston Basin. OKE has significant basin diversification throughout the United States. The company provides midstream services across the board, highlighting its asset strength.

As long as natural gas remains integral to the United States, and we see that as happening for decades to come, the company's assets will be essential. The company utilizes this asset base to support its double-digit dividend yield. That's despite its 50% drop in share price YTD as the company has been lumped into other COVID-19-related oil price drops.

Resilient Business Model

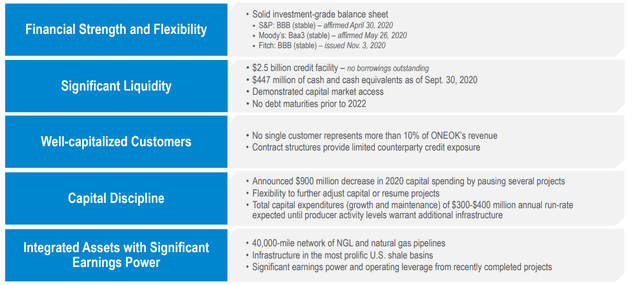

ONEOK has a resilient business model from its asset base that supports its overall commitment to shareholder returns.

Resilient Business Model - Investor Presentation

ONEOK has a solid investment-grade balance sheet with a stable rating consistently affirmed by the rating agencies. The company has $2.5 billion in available borrowings and nearly $500 million in cash and cash equivalents. It has a demonstrated ability to access the capital markets, and no debt maturities prior to 2022, highlighting its financial strength.

The company has distributed customers, with no single customer representing more than 10% of its revenue. The company cut 2020 capital spending significantly and expects growth and maintenance capital expenditures going forward

Create a High Yield Energy Portfolio - 2 Week Free Trial!

The Energy Forum can help you generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing and you can be a part of this exciting trend.

Also read about our newly launched "Income Portfolio", a non-sector-specific income portfolio.

The Energy Forum provides:

- Managed model portfolios to generate high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic market overviews.