Scotiabank (NYSE:BNS) is one of the larger Canadian banks available for investment. It's one of the "Big five" and prior to the COVID-19 crisis, it together with the other Canadian banks sported extremely safe dividend ratings and appealing investment fundamentals.

While the COVID-19 crisis has dimmed the safeties somewhat, with regulators deciding whether banks get to increase or even pay out their dividends, the overall fundamental appeal of the bank is, as I see it, largely unchanged. Even if year-over-year results are bad - and believe me, on paper they do look bad - we can't lose sight of the bigger picture here.

So let's look at what 3Q20 brought, and where we can consider the bank today.

Scotiabank - How has the company been doing?

Scotiabank, like virtually all financial stocks, has been hit hard by the COVID-19 pandemic. The only type of financial stocks, for the most part, that seem to have escaped negative impacts or even outperformed on a massive scale, are pure-play brokers. My own broker has more than doubled their net income on an annual basis, in no small part due to fee incomes which have spiked during these volatile months.

Alas, Scotiabank is no pure-play broker. So it's year-over-year trends in terms of income in its home market, Canada looks closer to this.

(Source: Scotiabank 3Q20 Presentation)

International operations look even worse and came in very close to not being able to achieve a positive result in 3Q20.

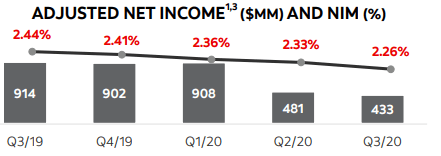

What's driving these trends, such as an adj. YoY 45% EPS drop, pre-tax profit down 3%, and core banking income margins down over 3%?

Earnings & Credit Losses

Well, there's margin compression, extremely low overall interest rates which lead to lower interest income in both core operating segments. Scotiabank has also taken significant hits from credit loss provisions, with the