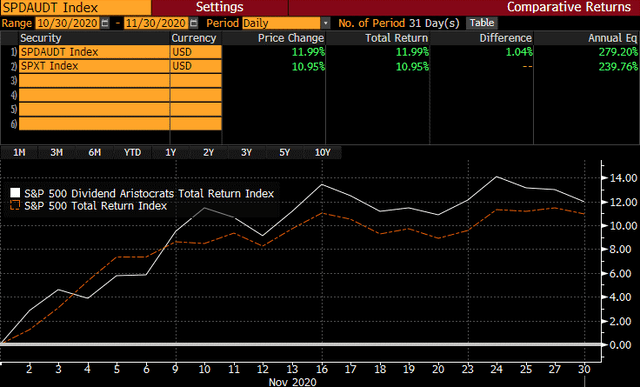

November 2020 was the third consecutive month of relative gains for the Dividend Aristocrats (BATS:NOBL) versus the S&P 500 (SPY). Unlike September and October 2020, where the outperformance for the dividend growth strategy was in a down month for stocks broadly, the dividend growth strategy outperformed in November in a very strong month for stocks broadly. It was the best monthly return for the dividend growth strategy (+11.99%) since the early recovery from the Great Recession in April 2009 (+12.19%).

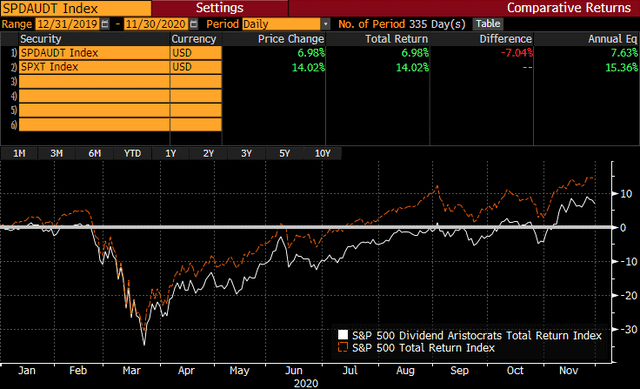

It has been a good three-month run for the strategy. After lagging early in the recovery due to the strategy's natural tech underweight, the dividend growth strategy has now slightly outperformed during the market recovery that started on March 23rd. Over longer time intervals, the strategy has tended to outperform in down markets and keep pace in recoveries, but 2020 - in a year of unusual activity - saw the strategy lag into the March lows and now slightly outpace the broad market in the subsequent recovery. The dividend growth strategy is still down on a relative basis versus the broad market, but now up about 7% on the year after November's strong rally.

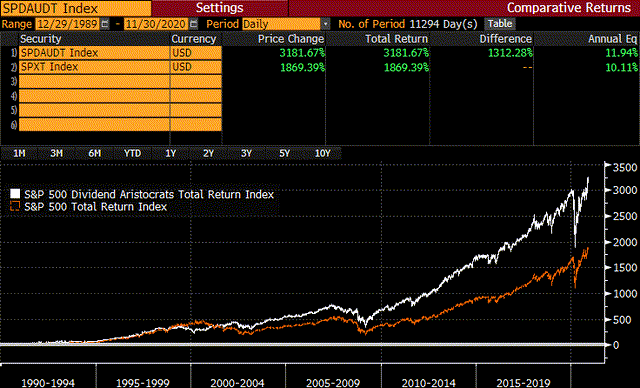

Expanding this time horizon to the full three decade plus dataset for the dividend growth strategy, and it has outperformed by about 1.83% per annum in spite of the relative underperformance in 2020.

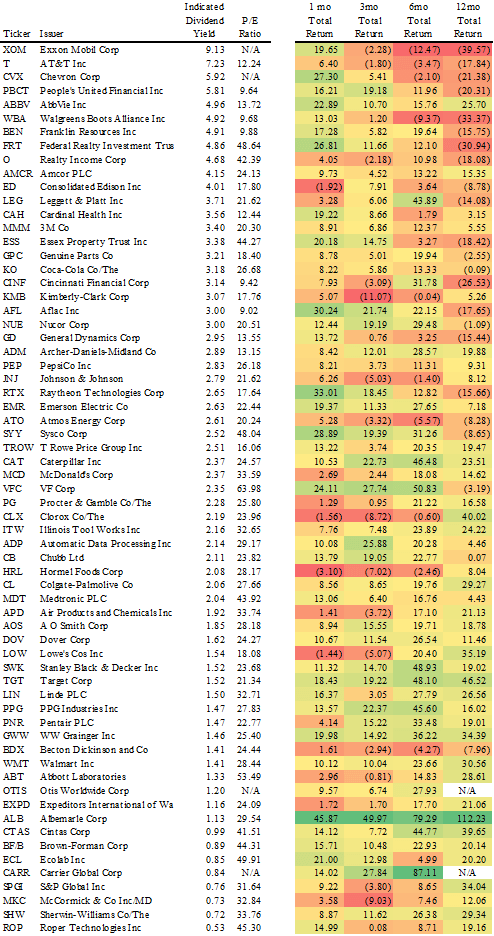

In the table below, the list of the current Dividend Aristocrat constituents is sorted descending by indicated dividend yield, and lists total returns, including reinvested dividends, over trailing 1-, 3-, 6-, and 12-month periods.

Here are a couple of notable observations from this list: