Brief Thesis

Over the past 5 years, climate change has become a progressively polarizing subject, constantly dividing experts, politicians, and the public alike. Several nations have committed to reductions in CO2 emissions and initiatives emphasizing environmental improvements.

The Paris Climate Accord has been a pivotal agreement and the object of much contention between richer nations pushing for curbs on pollution and developing nations whose growth prerogative requires more flexibility.

Irrespective of your personal convictions on the subject, climate change has undeniably become a flourishing and lucrative thematic in global capital markets.

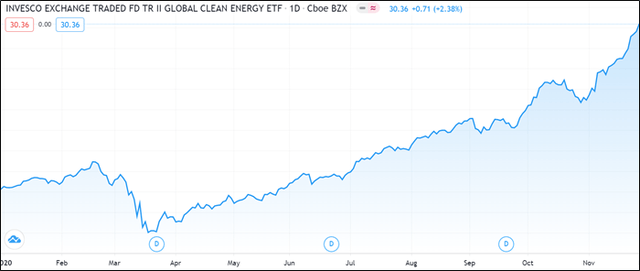

Price action year to date Invesco Global Clean Energy ETF

Source: TradingView

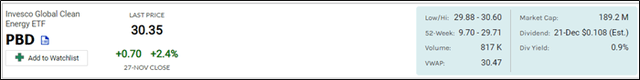

Regarding Invesco Global Clean Energy ETF (NYSEARCA:PBD) - my opinion remains neutral. While I recognize alternative energy will continue to be an enduring subject, I continue to be somewhat skeptical on underlying asset quality and perplexed by the onerous expense fees - specifically for an ETF which has no extraordinary traits, such as leverage or use of exotic derivatives, which may add to administration costs.

No options market exists for this ETF which is another drawback. This prevents income generation through covered call selling against which the ETF can be held as collateral. Likewise, without an active options market, it is impossible to protect the underlying from substantive drawdowns.

I advise investors to shop around the ETF marketplace before making a commitment. I additionally encourage investors to bring themselves up to speed with all facets of the energy mix and how this may impact the global economy. In passing, I recommend you watch "Planet of the Humans" by Michael Moore which takes a more critical view of the clean energy industry.

Source: Market Chameleon

Overview

Invesco Global Clean Energy ETF is a relatively dated offering having been launched on 13 June 2007. A passively managed open-ended structure, its aims