(By Colorado Wealth Management Fund, Co-Produced with Hoya Capital Real Estate)

We want to take a moment to touch on the data center REITs and cell tower REITs. Over the last several months, there was less opportunity in the space due to higher prices. On the other hand, we were seeing incredible opportunities in apartment REITs and mortgage REITs. Consequently, we spent far less time writing about this niche. These are REITs we expect to deliver excellent growth over the long term, but we were waiting for prices to retreat. Since late July, most of the sector has been trending down. It bounced a bit in early October, then resumed falling. We’re not looking for small companies in the space. There are precisely 3 data center REITs and 3 cell tower REITs we want to consider:

Data Centers

Cell Towers

Within those 6 REITs, the two we currently cover are DLR and CONE. We intend to expand coverage on the others. It didn’t make sense to do it over the summer because share prices weren’t actionable. When picking which REITs to add at any given point, we prefer to have an actionable price from the start.

Quick Overview

Who are these REITs for? They are for the dividend growth investor, especially those with a long time frame. We would encourage investors not to focus much on the dividend yield. Instead, consider the long-term demand and rate of growth in normalized FFO per share.

Data centers benefit from an increase in data traffic. The biggest challenge for the sector has been an increase in supply. While demand continues to expand, supply has been expanding even faster. Consequently, pricing has been quite competitive. When yields on development are attractive, you should expect these REITs to issue shares to fund more development. Issuing shares this way “appears dilutive.” By “appears,” we mean it is dilutive for the first year or two and then becomes accretive when the new projects are producing revenue. There are some smaller companies within this sector and they could be bought out. Larger data center REITs are more efficient. They have better scale on overhead and better positions for negotiating with tenants. Management of DLR has demonstrated one of the attractive traits by emphasizing that no one wants to brag about a bit on their data expenses by signing a deal with an unreliable provider.

Cell towers benefit from a unique oligopoly. There are very few major tower owners. While a cell phone provider like Verizon (VZ) could simply build their own towers, the total cost of building and owning that tower is significantly higher than the cost of leasing the space from a REIT like AMT. How does that work? AMT can sell space on a tower to multiple operators. Building a tower with 1 tenant is terrible. A tower with two tenants provides a very good return. A tower with 3 tenants provides an extremely attractive return. Consequently, the only way it could be cheaper for Verizon to own their own towers is if they could lease out space to another company like AT&T (T) or T-Mobile (TMUS). As you might imagine, if Verizon/AT&T/ TMUS were to own a large network of towers and lease space on those towers to each other, that would be quite an antitrust issue.

Valuation

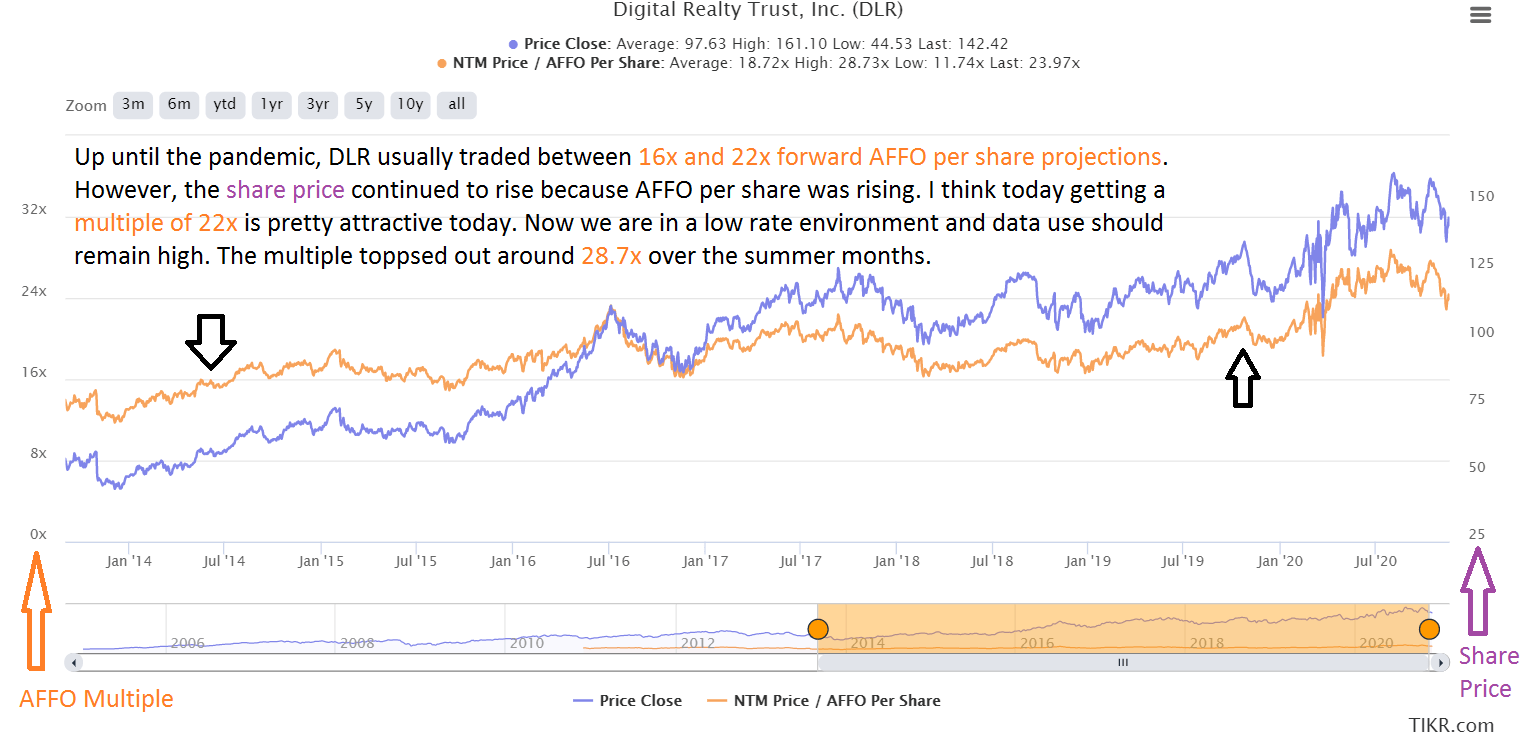

We’re going to focus on the REITs we already cover, but the general trend you’ll see in valuation is similar throughout the data centers. The chart below demonstrates the valuation on DLR over the last 7 years:

Source: TIKR.com

You can see that DLR’s multiple has gradually increased, but for quite a few years they traded within a relatively steady range. With Treasury rates being significantly lower, we think DLR will trade at a lower “implied cap rate.” That means they should have a higher enterprise value (stock + debt) compared to their NOI (Net Operating Income). When that happens, we also see a higher multiple of AFFO. Consequently, we expect the range of AFFO multiples going forward to be higher than the range was from 2014 through 2019. Rather than 16x to 22x, we might say that 21x to 27x would be a more likely range going forward.

The main area for returns here is growth over time (not yield today). Whether investors think about that as share price growth or dividend growth, either metric should be related to AFFO per share over the long term. In the short term, we would expect volatility to continue, but the REIT remains an excellent data center operator.

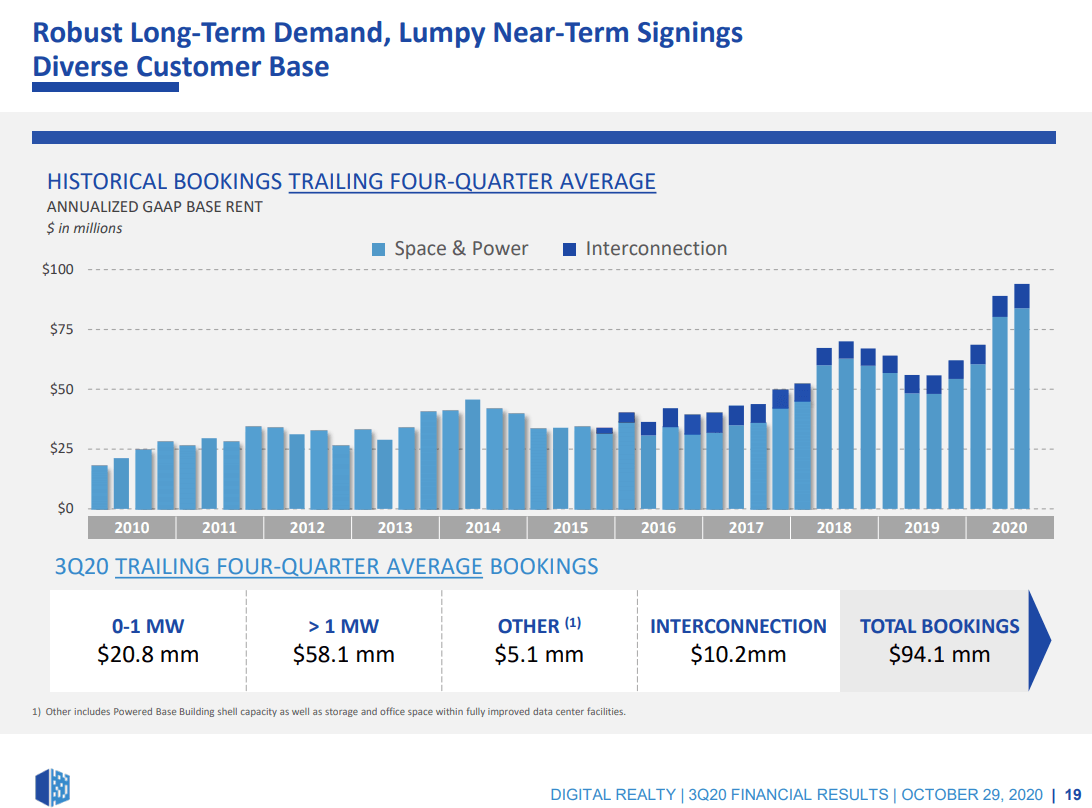

When we talk about Data Center REITs, one of the keywords is “bookings.” Think of this as a leading indicator of revenue. DLR has continued to rapidly increase bookings:

Source: DLR

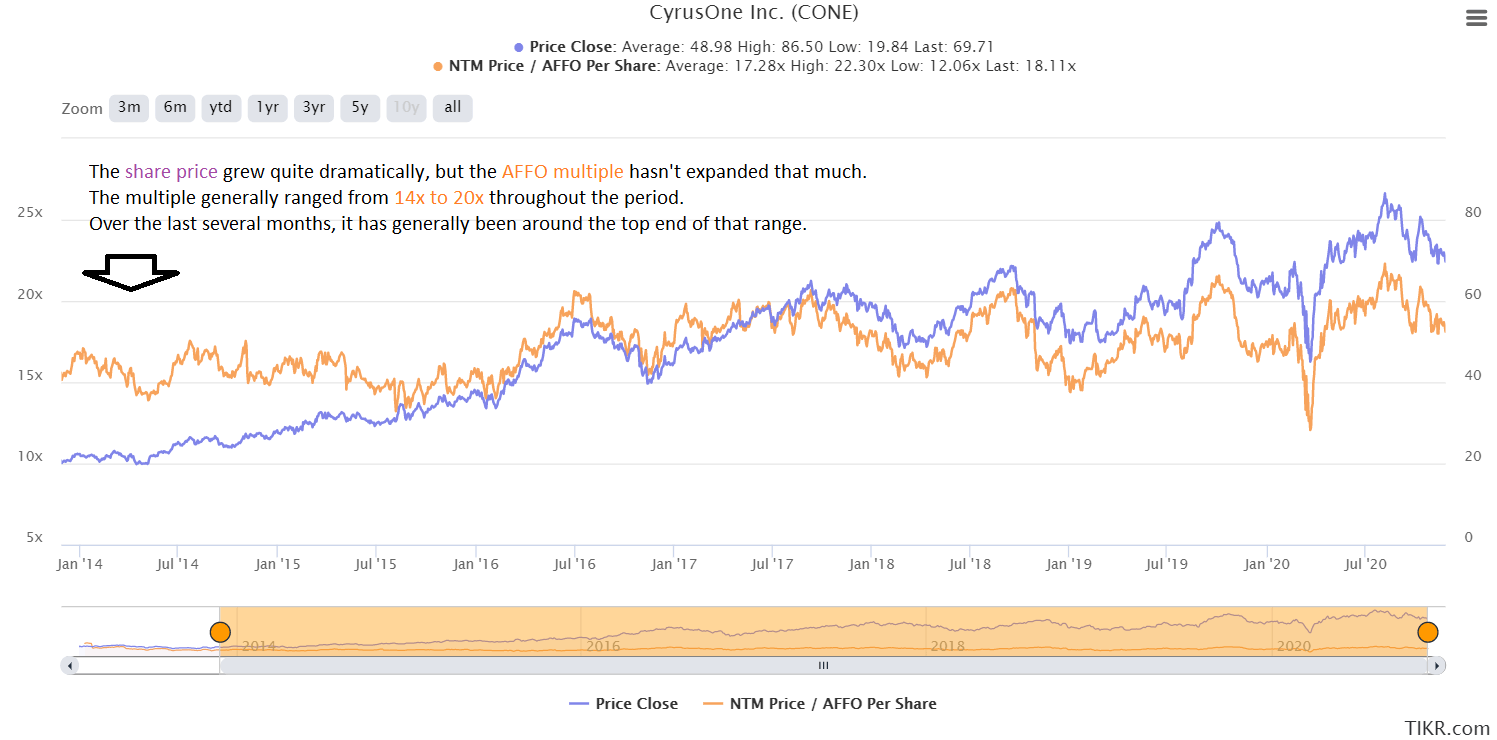

That kind of expansion in bookings (future revenue) doesn’t come without expanding the volume of shares outstanding. Being able to issue shares is how they drive that growth. However, they are still generally growing values on a “per share” basis as well. Well, switch over to CONE for a quick look at the valuation next:

Source: TIKR.com

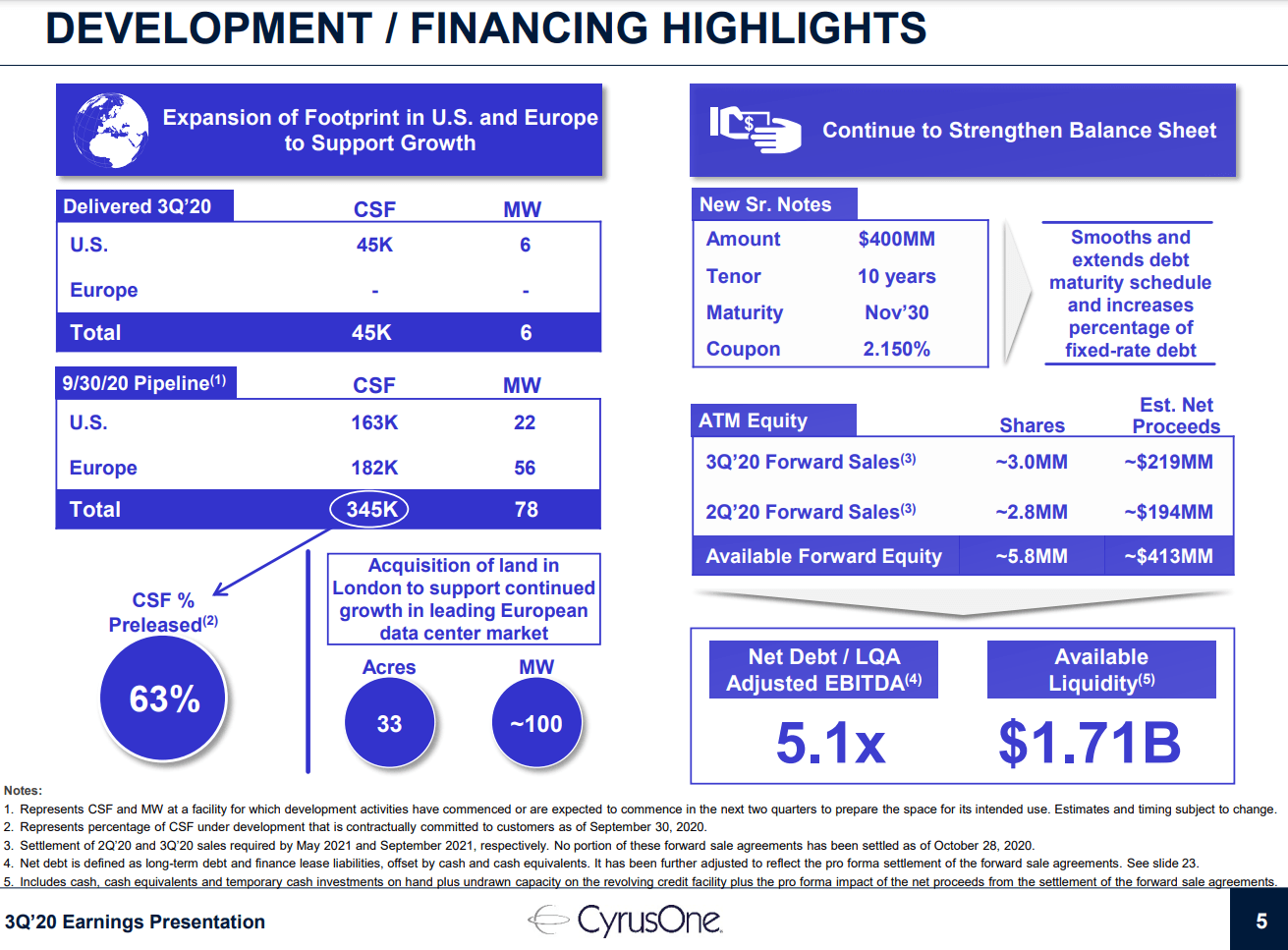

During that time CONE has continued to issue new shares using their ATM program. Using “Forward Sales” to lock in prices, they generated net proceeds of $413 million during Q2 2020 and Q3 2020. That helps CONE strengthen the balance sheet because it means more projects can be funded with equity instead of debt. This is important. While we expect revenue growth to continue for data center REITs, we don’t like risk. We don’t want to see high leverage. We would much rather see a REIT focusing on low leverage:

Source: CONE

What Happened to Data Center and Cell Tower REITs?

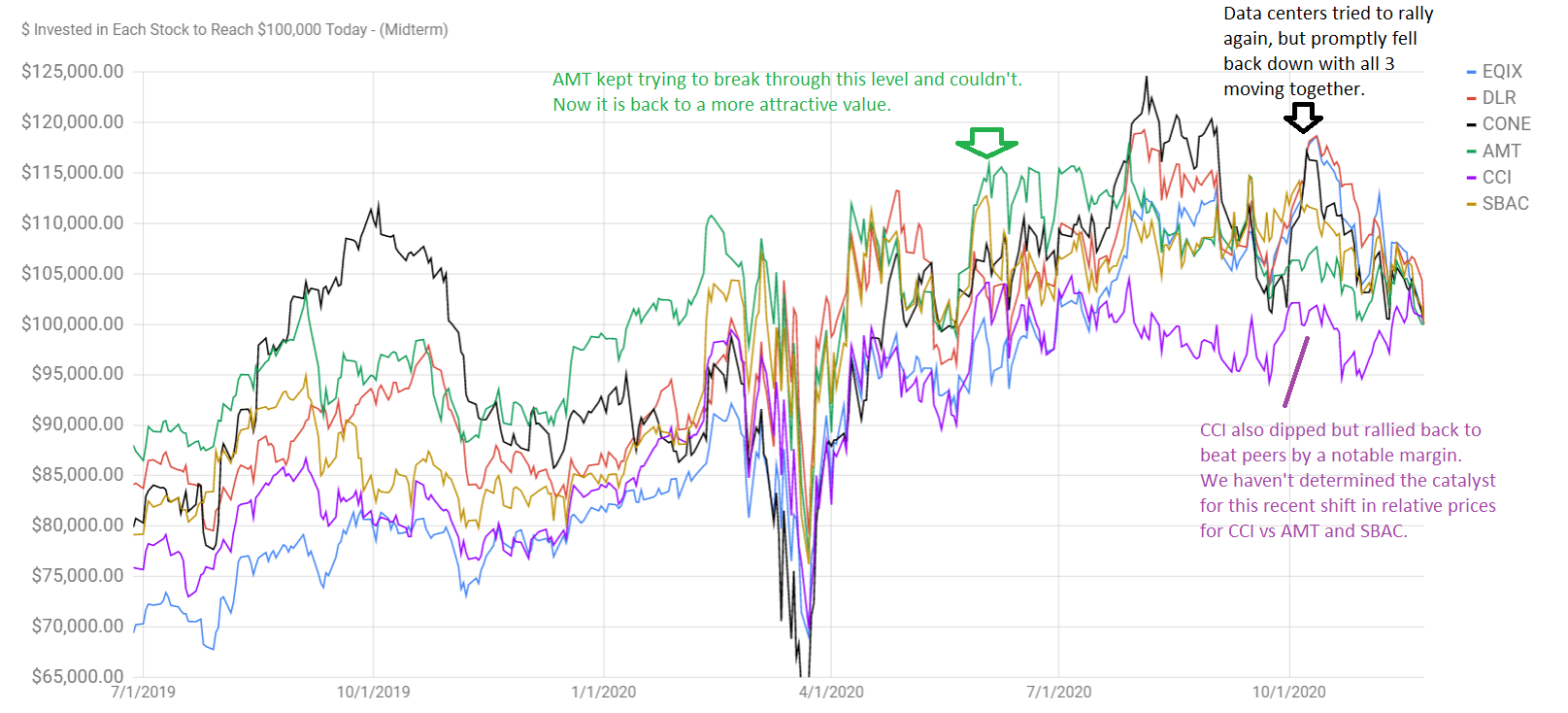

They have an exceptional growth trajectory over the long term, but they also had some dips lately as shown in the $100k chart:

Note: The $100k chart demonstrates how much needed to be invested on any prior day to reach $100k as of the current day. For this article, the current day represents 11/24/2020 since that is when the piece went to subscribers.

Note: The $100k chart demonstrates how much needed to be invested on any prior day to reach $100k as of the current day. For this article, the current day represents 11/24/2020 since that is when the piece went to subscribers.

Since we don’t cover the cell tower REITs frequently yet, we haven’t put together a hypothesis on the recent outperformance by CCI. However, the recent dip for AMT looks like it could be appealing. You may notice within this chart there is generally a pretty strong correlation. That isn’t unusual, data centers REITs and cell tower REITs each tend to move together. Why? These are global high-growth data-focused REITs. Some investors may simply rotate between sectors driving money in and out, leading the prices to move higher or lower.

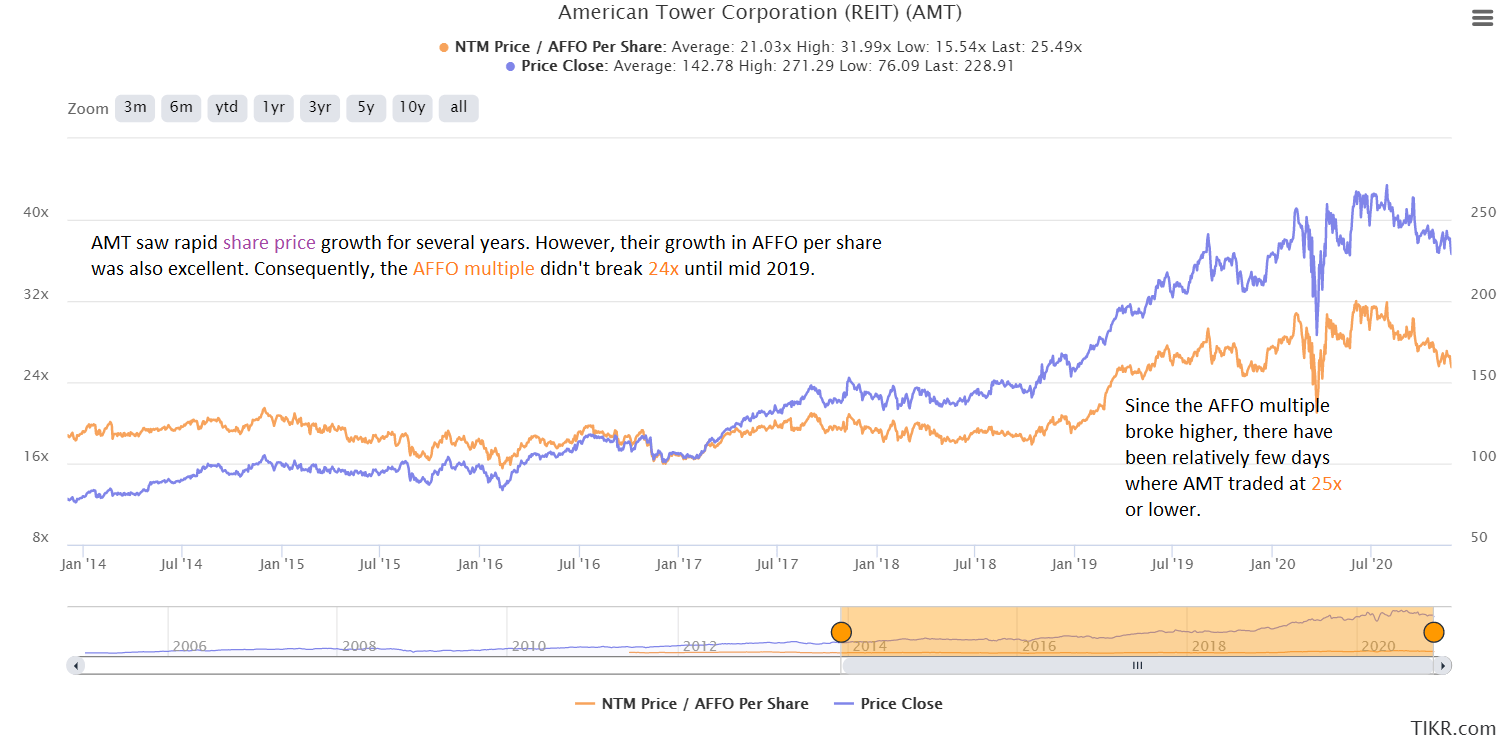

AMT’s chart for the multiple is quite interesting as well. Shares regularly traded within a range until mid-2019. Then the range shifted rapidly and shares began trading at a materially higher multiple. Since then, we haven’t seen them at 25x or lower very often:

Source: TIKR.com

At current valuations, we are considering starting a small position in AMT or making small additions to CONE or DLR. We’re currently at 33.9% cash, which is materially above our normal range. That happens after taking some huge profits. We expect to maintain a defensive focus, but may purchase a small amount in any of these 3 REITs.

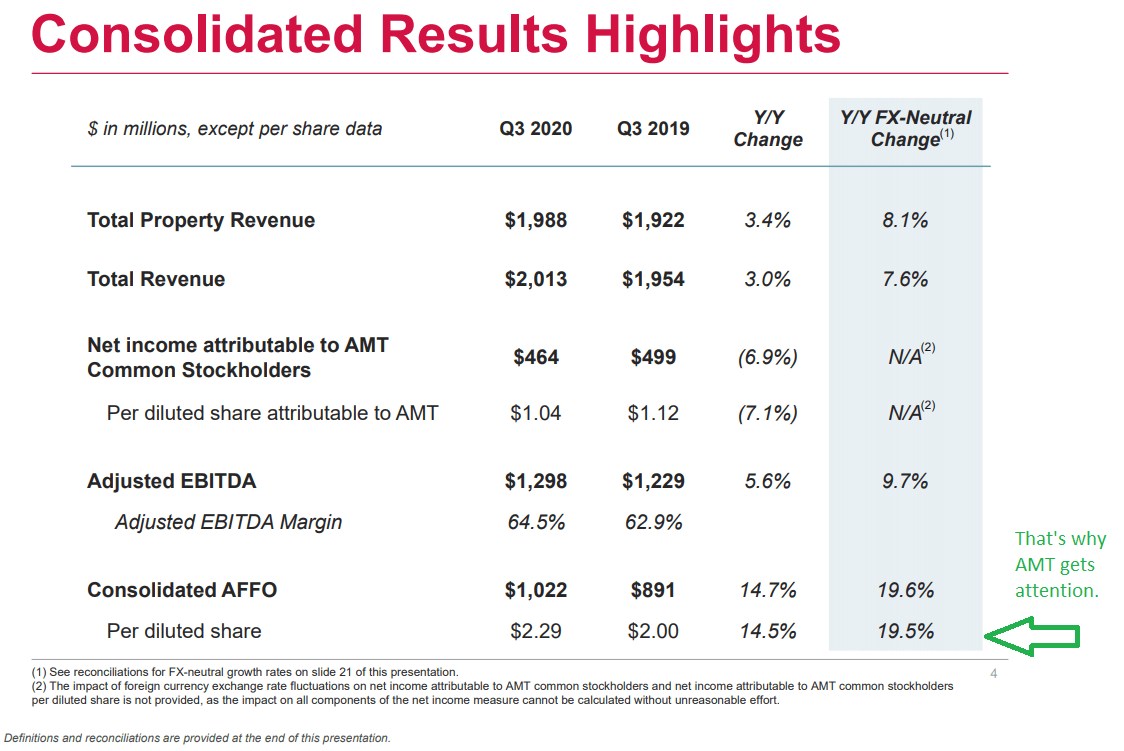

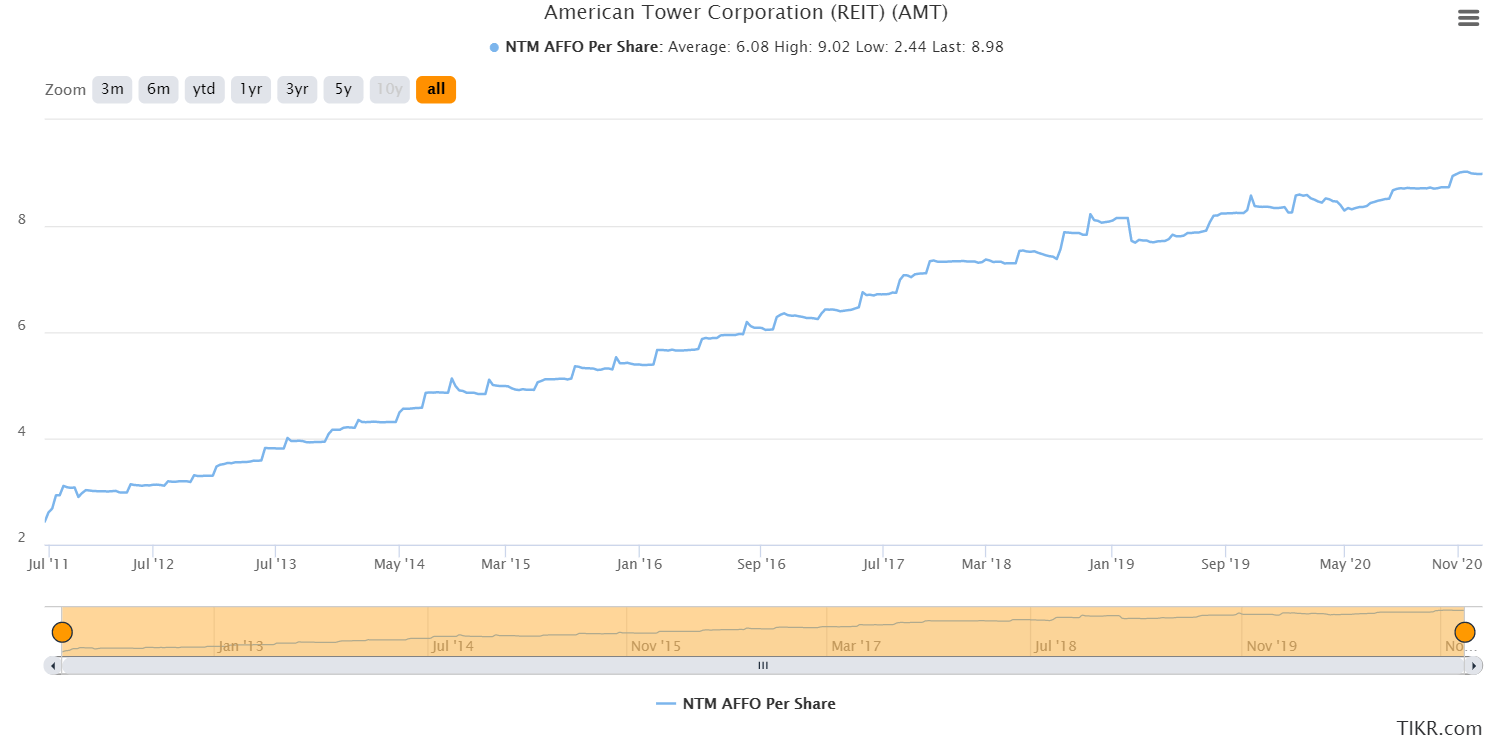

So how fast is AMT growing AFFO per share? Really fast:

Source: AMT

We don’t expect it to normally be anywhere near that level, but it has consistently been pretty strong. Here’s a chart of the forward-looking AFFO per share expectations since 2011:

Source: TIKR.com

Source: TIKR.com

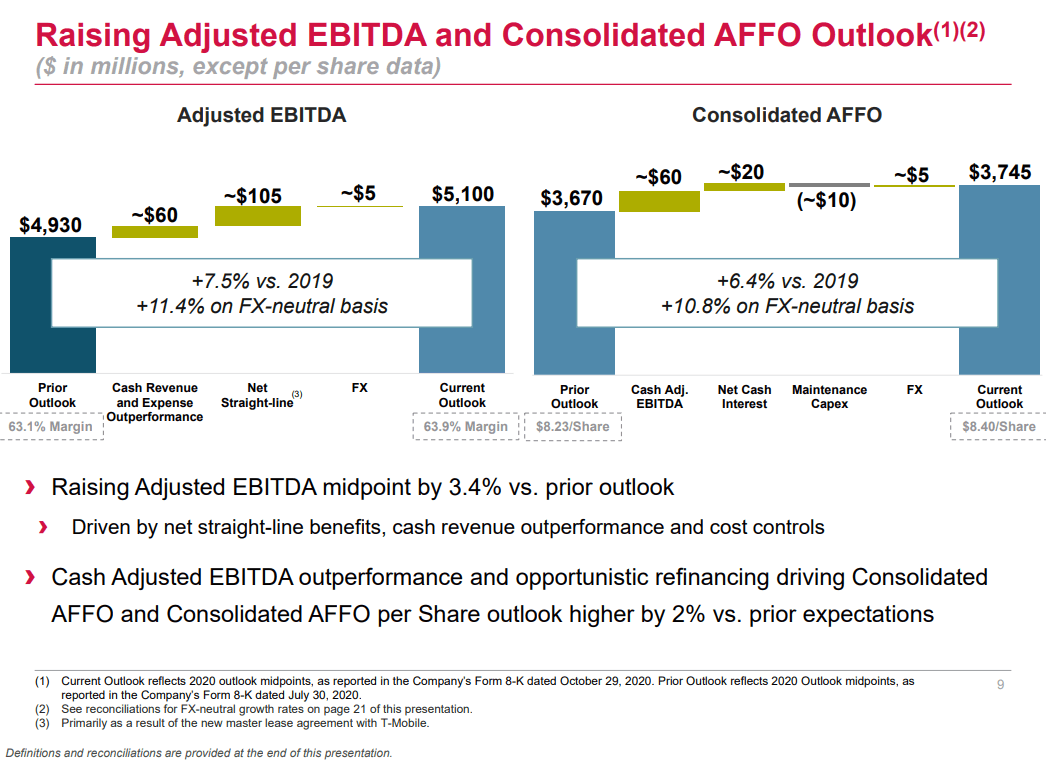

That’s rapid growth and consistent growth. That makes earnings releases more fun. When you’re growing that fast, raising guidance comes naturally:

Source: AMT

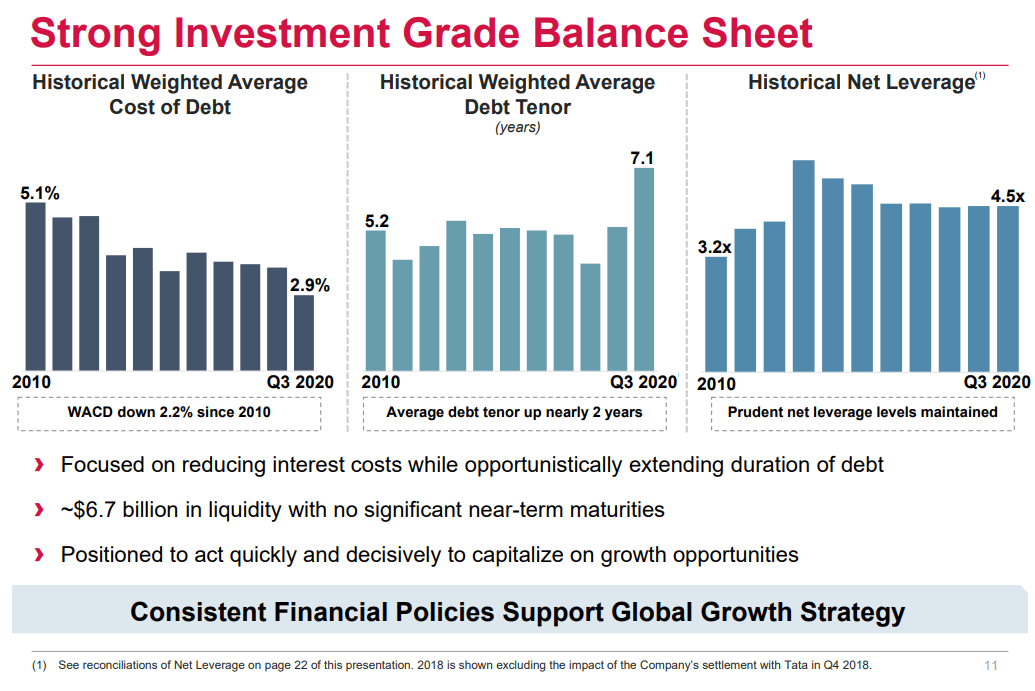

They’ve also done well on one of our other important qualifications. They kept leverage low:

Source: AMT

They’ve been ramping up the weighted average term on debt, lowering the interest rate, and keeping their net leverage at a reasonable level.

Open Positions

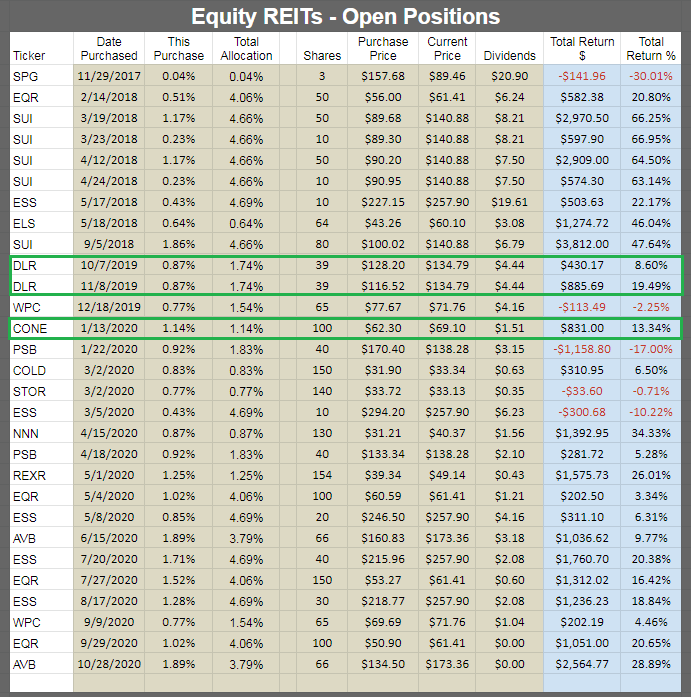

Our open equity REIT positions are shown below with the positions for this subsector highlighted by a green box:

Source: The REIT Forum

Note: The chart only shows equity REIT positions, it doesn't show mortgage REITs or preferred shares.

We haven’t been actively buying in this segment since late 2019/early 2020. Those positions have done well for us though. Over the last several months we had far more opportunity in other REIT segments, so we invested in them instead.

Conclusion

Since early October and especially since the start of November, we’ve seen these high-growth REITs dramatically underperforming as investors piled back into the “value” investments. These are great REITs. They were too expensive for us to get excited over the summer, but a recent dip while much of the market rallies is precisely what catches our attention. We expect to be expanding coverage here throughout the next year or two. With DLR and CONE under coverage, the most likely candidate for adding to our sheets in the near term is AMT. They have an exceptional long-term record of delivering shareholder value. The multiple is down from the summer months and the great alternatives are now far fewer.