Over the past six months, beverage company Keurig Dr Pepper (NASDAQ:KDP) has seen its shares rise by 7.3%. While that's a nice gain, it trails the increase of both beverage giants the name is competing with. The smallest name of the three also trades at a discount to its peers, despite a decent growth profile for the next two years. Today, I'll explain how I think the name can regain some favor with investors, and it starts by raising the dividend.

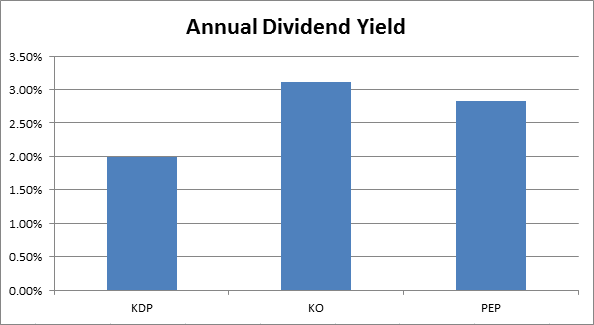

Keurig Dr Pepper shares currently pay a quarterly dividend of $0.15 per share, a rate we've seen for more than two years now. The company is not in the S&P 500 right now, although it could be added at any time. I bring up the popular index because the current annual yield of 1.99% wouldn't even put the name in the top 200 of those 500 names in terms of yield. Beverage giants Coca-Cola (KO) and PepsiCo (PEP) have significantly higher annual yields as the chart below shows.

The one headwind to dividend growth that's most evident is the balance sheet. As the company's latest 10-Q filing shows, there was less than $200 million in cash at the end of September against almost $14 billion in debt. The company has brought that debt pile down by over $530 million this year, and after a $1.75 billion maturity in May 2021, there isn't a lot of debt due right away. I think that borrowing can easily be refinanced at a decent coupon in this low interest rate environment.

However, at the moment, it's not really a matter of poor cash flow that's limiting the dividend. Last year, the company produced free cash flow of over $2.14 billion, and cash dividend payments were just $844 million. That's a payout ratio that didn't even hit 40%. So far this year, free cash