The Global X FinTech Thematic ETF (NASDAQ:FINX) is designed to track the Indxx Global FinTech Thematic Index and does so by investing in companies that are disrupting existing financial services and banking business models. The technologies being used to disrupt these sectors range from digital and mobile solutions to the adoption of emerging cryptocurrencies. These technologies are being adopted because they are cheaper, quicker, and more convenient than existing services.

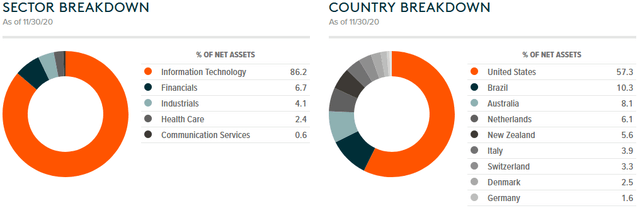

The FINX ETF has a 0.68% expense ratio and currently has ~$900 million in AUM. Not surprisingly, FINX is primarily invested in IT companies (see graphic below). It is a global fund with 57.3% of net assets being in the United States:

Source: Global X

Source: Global X

Driven by technologies like advanced APIs, AI, blockchain and distributed computing, ResearchandMarkets.com expects the global FinTech market to grow at a CAGR of ~20% over the coming years and ultimately be a $300+ billion industry by 2025. The global pandemic has turbocharged FinTech companies because they reduce the need for person-to-person transactions.

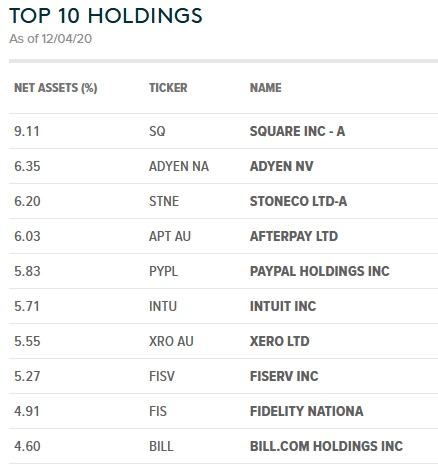

Top-10 Holdings

The top-10 companies in the FINX ETF are shown below:

Source: Global X

The #1 holding with a 9.1% weighting is Square (SQ) - creator of the popular CashApp. According to CEO Jack Dorsey on the Q3 conference call, CashApp has been a resounding success story:

Since launching it less than a year ago, more than 2.5 million customers have bought stocks using Cash App and billions of dollars have been traded by the end of the third quarter.

As I reported in my recent Seeking Alpha article on the Grayscale Bitcoin Trust (GBTC) - Bitcoin Penetrates Further Into The 'Mainstream' - It Should Penetrate Your Portfolio Too - CashApp is not only a convenient way for investors to convert dollars to Bitcoin, but note that Square itself recently