Fresh Del Monte Produce (NYSE:FDP), one of the world's largest producers and distributors of fresh fruit and vegetables, is committed to sustainable operating procedures in its conduct of business. And despite the wariness of prospective investors in light of recent years, the stock may prove to be a sustainable investment at its current valuation.

According to a press release issued on 12/02/2020, Fresh Del Monte Produce declared that it has joined the Science Based Targets initiative (SBTi). The objective of this initiative is to drive the private sector to take action in respect of climate change by reducing greenhouse gas emissions, which Fresh Del Monte Produce has pledged to do by 2030. This partnership is the latest step that the firm has taken in making its operations greener, as it previously had its largest banana growing operation certified as carbon neutral in 2015.

The need for climate action was underlined by Fresh Del Monte Produce's Chief Sustainability Officer Hans Sauter:

We continue to see an increase in the impact of climate change on our lives through unusually active hurricane seasons and deadly wildfires...This year, we joined the Science Based Targets initiative in order to create a more sustainable and equitable future, not just for our company but for the world. Climate action is our top priority and I’m honored to work for a company that is unafraid to make these commitments.

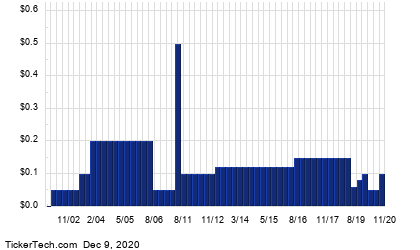

Shareholders may be forgiven for being cynical about the firm's commitment to climate stability when there are doubts about its commitment to shareholder-friendliness, however. Those doubts have their origin in the dividend record, as while the dividend streak has been relatively steady for much of the decade, the past two years have seen a couple of dividend cuts inflicted. However, there were valid reasons for these cuts.