Main Thesis

The purpose of this article is to evaluate the Nuveen AMT-Free Quality Municipal Income Fund (NYSE:NEA) as an investment option at its current market price. NEA is one of only a few holdings of mine I feel confident in adding to heading into the new year. While the muni market is rife with challenges, I believe better days lie ahead in 2021, supporting positions now. In particular, NEA continues to sport a healthy discount to NAV, and its income stream remains very attractive. While I always like tax-free distributions, NEA has also boosted its payout twice this year, which is quite impressive. Further, corporate spreads have narrowed considerably since the COVID-19 crisis began, meaning investors will have trouble finding value in that sector, improving the relative value of munis. Finally, I expect state and local aid from Washington to occur next year. In the meantime, state governments have made hard choices, including job cuts, limiting the probability of defaults in the sector.

Background

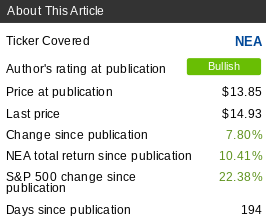

First, a little about NEA. It is a closed-end fund with an objective "to provide current income exempt from regular federal income tax and the alternative minimum tax applicable to individuals, by investing in an actively managed portfolio of tax-exempt municipal securities". Currently, the fund trades at $14.93/share and pays a monthly distribution of $.0585/share, yielding 4.73% annually. NEA is a long-term holding of mine, and I continued to recommend it back in May. In hindsight, NEA has remained a profitable choice, generating a total return in excess of 10% since that last review, as shown below:

Source: Seeking Alpha

As we approach 2021, I thought now was an opportune time to take another look at NEA. After review, I continue to see merit to owning and adding to this fund, and I will explain why in detail below.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.