China-based Huazhu Group Ltd. (NASDAQ:HTHT) manages 6,507 hotels either directly on leased properties or by collecting fees from franchisees. With over 610k hotel rooms in operation, Huazhu is a leader in China with its brands focusing on the economy and mid-market segments. While the COVID-19 pandemic represented a major disruption to the business earlier this year, occupancy rates have recovered to approach levels from 2019 and the company highlights a growing market share driven by an ongoing expansion strategy. The company recently reported its latest quarterly results which included year-over-year revenue growth and an improving outlook. We see the company as well-positioned to benefit from significant growth opportunities supported by overall solid fundamentals.

(Seeking Alpha)

HTHT Q3 Earnings Recap

Huazhu Group reported its Q3 earnings on December 4th with a GAAP EPS loss of -$0.11, which missed expectations by $0.24. Revenue in the quarter at RMB 3.2 billion, or approximately $466 million, climbed 3.4% y/y and notably ahead of prior guidance targeting flat to a 2% increase. The story here was the overall improving financial conditions compared to the more difficult first half of the year. Q3 EBITDA reached RMB 190 million or $28 million, reversing a loss of negative RMB 169 in Q2 which was more impacted by the pandemic.

Growth this quarter was primarily driven by the addition of new hotels over the past year along with the contribution from the company's Q4 2019 acquisition of German hotel group 'Steigenberger Hotels AG', also known as Deutsche Hospitality "DH", which added 117 hotels to the company's network. In Q3 the legacy Huazhu business opened 520 hotels while the DH business concentrated in Europe and Northern Africa added 3 properties. The entire business has 2,313 unopened hotels in the pipeline expected to open over the coming year.

(Source: Company IR)

The DH business has been an overall drag on the results considering the European region has faced a weaker recovery compared to China, limiting occupancy and facing lower average room rates. Huazhu notes that the adjusted EBITDA excluding DH was RMB 853 million compared to an adjusted EBITDA of RMB 901 million in Q3 2019. The adjusted operating margin excluding DH in Q3 was 19.1%, still down compared to 23.0% in Q3 2019, but favorably up from a negative 11.4% in Q2.

(Source: Company IR)

In terms of key operating metrics, the average occupancy rate in Q3 reached 82.0%, compared to 87.7% in Q3 2019 but favorably up from 68.8% in Q2. Management noted that for 2 weeks during the quarter, the occupancy exceeded levels from the same period last year. Also, the company's occupancy rate through the last reported week at 76% is well above the average for China's hotel operators at 62% implying Huazhu's comparative strength.

(Source: Company IR)

An important monitoring point for the business is the revenue per available hotel room "RevPAR". While the average for the quarter in the China operation at RMB 179 was still down 17% year over year, there has been a solid sequential recovery through Q3 that ended September at 100% relative to 2019 on a blended basis that includes the pricing at new hotels. Early Q4 data through October also shows RevPAR at 98% levels observed in 2019. The outlook is weaker with respect to the smaller European business which is still facing a major COVID outbreak while China has been able to contain the virus.

(Source: Company IR)

Management explains that pricing has improved with mobility and business travel recovering in the country. The company has made an effort to attract corporate members through a loyalty program that represented 10% of total room nights in Q3 compared to 8% for 2019.

In terms of guidance, management expects Q4 net revenues in a range between flat to up 3%, or down 4% to 7% excluding the contribution of DH acquired last year. For the full year, the company expects to reach its target of opening between 1,600 and 1,800 hotels, while closing 550 and 600 underperforming properties.

(Source: Company IR)

Longer term, the company intends to manage 10,000 hotels by 2022 which would represent nearly a 53% increase from its current footprint. Strategically, a focus has been to improve the overall quality and brand perception in China while proceeding with regular upgrade and renovation projects. Investments have been directed at improving digitalization and integration of technology like mobile check-in to enhance the customer experience. CEO Ji Qi made the following comments in the earnings press release projecting an optimistic outlook.

"We remain very confident to achieve our target of 10,000 hotels by 2022 as we believe the pandemic will accelerate the industry consolidation where Huazhu, as one of the market leaders, should be the major beneficiary. In addition, we are also exploring new opportunities in lower-tier cities to further expand our presence across China."

Finally, the company ended the quarter with RMB 6.6 billion in cash and equivalents corresponding to about $969 million. Separately, the company also maintains RMB 1.3 billion in restricted cash based on financial covenants. This compares to a total debt balance of RMB 13.5 billion. For context, the company generated a positive operating cash flow of RMB 1.2 billion in Q3 across its China operation and also has untapped revolving credit facilities totaling RMB 4.1 billion supporting the overall liquidity and financial profile.

Analysis and Forward-Looking Commentary

Huazhu Group with a market cap of $14.5 billion is a major company representing targeted exposure to one of the fastest-growing hospitality regions in the world. China's economy continues to benefit from an emerging middle class driving the demand for hotel services supported by strong economic growth in the region.

It's clear that the company's acquisition of the Steigenberger Hotels AG, which was meant to drive a global expansion outside China and also an entry into the higher luxury segment, suffered from poor timing considering the deal occurred just months before the COVID-19 outbreak. A positive trend for the company is that the crisis this year has led to a decline of independent hotels and smaller operators allowing Huazhu to consolidate its market share as the industry remains fragmented.

(Source: Company IR)

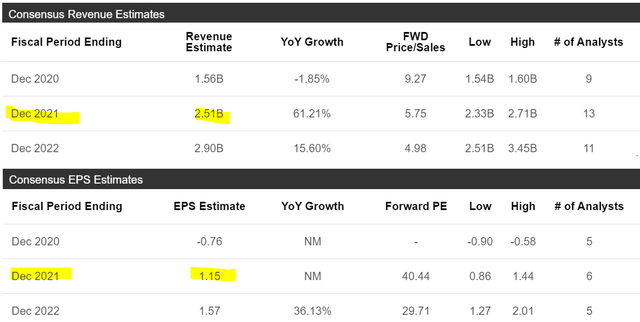

We are encouraged by the trends in China and the ongoing recovery including improving financial results in the region. Looking ahead, an eventual recovery from the European market would add incremental growth and can represent an upside to long-term profitability potential. According to consensus estimates, company revenues are expected to increase 61% in 2021 to $2.51 billion considering the soft comparison period this year. The company is also forecast to reach profitability with an EPS of $1.15 next year.

(Seeking Alpha)

In our view, a 1-year forward price to earnings multiple of 40x is reasonable in the context of the growth outlook which also includes the company's plan to continue adding new hotels to its network. Currently, 33% of revenues are based on franchisee income which represents a high margin segment with low capital requirements and recurring income opportunity. The franchisee model justifies a climbing premium for the stock that maintains an overall positive outlook.

It's worth noting that Huazhu has been subject to short-seller allegations of potential fraud asserting the company inflated income by underreporting the number of properties it controls. Management even responded directly with a press release back in September dismissing the reports as containing errors and misleading conclusions. Importantly, there is no record of any SEC investigation and the market has largely brushed off any concerns evident by the impressive rally in the stock. HTHT is up 16% year to date and gaining momentum in recent months currently trading near an all-time high first reached back in 2018.

(Source: finviz.com)

Final Thoughts

We are bullish on shares of HTHT and see the company benefiting from accelerating operational and financial momentum over the next year in what remains a turnaround story. We rate shares of HTHT as a buy with a price target of $60 for the year ahead. To the upside, stronger than expected top-line growth and firming margins could be a catalyst for shares to climb higher. The COVID-19 vaccine can effectively end the pandemic and help normalize global travel and trends in hospitality. Huazhu is well-positioned to benefit from its market leadership position in China.

The risk here beyond a global cyclical slowdown comes down to its execution of what remains an ambitious growth plan. The rapid expansion including the acquisition of smaller hotels while onboarding new franchisees can become difficult to manage and introduces headwinds to maintain a standard of quality. Monitoring points going forward include metrics like the occupancy rate and average revenue per hotel room. Weaker than expected results could force a reassessment of the long-term outlook and drive renewed bearish sentiment in the stock.

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.