Editor's note: Seeking Alpha is proud to welcome Anh-Tuan Bui as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Editor's note: Seeking Alpha is proud to welcome Anh-Tuan Bui as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Summary Thesis

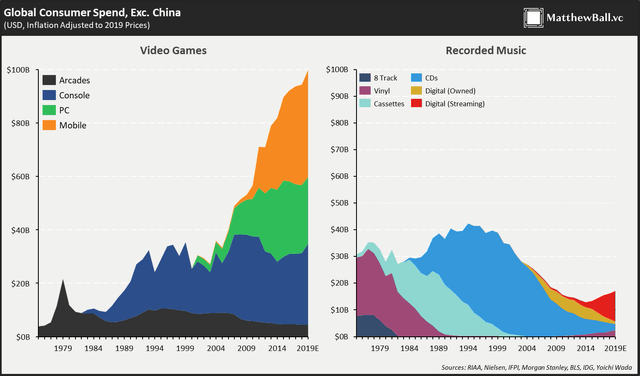

Even before COVID, video games had a uniquely compelling value proposition as a highly immersive, social place to hang out and create stories with your friends. This value proposition made gaming the fastest-growing industry within media with global consumer spending on video games (excluding China) tripling from $30B in 2000 to $100B in 2020 (vs. the music industry, for example, which has seen revenue fall by 1/3). There are many reasons to believe that the drivers of the rapid growth in gaming should continue in the future and I believe that the VanEck Vectors Video Gaming and eSports ETF (NASDAQ:ESPO) is a great way to play these long-term trends.

Source: matthewball.vc

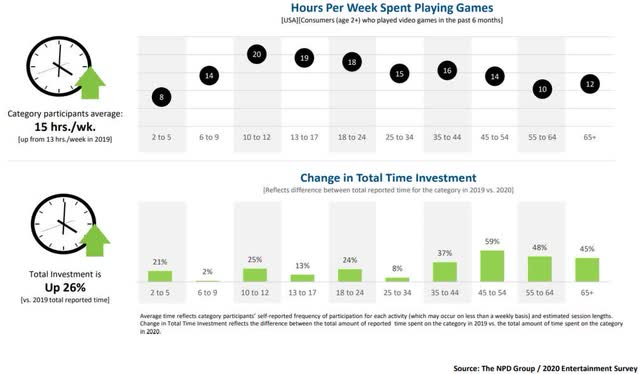

Furthermore, COVID-19 and the ensuing lockdowns are permanently accelerating these trends, as more and more people who were stuck at home with nothing to do discovered the magic of gaming and made it a core part of their lives.

Source: NPD Group

Video games are no longer just for dorky teenagers, as even NBA stars Gordon Hayward and Karl-Anthony Towns are known to be hardcore gamers and use gaming to expand their social media audience. As a result, the video game industry has done phenomenally well in 2020, with the MVIS Global Video Gaming & eSports Index