It's been a volatile month for the Gold Miners Index (GDX), and more than 50% of the sector is now stuck beneath its 200-day moving average. However, Alamos Gold (NYSE:AGI) has held up much better than its peers during the decline, and last week's FY2021 guidance and long-term outlook certainly didn't hurt matters. The company reported that it is expecting double-digit annual production growth next year and the potential to grow annual production to 600,000 ounces from existing projects by FY2025. More importantly, costs will decline materially as output ramps up. Based on the company's strong organic growth potential from predominantly Tier-1 jurisdictions and industry-leading earnings growth, I continue to see the stock as a top-12 name in the sector.

(Source: Company Presentation)

(Source: Company Presentation)

Alamos Gold released its Q3 results in late October and reported quarterly gold production of ~117,100 ounces, a significant improvement from the rough Q2 due to COVID-19 related shutdowns. This has placed the company on track to meet its revised FY2020 production guidance of 420,000 ounces at the midpoint, with ~306,400 ounces produced year to date. More importantly, the company finally completed its Lower Mine Expansion at its flagship Young-Davidson Mine, with FY2021 gold production of ~198,000 ounces at the midpoint, a more than 6% increase from the 188,000 ounces produced in FY2019. Meanwhile, all-in sustaining costs are expected to drop by over 2%, with the FY2021 guidance midpoint for Young-Davidson sitting at $1,025/oz, an improvement from costs of $1,047/oz in FY2019. This has set up Alamos for a near-record year in FY2021. However, it's the long-term outlook that's much more exciting, which we'll dig into later. I have used FY2019 as a comparison for Young-Davidson as FY2020 was abnormal operationally due to downtime to tie in the Lower Mine Expansion and COVID-19 related headwinds.

(Source: Company News Release)

(Source: Company News Release)

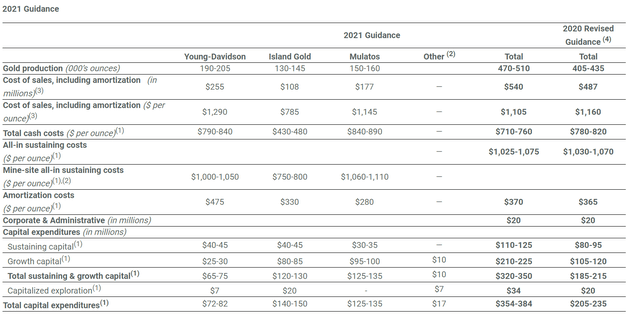

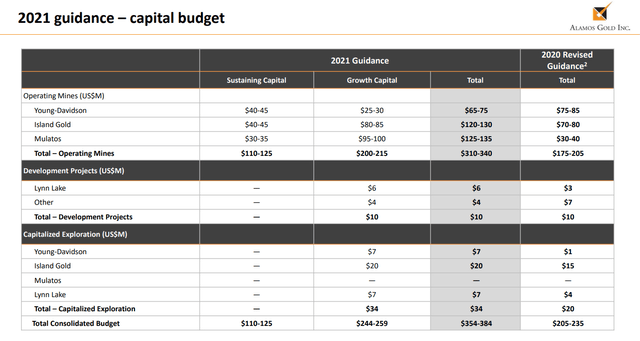

Beginning with the FY2021 outlook, we can see that Alamos is expected to produce 490,000 ounces of gold next year at the midpoint, with all-in sustaining costs of $1,050/oz. This is in line with FY2020 despite higher production, which might disappoint some investors taking a quick glance at the recent news update. However, it's important to note that the company is re-investing in its projects significantly next year, with growth capital expected to surge from FY2020 guidance of $113 million at the midpoint to $217 million at the midpoint in FY2021. This is related to the ramp of construction at La Yaqui Grande in Mexico and investing in the Phase III Expansion at the bonanza-grade Island Gold Mine. In total, capex is expected to come in at $325 million in FY2021, 70% above the revised guidance of $190 million in FY2020. Therefore, while costs will come in above the industry average of $990/oz next year, it's worth noting that this is partially due to much higher investment than normal and increased sustaining capex for stripping activities at Mulatos.

(Source: Company Presentation)

(Source: Company Presentation)

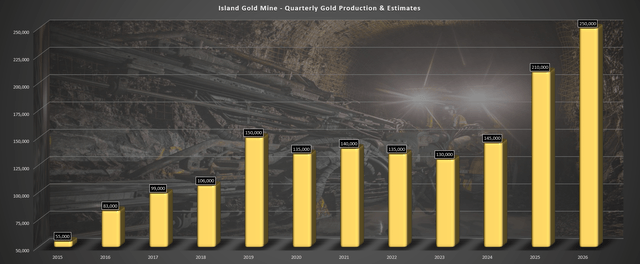

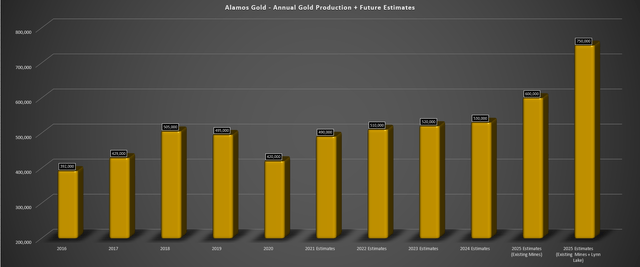

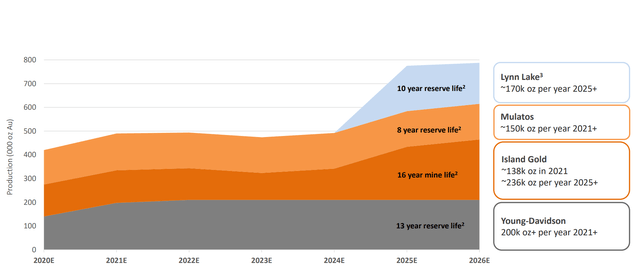

The good news is that these investments will pay off in spades over the long run, with the company building out a massive predominantly Tier-1 production profile. As shown below, Alamos Gold is hoping to increase its annual gold production from ~420,000 ounces in FY2020 to 600,000 ounces in FY2025, translating to a compound annual growth rate of ~7%. This growth is based strictly on its existing mines, with the most significant growth coming from the Island Gold Mine Phase III Expansion. For those unfamiliar, the recent study has the potential to be a game-changer for Alamos, with projected gold production of 236,000 ounces per year at all-in sustaining costs of $534/oz, a figure that is nearly 50% below Alamos' FY2021 current cost profile (~$1,050/oz). Meanwhile, if the company can bring its Lynn Lake Project online in Manitoba, the compound annual production growth rate will surge to above 12% from FY2020 levels. This is because Lynn Lake is expected to produce 170,000 ounces per year, and Alamos hopes to make a construction decision in FY2022. The chart below shows the expected ramp-up at the Island Gold Mine in what has been a brilliant acquisition by Alamos.

While these compound annual growth rates are quite robust, the fairest way to measure them is against the prior peak in annual gold production of ~505,000 ounces in FY2018. If we adjust these compound annual growth rates to start from the prior peak, they fall to 2.5%, and 5.8% for existing mines and Lynn Lake upside, respectively. However, these are still very impressive compound annual production growth rates relative to the sector, with few miners expected to grow production even by 20% over the next five years. This should translate to a premium for Alamos Gold relative to most of its intermediate producer peers, especially considering that the increased production profile will shift the company to becoming a Tier-1 jurisdiction producer.

I classify Tier-1 jurisdiction producers as those with more than 75% of their production coming from Canada, Australia, and the United States, and currently, Alamos Gold is a Tier 1.5 producer. This is because Alamos has just 68% of production from Canada, with Alamos' Mulatos Mine in Mexico making up the other 32%. This transformation is occurring because Island Gold production is increasing, which will dilute the share of production from Mexico. Meanwhile, Lynn Lake would push total gold production above 75%, with just ~150,000 ounces of ~750,000 ounces coming from Mexico. Finally, all-in sustaining costs are expected to dip to $800/oz in FY2025, translating to 24% lower costs vs. the FY2021 guidance midpoint. This translates to three separate justifications for a re-rating, with higher margins (lower costs), better jurisdictions, and material production growth. Obviously, much of this will depend on execution, but I like the company's chances with a solid track record of meeting or beating its goals.

(Source: Company Presentation)

(Source: Company Presentation)

Finally, it's worth noting that while production growth is great, it's sustainable production that's the most important. In Alamos' case, the company has a minimum 8-year reserve life in its portfolio (Mulatos), with up to a 16-year mine life at its most impressive asset: the Island Gold Mine. This means that there's no need to go out and do M&A to maintain this production growth. The only exception is Mulatos, but I don't see any reason the company won't be able to add a few additional years of mine life through exploration and resource conversion over the next few years. All of these factors combined suggest that Alamos' forward earnings multiple should increase to 16 long-term, from a current multiple of 14. The bonus is that Alamos is now paying an $0.08 yield, so investors are getting paid an extra ~0.90% per year to wait for this growth.

So, what's a fair valuation for the stock today?

(Source: YCharts.com, Author's Chart)

(Source: YCharts.com, Author's Chart)

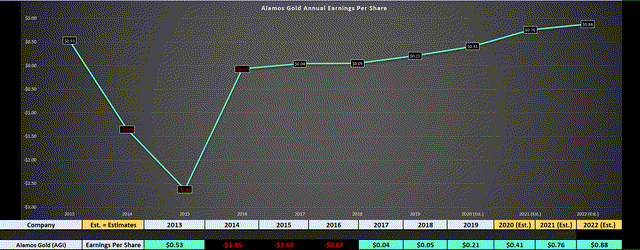

Based on a forward earnings multiple of 14 and FY2021 annual EPS estimates of $0.76, I see a conservative fair value for Alamos of $10.64. This assumes no upside in current earnings estimates, a similar gold price (GLD) to what we're working with currently, and the company only managing to meet its guidance midpoint next year. If we were to see a new high for gold, which would likely translate to over $0.80 in annual EPS, this conservative fair value would move above $11.00 per share. Therefore, with investors able to buy the stock at $8.85 today, I continue to see the stock as undervalued at current levels. This is especially true considering that Alamos is one of the only gold producers expected to grow annual EPS by over 85% next year based on forecasts ($0.76 vs. $0.41). Let's take a look at the technical picture:

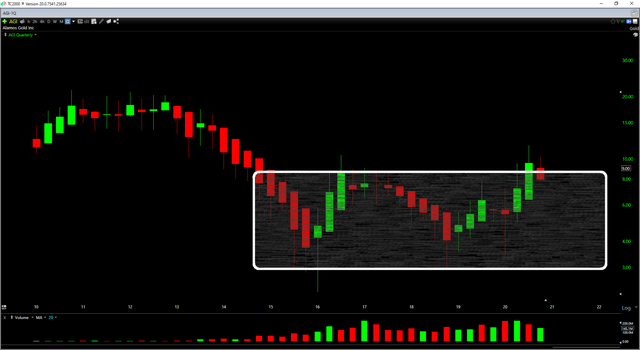

While Alamos has struggled over the past few months, it's worth noting that the company hit a new 5-year high in Q3 and confirmed a breakout by closing above the multi-year box it's been trading in since FY2015. This suggests that the technical picture is sniffing out the strong fundamental growth over the next few years, with the technicals typically moving ahead of the fundamentals. This is because the market discounts ahead, and it seems that smart money is catching onto Alamos' long-term growth potential. While this breakout hasn't shown much follow-through yet, I see no reason to consider this a failed breakout unless Alamos closes below $8.00 on a quarterly basis. For now, the stock seems to be trying to hold near the $9.00 level, a positive sign. In summary, while the daily chart is certainly a mess after a choppy four-month correction, we've seen zero damage to the bigger picture.

(Source: Company Presentation)

(Source: Company Presentation)

Alamos Gold has been beaten up the past few months with the sector-wide carnage, but the stock seems to have found a bottom near $8.00, and the conservative fair value for the stock is at $10.64. This conservative fair value does not take into consideration the company's long-term growth plans, which means that investors are getting a nearly 20%-off sale for a producer set to grow production at a compound annual growth rate of between 2.5% and 5.8% over the next five years relative to previous peak production. This suggests that Alamos is a steal if it continues to pull back, and the ~0.90% annual dividend yield doesn't hurt either. For now, I continue to see Alamos as a top-12 gold producer in the sector, and I may look to start a position in the stock before year-end.