In this article, I will make the case for owning REITs and show why there are extraordinary opportunities – and a few pitfalls – for REIT investors in the current investing environment.

REITs are generally beneficial in a portfolio for a myriad of reasons, but here are the top 5.

1) Higher returns

2) Higher yield

3) Diversification

4) Discount to NAV

5) Cheap relative to S&P

Higher Returns

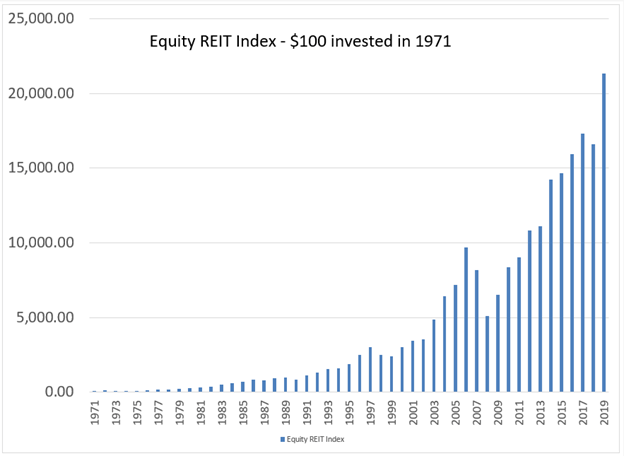

REIT returns have been exceptionally strong over a very long time period. If one were to have invested $10,000 in the equity REIT index in 1971, that $10,000 would be worth just over $2.1 million at the end of 2019.

Data from NAREIT

Part of this is the power of compounding when investing for a long period of time, but compounding worked better in REITs due to a higher rate of return. Over this period, REITs had approximately an 11.8% CAGR; a rate of return which beats just about every other asset class, including the S&P, corporate bonds, and treasuries.

Historic returns obviously do not guarantee future results, but it does suggest the asset class generally has the potential for high returns. Going forward, I am anticipating a lower return CAGR for all asset classes. Stocks and bonds are both more expensive now than they were in 1971, which leads to lower returns, but the relative returns should be similar. In order of expected return going forward, I am anticipating the long run to look like REITs > S&P > corporate bonds > treasuries.

Higher yield

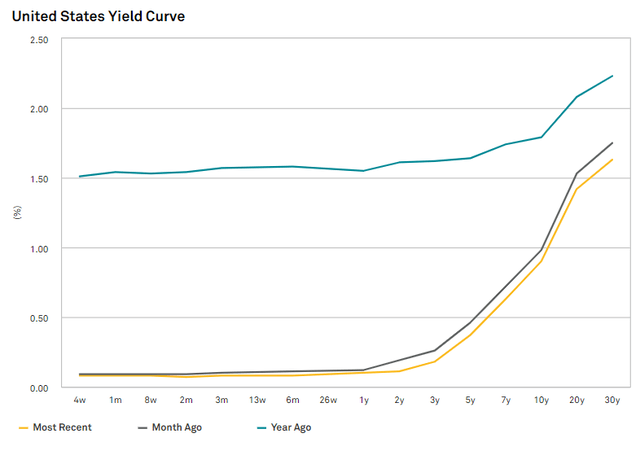

The REIT index has a dividend yield of about 3.3%, which is significantly higher than other asset classes. Treasuries are below 1% for most maturities, and even if one goes all the way out to 30-year duration, they yield only about 1.63%.

Source: SNL Financial

The S&P yields about 1.6%.

This modern investment environment has been referred to by the acronym “TINA” (There Is No Alternative), which is used to express the market’s collective pursuit of yield as there are so few instruments that provide a decent income. REITs are among the last bastions that still have a reasonably high yield.

Despite it being higher yield than the alternatives, I am personally not all that excited by the 3.3% yield of the REIT index because I believe it is quite possible to get yields in the 5% to 11% range without sacrificing on quality by hand-selecting specific REITs.

Let’s take a look at the 7 highest yielding REITs.

Company (ticker) | Dividend yield |

GEO Group (GEO) | 14.42% |

American Finance Trust (AFIN) | 11.3% |

Global Net Lease (GNL) | 9.48% |

Office Properties Income Trust (OPI) | 9.33% |

Preferred Apartment Communities (APTS) | 8.78% |

One Liberty Properties (OLP) | 8.58% |

Brookfield Property REIT (BPYU) | 8.50% |

I find this particular set to be a great preview as to what REITs consist of. You can get some extremely high yields, but it is absolutely crucial to be guided by experience because there are both treasure troves and landmines. A quick rundown might illuminate this finding.

GEO Group is a great company that is currently troubled by the social/political environment in which private prisons are disliked by the political party that is soon to be in power. Therefore, there is some risk of reduced contract volumes at the federal level. It is the deep value, high-risk/high-reward play.

American Finance Trust is what I refer to as an accidental high-yielder. The triple-net business model in which properties are leased out through 10-year + contracts is rock solid, and this has been demonstrated by strong rent collections throughout the pandemic. It should not trade this cheaply and is a great opportunity to get extra yield without taking on outsized risk.

Global Net Lease is similarly opportunistic as AFIN and also a triple net. GNL’s yield is not quite as high (a mere 9.48%), but its property types are better as GNL has significant exposure to industrial, which is a growing sector. Not only is GNL’s yield fully covered, but I see significant room for growth in FFO, which will eventually allow dividend growth.

Office Properties Income Trust is one of the landmines. The properties are okay, and the dividend is fantastic, but the company is run by an external manager that has a history of pillaging shareholder value for their own gain. This would have to get significantly cheaper for me to even consider touching it with a 10-foot pole.

Preferred Apartment Communities is another potential landmine, although not quite as bad. Its issue is the capital structure. The common shares are drowning underneath a mountain of preferreds, which causes the functional leverage to be extremely high even if the debt itself isn’t that high. This amplifies any fundamental moves and something as small as a 10% revenue loss could wipe out the common.

One Liberty Properties is a historically strong company that I have liked less lately because they had the wrong set of tenants heading into the crisis. The weak tenants caused OLP to suffer more damage than most of its peers. If the economy recovers well, OLP should rebound nicely, but I’m going to wait for a bit more clarity before buying.

Brookfield Property REIT is a COVID-19 recovery play. With its portfolio of high end malls, it is, of course, hurting during the pandemic shutdown, but as the world opens back up, retailers are going to want to beef up their omnichannel presence with some brick and mortar space to go along with their online sales. The leasing should improve significantly and depending on how that goes, BPYU could be a big winner. That said, I prefer SPG in the mall space.

The higher yield, along with the higher expected return of the asset class, suggests that putting REITs into a portfolio can enhance its return potential. Importantly, it would appear as though this can be done without increasing volatility as REITs provide a substantial amount of diversification.

Diversification

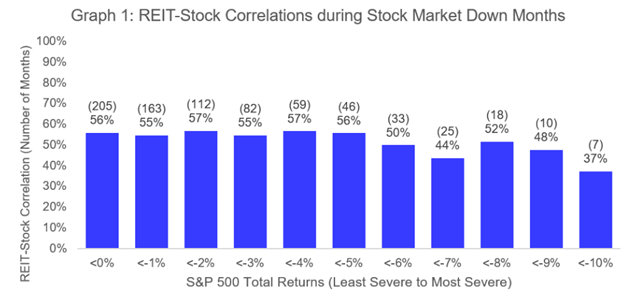

From an academic theory perspective, having low correlations between asset classes in a portfolio will reduce overall volatility. Most people are primarily concerned about volatility in the down direction, so let us look at how REITs correlate with the S&P when the broad market is down.

Source: NAREIT

Source: NAREIT

2 things are of note in the above graph.

1) The correlation is somewhat low across the board. A 100% correlation would mean REITs are moving down in tandem with the S&P, while the 37% to 57% correlations shown above mean REITs are only somewhat moving down with the S&P.

2) Correlations are lower when the S&P is crashing hard. Historical correlations between REITs and the S&P are lower when the S&P is down 7% or more in a given month, with the lowest correlation being when the S&P is down 10%.

Each of these has the effect of dampening volatility. From a portfolio management perspective, this is a clear benefit. Institutional portfolio managers are often judged by something called the Sharpe Ratio which is calculated as follows.

Source: Investopedia

It essentially means you want as high of returns as possible with as low of volatility as possible. REITs help to improve this ratio.

Statistical diversification versus fundamental diversification

I am an institutional portfolio manager, albeit a small one, so I am supposed to care about correlations and covariance, but to be honest with you, I don’t buy it as a proper measure of risk, and here’s why: Correlation is entirely backward-looking. 2 stocks or indices are considered correlated if over whatever time period one is looking at their stocks moved together.

In my time of watching the market, I have frequently seen stocks move together when they had absolutely nothing in common. So, to the extent strange and nonsensical stock movements happened in the past, correlation assumes those same nonsensical stock movements will occur in the future.

I prefer a more fundamental approach to diversification. By owning stocks with different revenue drivers and different economic exposures, I believe one can diversify the true fundamental risk to their portfolio. REITs help in this regard as they have different fundamentals than the stocks in the S&P.

Discount to NAV

The diversification benefits discussed above apply to owning hard real estate as well as to owning real estate through securities like REITs. There are times when it can be better to buy an actual property rather than a stock, but now is not one of those times.

The average REIT is trading at a significant discount to net asset value (NAV) meaning it is far cheaper to buy a REIT than it is to buy properties similar to what the REIT owns. Instead of buying apartment properties in hard assets, one could put that money into an apartment REIT trading at 80% of NAV and functionally own 25% more apartment units of the same quality.

Once again, I would like to give a few examples to illustrate the depth of REITs. Here are 5 REITs trading at massive discounts to NAV.

REIT (ticker) | Price to NAV (lower is cheaper) |

CatchMark Timber (CTT) | 73.6% of NAV |

SL Green (SLG) | 67.6% of NAV |

Industrial Logistics Properties (ILPT) | 73.9% of NAV |

Farmland Partners (FPI) | 76.7% of NAV |

Macerich (MAC) | 86.7% of NAV |

The interesting thing about net asset value is that it self-corrects for property sector. Everyone knows malls are struggling, but this is already corrected for in the asset value because the malls are worth less than the same amount of operating income would be in a different type of asset. So, even when a mall is trading at a discount to NAV, it should raise some eyebrows.

Macerich, for example, is trading at 86.7% of the already heavily discounted value assigned to its malls. So, one may think they can scoop up troubled malls cheaply in the private market, but it is even cheaper to buy malls through a REIT.

CatchMark Timber, in my opinion, is the best timber REIT because, in addition to its discount, it has highly productive timberlands producing more per acre than any of its peers. I anticipate demand for timber will continue to ramp up as homebuilding kicks off to correct the current undersupply of apartments in the sunbelt, which is the area CTT supplies.

SL Green is the best managed office REIT, and it has trophy caliber properties as well as a dominant market share in NYC. If one believes people will return to the office, which I do, SLG is the way to play the office recovery.

Industrial Logistics Properties is run by the same questionable external manager as OPI, so I am avoiding it. The industrial property sector is great right now, and the discount is tempting, but in the past, RMR has destroyed so much shareholder value that I still don’t think this is worth it.

Farmland Partners is trading at a roughly 25% discount to NAV, which may not sound crazy, but American farmland is one of the most efficient markets in the world. In private transactions, farmland will almost always trade at fair value or within a few percentage points. One simply cannot buy farmland at a 25% discount to fair value except through buying FPI.

NAV is basically the measure of absolute valuation. Next, we take a look at the relative valuation of REITs.

Value relative to S&P

In the past few quarters, there has been a disparity between fundamental changes and price movements. From a fundamental perspective, REITs and the S&P are each affected by the COVID-19-related economic slowdown in similar magnitude, but the prices have moved in opposite directions. The S&P has fully recovered to all-time highs, while REITs remain substantially discounted. One of these moves is likely wrong, and my suspicion is that the S&P should not be near all-time highs, given the economic challenges of today’s environment.

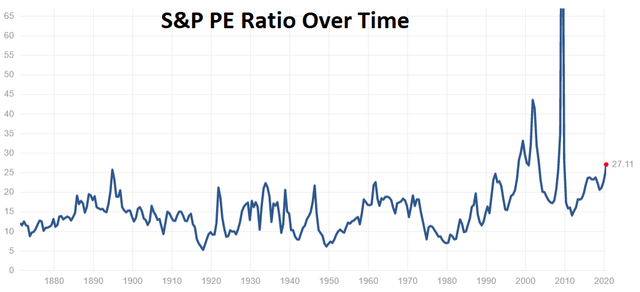

In looking at the earnings multiples of the S&P and FFO multiples of REITs, we believe REITs are relatively more opportunistic from a valuation perspective. REITs are trading at normal valuation levels, while the S&P is at a multiple higher than it has ever been outside of the dot com bubble and a brief period where earnings dropped to near-zero during the financial crisis.

Source: Multpl.com

One of the most consistent findings of investment research is that, entering into a position at a low or reasonable valuation leads to higher returns than entering at a lofty valuation.

Putting it together

So far, we have discussed a variety of benefits to owning REITs in one’s portfolio. To summarize briefly, REITs have,

- Higher return potential

- Higher yield

- Diversification benefits

The reason I called this 5 reasons to own REITs anytime and especially now is because it really is an unusual opportunity.

- Discount to NAV

- Valuation relative to S&P

Historically, REITs trade very close to NAV, usually in the range of 95% to 105%. The discounts available today are not typical. In the past, REIT multiples have usually been around the same as the P/E multiples of the S&P. Today, REITs are much cheaper than their S&P peers.