(This report was published to members of Yield Hunting on Dec. 3. All data herein is from that date.)

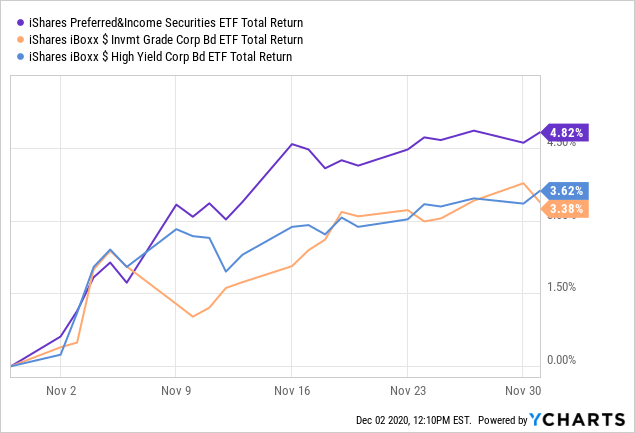

Like most asset classes, preferred stocks had a strong November. They even outperformed IG and high yield bonds by over 100 bps. It appears that tax loss selling came early this year and ended on Oct. 30.

With investment grade preferreds at nosebleed levels, much of the outperformance in November was driven by high yield and unrated preferreds. The best (only?) opportunities in the preferred space are currently among unrated preferreds which are typically not owned by institutions or funds.

A good measure of where we are in the preferreds market are recent IPOs. PSA is the bellwether of preferred stock safety and they IPOed a 3.9% coupon on 11/9. This is actually a slightly higher yield than the 3.875% preferred they IPOed in September. Both preferreds are trading near stripped par. This indicates that there has been little upside in the highest rated portion of the market since September.

Moving down in quality to high-quality-high-yield (BB, BB+), we've seen some greater upside movement. Brighthouse Financial (Insurance) IPOed a split IG (BBB-/Ba2) preferred at 5.375% which quickly rocketed to $26+, demonstrating substantial demand at that portion of the credit spectrum. Later in the month, Assurant (Insurance) IPOed a BB+/Ba1 long duration baby bond at 5.25%. After that, CNO (Insurance) priced a slightly lower quality long duration baby bond at a slightly lower coupon -- 5.125% for BB/Ba1/BB.

Perhaps most surprising was the VNO IPO. VNO is an office building REIT that IPOed a 5.25% preferred. While the preferred is technically split-IG at BB+/Baa3, I would characterize their underlying business as "hanging in there" at best. Physical occupancy at office buildings is down 80% from pre-pandemic levels with some major markets like

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.