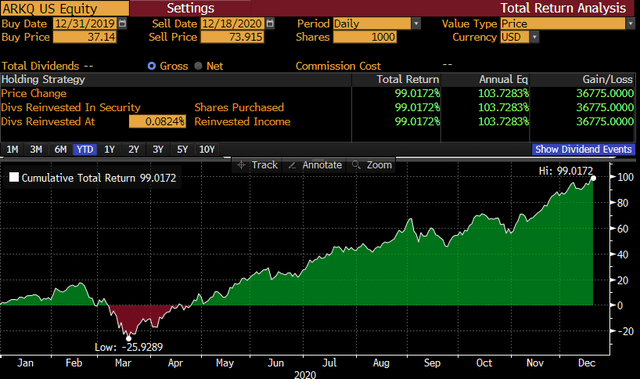

The ARK Autonomous Technology and Robotics ETF (BATS:ARKQ) has been one of the standout performers in the ETF space. At the time of writing, the ETF had appreciated by 98% through a turbulent 2020. ARKQ is an actively managed ETF offered by ARK Funds. The ETF seeks to generate long-term capital growth by investing in companies focused on autonomous technology and robotic application. ARKQ has the ability to invest globally in its quest to uncover disruptive companies which fit the autonomous technology and robotics theme.

Source: Bloomberg

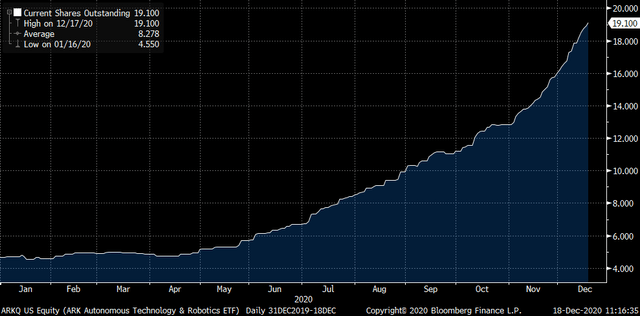

ARKQ's performance has not gone unnoticed as investors have flooded into this vehicle. The number of units outstanding in ARKQ have increased by an astounding 410% in 2020 alone.

Source: Bloomberg

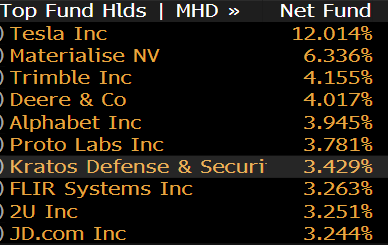

A look under the hood is required in order to understand the constituents driving the performance. Recall that the ARKQ is an actively managed ETF and as a result, there is no passive benchmark that ARKQ is beholden to. The current composition of ARKQ is heavily weighted towards Tesla (TSLA), followed by Materialise NV (MTLS), Trimble (TRMB) and Deere (DE). Tesla represents 12% of the ETF while the top 10 holdings represent ~47% of the ETF.

Source: Bloomberg

We all know that Tesla has had a remarkable year in 2020. The stock has appreciated almost 684% through 2020 as of December 17 2020. Using simple math, a 12% allocation towards Tesla and a 88% allocation towards cash would lead to an overall portfolio appreciation of 70%. Recall that ARKQ has appreciated by 98% through Dec 17. As for the remaining 88% of the portfolio, it has generated approximately 28% of 2020 returns.

ARK Funds has regular disclosures for the components within their ETFs including the ARKQ ETF. A link to these disclosures can be found here. I used the daily reported weights