Editor's note: Seeking Alpha is proud to welcome Beta Investor as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

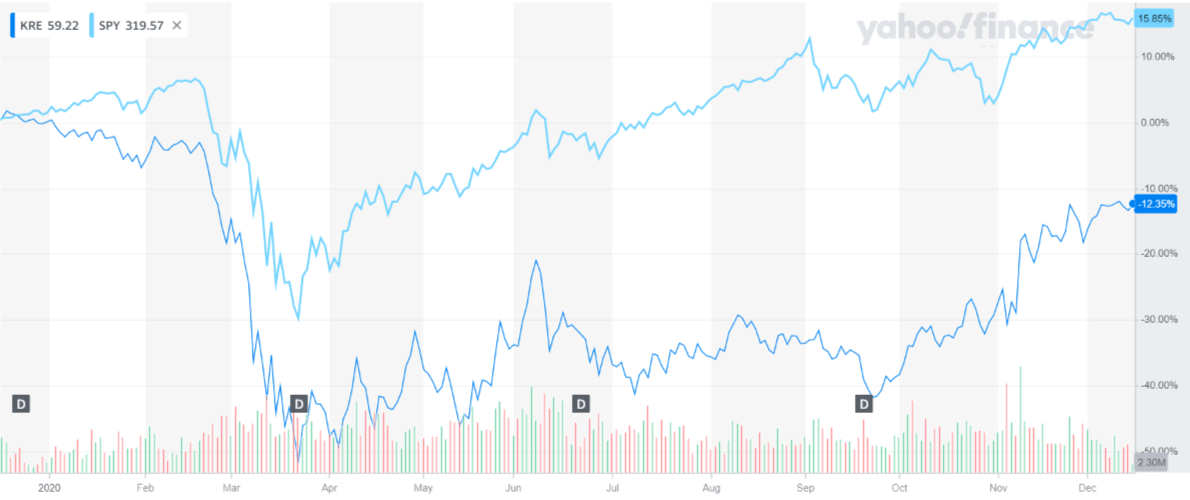

US bank stocks (NYSEARCA:KRE) have underperformed the S&P 500 by ~28% the last 12 months.

source: Yahoo Finance

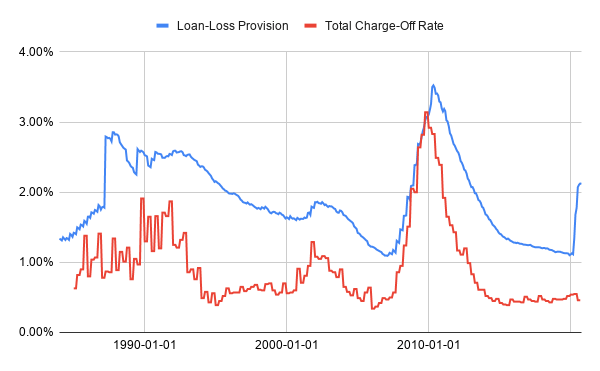

The market is pricing-in elevated solvency risks within the banking sector's loan books. Bank management teams generally agree with the market's risk assessment - the banks have nearly doubled their loan-loss provisions over the past 6 months.

source: FRED

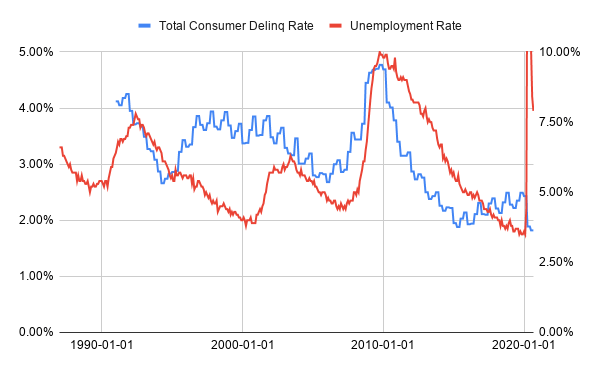

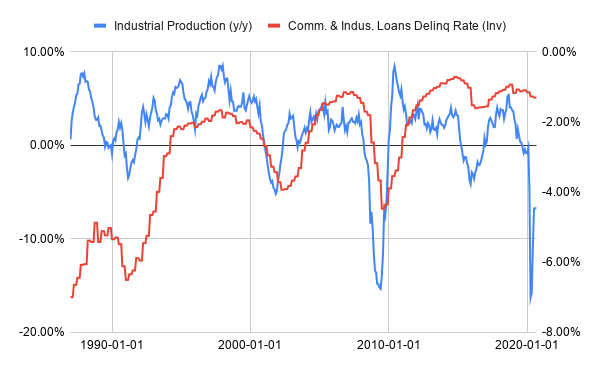

Bank management teams are prepared for a material increase in charge-offs (loan defaults). Economic fundamentals are improving from their nadir earlier this year, but still imply massive credit distress at current levels. The following charts show 1. Consumer credit delinquency rates vs. unemployment, and 2. Commercial/Industrial delinquency rates vs. Industrial Production.

source: FRED

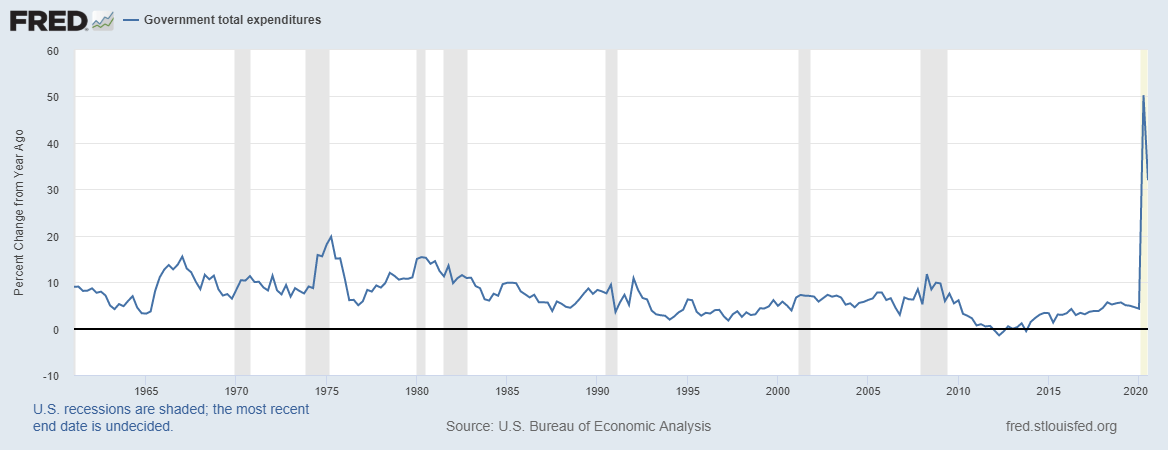

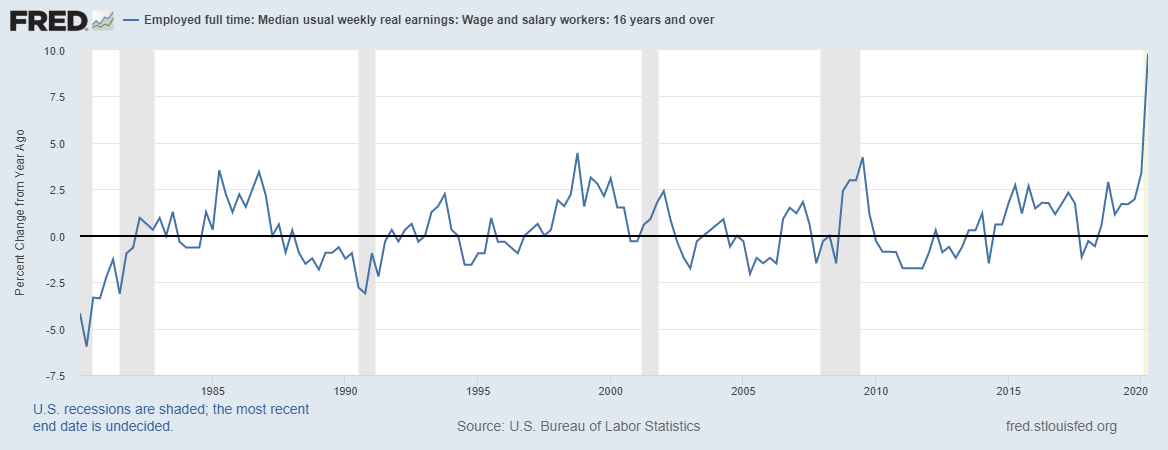

Credit fundamentals have diverged from economic fundamentals because of massive increases in government spending in 2q and 3q (by far the largest spending surge going back to 1960!). Loan programs like the PPP kept businesses afloat, and federal additions to unemployment benefits actually increased wages.

source: FRED

Historic government stimulus has buoyed commercial and individual credit. Congress is attempting to pass another (but smaller) stimulus bill ASAP. Widespread vaccine distribution is set to occur in April/May. Will economic life "return to normal" this summer without the Covid economic disruption resulting in any real credit distress? What are the potential scenarios and what do they mean for KRE (assuming widespread vaccine distribution in May)?

- Congresses passes the proposed stimulus package, and then passes another meaningful stimulus package once Joe Biden takes office. If Dems can win both senate seats in Georgia and thus control the senate, the chances