Introduction

Goldman Sachs recently made the news with its statement that the world is heading into a new commodity super-cycle which will be on par or larger than the super-cycle that occurred before the financial crisis. More or less every commodity will enter a structural bull market.

If this is true, then how should a REIT investor position him or herself in front of this commodity bonanza? Looking at the longlist of REITs trading, I found a subsector called Timberland REITs.

Source: Image

The group consist of CatchMark Timber (CTT), PotlatchDeltic (NASDAQ:PCH), Rayonier (RYN) and Weyerhaeuser (WY).

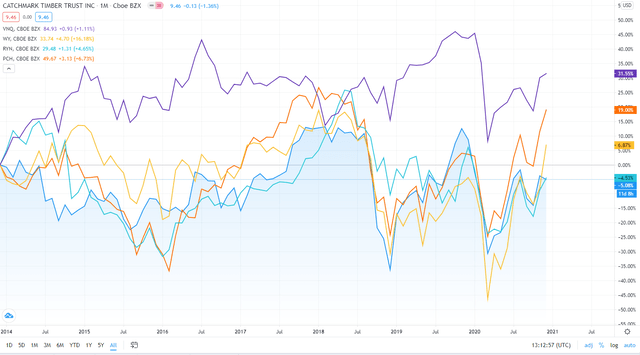

Comparing the development of these four stocks with the (by REIT investors) commonly held Vanguard Real Estate ETF (VNQ), we see below that all four stocks have lagged VNQ. The top-performer during the last six years was PCH followed by WY, with returns of 19% and 7%, respectively, however both RYN and CTT posted negative returns, even when taking into account dividends.

Source: TradingView.

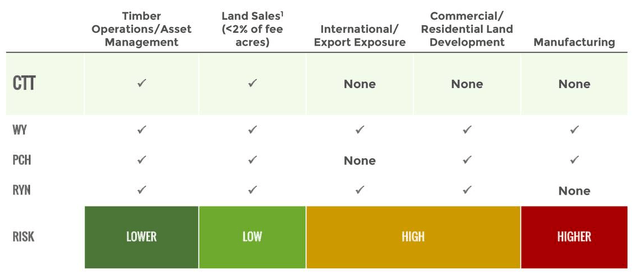

From a macro point-of-view CTT is more of a pure play on US timber and timberland prices compared to the other three REITs. As shown below from CTT latest investor presentation, both WY and RYN have international exposure (which on the one hand might not be bad for sake of diversification) and all the other timber REITs have commercial and residential land development which CTT does not have. Given this, I will focus in this article on CTT, however I'm looking at covering the other stocks in forthcoming articles.

Source: CatchMark investor presentation

Looking at CTT in isolation and if we zoom in, we see that there has been a large return differential between VNQ and CTT of 36.5% during the last six years. Given this, the question beckons, will this trend continue or will things change around?

Source: