Interactive Brokers (NASDAQ:IBKR) operates as an automated electronic broker worldwide. The company excels in many aspects when compared to its peers and thus it has grown its business at a tremendous pace over the last decade. However, the stock has retrieved all its pandemic-driven losses and thus it is currently trading at a lofty valuation level. Therefore, investors should wait for a better entry point.

Business overview

Interactive Brokers is the largest U.S. electronic broker. Thanks to its admirable growth trajectory, the stock has reached a market capitalization of $25 billion while the company has access to 135 markets in 33 countries.

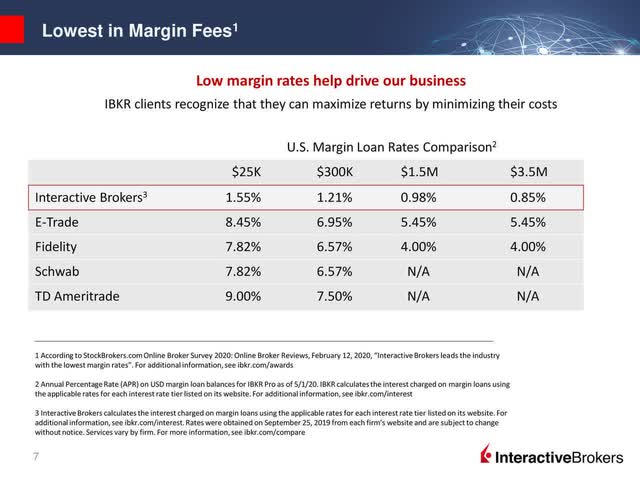

Its primary competitive advantage is the fact that it is the lowest-cost broker. The company has achieved this thanks to its proprietary technology. Most of its senior managers are software engineers, who are laser-focused on automating as many processes as possible. Interactive Brokers thus offers extremely low commissions and fees to traders of stocks and options. It also offers by far the lowest lending rate to the investors who use leverage in their portfolios.

Source: Investor Presentation

As shown in the margin rates charged by the major brokers, it is essentially impossible for investors with leveraged portfolios to switch from Interactive Brokers to another broker, as their loan rate would more than quintuple.

Thanks to its advanced technology and its exceptionally low commissions and fees, Interactive Brokers has been awarded as the low-cost broker for several years. In fact, Barron's has rated Interactive Brokers as the "low-cost broker" nearly every single year in the last 20 years.

Offering low commissions is one of the most important features of brokers for investors, regardless of their trading profile. The advantage of a low-cost broker is evident for traders who execute many trades per day. Even those who are not daily traders but have