EZCORP Inc. (NASDAQ:EZPW) is a leading pawnshop operator with over 1,000 stores primarily in the U.S. and Mexico along with locations across Latin America. This year's pandemic represented several disruptions to the business forcing temporary store closures and reduced business hours in many locations. The company just reported its latest quarterly results highlighted by continued operational headwinds, citing fiscal stimulus measures implemented by the government to support the economy in the U.S. including direct payments and unemployment assistance as limiting the demand for traditional pawn loans. Recognizing the near-term challenges, we believe EZCORP can emerge stronger out of the pandemic as the core business plays an important role in an underserved segment of the consumer financing market supporting a positive long-term outlook.

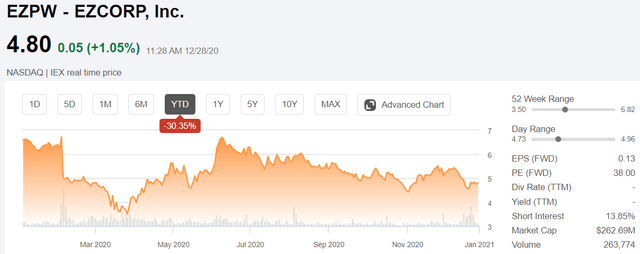

(Seeking Alpha)

EZPW Earnings Recap

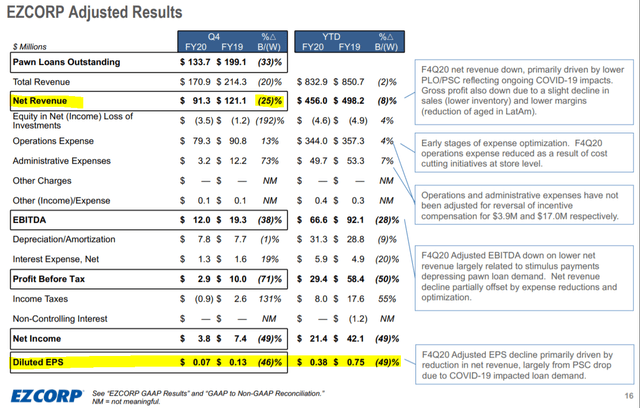

EZCORP reported its fiscal 2020 Q4 earnings on December 14th with non-GAAP EPS of $0.07, which was $0.16 ahead of estimates. On the other hand, a GAAP EPS loss of -$0.42 was $0.32 below expectations. Net revenue of $91.3 million was down by 25% year-over-year. For the full fiscal year, net revenues declined by a more moderate 8% compared to fiscal 2019 considering a stronger start to the year. Adjusted EPS of $0.38 for fiscal 2020 was down 49% from $0.75 in fiscal 2019.

(source: Company IR)

Within the GAAP financial results this quarter, the company booked several charges totaling $20.4 million related to broader cost savings initiatives including eliminating some management positions, closing the 'CASHMAX' business in Canada, and shutting 7 stores across the U.S. and Latin America pawn.

As mentioned, the story here is the ongoing COVID-19 impacts. This is a business model that has historically been very profitable, generating revenues and fees from multiple streams including the core pawn loans, sales of the forfeited collateral merchandise, and separate cash advance lending operation. Going back to around

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.