Ping Identity (PING) remains one of our favorite mid-cap technology stocks. Ping has one of the most sophisticated and robust identity management platforms in the industry. Ping is also cheap when compared to many names in technology, including Okta (OKTA), a close competitor.

Over the last three quarters, Ping underperformed the tech index, given the slowing growth. Many businesses are looking to conserve cash during the pandemic, leading to long deal closing times and smaller deal sizes, leading to revenue slowing and the subsequent Ping's underperformance this year. We believe this is set to reverse in C2021, as cloud, sale of hybrid Identity offerings, industry consolidation, and replacement of legacy products, all accelerated by the SolarWinds (SWI) hack, will drive sales.

Ping remains a compelling alternative to Okta, with a reasonable valuation, marquee customer base, and exciting product portfolio that address on-prem, cloud, and hybrid cloud architectures. Therefore, we would buy the shares now to position well for the impending revenue acceleration. For a more detailed view of Ping's core business, please refer to our prior work on SA.

Stock underperformed in 2020

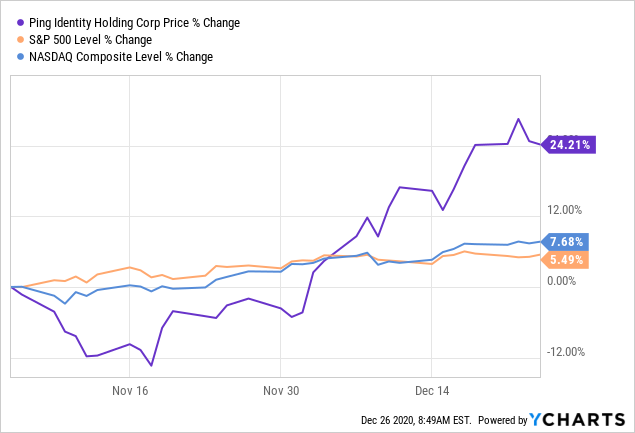

While the stock outperformed both Nasdaq and S&P indices since the last report on November 5, Ping Identity underperformed Nasdaq by a wide margin this year. PING is only up about 19% YTD, while Nasdaq is up 43%.

Underperformance driven by slowing ARR/Revenue

This underperformance is attributed to slowing growth much of this year. Revenue growth slowed from +15% in F4Q19 (December quarter 2019) to about -3% during the last reported quarter (September quarter 2020). The slowdown in revenue is attributed to the phasing-in of large enterprise deals and contraction of deal durations, as many customers were looking to conserve cash during the pandemic. However, the company noted at several conferences during December that the pipeline continues to improve, and the company is much confident that the deal outlook is