I come from a family of real estate entrepreneurs, and from a very early age, I have been touring investment properties and going to construction sites with my father.

As I grew up, I knew that I wanted to also become a real estate investor and so I studied accordingly, passed the CFA exams, completed two bachelor's degrees in real estate, and eventually landed a job in private equity. We managed hundreds of millions worth of property investments and it taught me a lot.

With this background, I was very well prepared to become a real estate investor, and so I did. I bought one property... a second... but eventually, I came to the conclusion that it wasn't worth it and stopped investing in private real estate.

Why is that?

I discovered REITs and came to the conclusion that they were better investments in most cases. I quit my private equity career to become a full-time REIT analyst, and that's what eventually landed me here on Seeking Alpha to discuss some of my investment ideas.

In today's article, I take a step back to present the five reasons why I stopped buying private properties to instead focus on REIT investing. If you are still undecided between the two, I hope that this article will help you gain a fuller picture to make your own decision.

Reason #1: REITs Deliver Better Investment Returns

Exceptions always exist, but on average, REITs have historically generated higher returns than private real estate.

According to NAREIT, REITs have outperformed on average by about 4% per year:

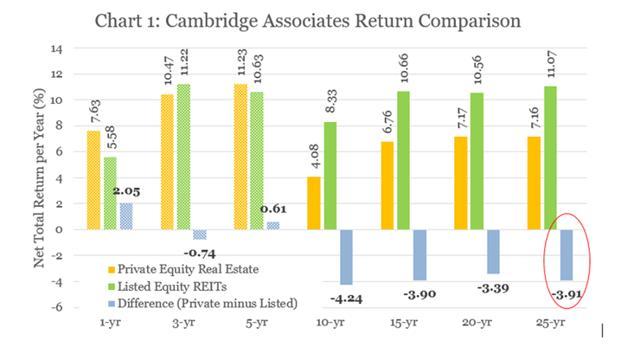

Another study conducted by Cambridge comes to the same conclusion:

There are two main reasons why REITs outperform private real estate:

1) They enjoy significant economies of scale. When you own 100s of properties, you enjoy savings on

Our Favorite Opportunities for 2021

We spend 1000s of hours and over $100,000 per year researching the real estate markets for the most profitable investment opportunities and share our Best Ideas with the 2,000 members of High Yield Landlord.

For a Limited Time - You can get access to all of them for free with our 2-week free trial!

Join us today and gain instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

We are also offering a Limited-Time 28% discount for new members!