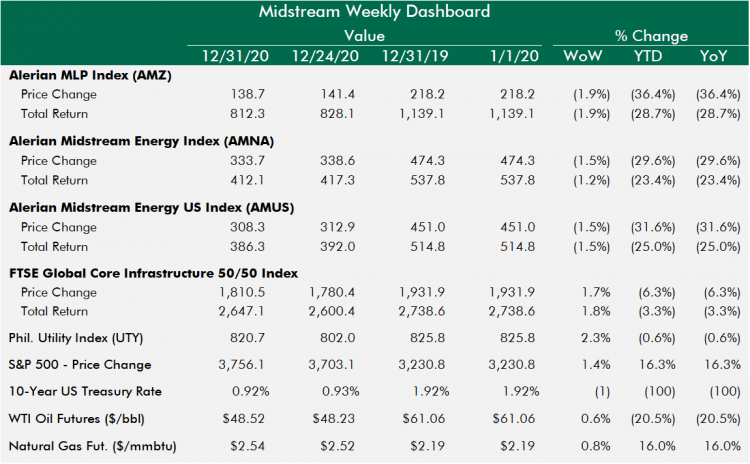

The short final week of the year was good for most stocks, but midstream stocks were left out again. The S&P 500, utilities and infrastructure stocks traded up, along with oil and natural gas prices. Midstream stocks underperformed the broad market for a fourth straight week. Midstream's bounce off the bottom early in the quarter appears to have left positioning largely settled into year-end.

The last month or so has been quiet in midstream-related news. Expect some company news in the coming weeks, potentially M&A or at least some capital markets activity. Also, the first week of 2021 offers potential macro news that could drive volatility in midstream. First, there is an OPEC meeting on Monday, which always carries some risk. Then, the Georgia runoff elections are on Tuesday, which could have regulatory or tax implications for midstream stocks.

After yet another year of underperformance, it does feel that midstream is due for a bounceback in stock performance. Some would argue that 2021 is finally the year that high free cash flow yields will be realized and stocks will attract investor attention. But elevated financial leverage, weak corporate governance, excess capacity across most basins, and continued fund flow moves away from energy stocks remain headwinds to performance.

High quality, demand-pull pipeline and export infrastructure should outperform upstream-oriented names in a sector where money flows into midstream sector funds is challenged, but generalists might find value and opportunity among a few of the higher-quality, scale midstream players. That should lead to further sector rationalization, potentially some consolidation, such that there are fewer midstream tickers this time next year.

Being happy to see 2020 end is beyond a trope at this point. Netflix even made a Mockumentary about it that hit on all the obvious jokes about what a brutal and bizarre year