SuRo (NASDAQ:SSSS) is an internally managed BDC that invests in pre-IPO tech companies. In general, BDCs are valued on a P/NAV (net asset value) multiple. SSSS’s last NAV was $12.46/share (reported 9/30/20). Since then, the company has paid three dividends worth $0.72/share in total (one in October, November, and December), so dividend adjusted NAV is ~$11.74/share. With SSSS shares currently trading at a slight premium to that level (last trading price = $12.58), SSSS might seem a strange recommendation for a top idea pick. However, we believe there is good line of sight into SSSS’s NAV increasing significantly in 2021.

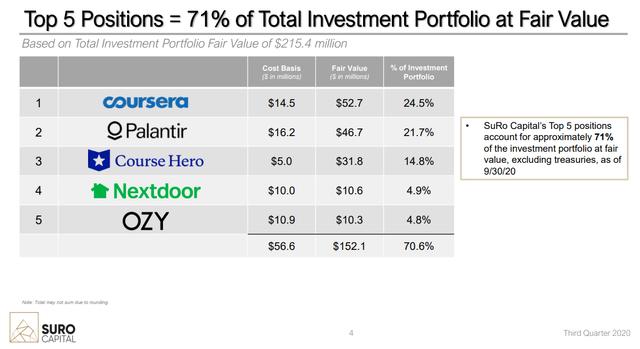

To understand why, we need to look at SSSS’s investment portfolio. The company is rather concentrated, with their top 3 positions making up ~60% of their investment portfolio and their top 5 positions making up ~71%. That concentration is important, because we think the next year will have catalysts that will result in a meaningful increase in value for each of their top four positions.

To illustrate why we think SSSS’s NAV is set to increase so quickly, let’s highlight the simplest story: SSSS’s investment in Palantir (PLTR). At the end of the third quarter, Palantir’s stock price was ~$9.50/share. SSSS actually carried it on their books at ~$8.70/share at the end of their quarter (likely due to some lockups on their shares). Since quarter-end, Palantir’s stock has skyrocketed to $24.66/share. SSSS has sold some shares since quarter-end, but they continue to hold the vast majority of their position and will have to until two days after PLTR reports their FY20 earnings to sell anymore. Marked to market for PLTR’s stock price, SSSS’s position in PLTR is worth ~$127m, or ~$5.88/share, versus $46.7m, or $2.21/SSSS share, at 9/30/20. That’s a >$3/share increase in NAV from just the share price movement of PLTR in Q4!

To illustrate why we think SSSS’s NAV is set to increase so quickly, let’s highlight the simplest story: SSSS’s investment in Palantir (PLTR). At the end of the third quarter, Palantir’s stock price was ~$9.50/share. SSSS actually carried it on their books at ~$8.70/share at the end of their quarter (likely due to some lockups on their shares). Since quarter-end, Palantir’s stock has skyrocketed to $24.66/share. SSSS has sold some shares since quarter-end, but they continue to hold the vast majority of their position and will have to until two days after PLTR reports their FY20 earnings to sell anymore. Marked to market for PLTR’s stock price, SSSS’s position in PLTR is worth ~$127m, or ~$5.88/share, versus $46.7m, or $2.21/SSSS share, at 9/30/20. That’s a >$3/share increase in NAV from just the share price movement of PLTR in Q4!

Please contact me with any questions or interest in Sifting the World.

It’s not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it – who look and sift the world for a mispriced bet – that they can occasionally find one.