Introduction

Whilst the unitholders of many Master Limited Partnerships saw their distributions being reduced during the turmoil of 2020, unitholders of others such as EnLink Midstream (ENLC) were forced to endure two reductions. Even now many months later, their distribution yield is sitting at a very high level of just above 10%. This article provides a follow-up analysis to reassess the safety of their distributions since more than half a year has passed since my previous article.

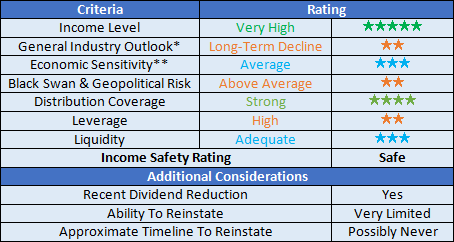

Executive Summary & Ratings

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that was assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Image Source: Author.

*There are significant short and medium-term uncertainties for the broader oil and gas industry, however, in the long-term they will certainly face a decline as the world moves away from fossil fuels.

**Whilst the oil and gas industry to which they service has high economic sensitivity, given the more stable nature of the midstream sub-industry this was deemed to be average.

Detailed Analysis

![]()

Image Source: Author.

Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and best captures the true impact to their financial position. The main difference between the two is that the former ignores the capital expenditure that relates to growth projects, which given the very high capital intensity of their industry can create a material difference. Similar to all of my other analyses, I further stress test their distribution coverage by including other relevant miscellaneous cash expenses that outrank