Editor's note: Seeking Alpha is proud to welcome Satya Damaraju as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Investment Thesis

Electronic Arts (NASDAQ:EA) is an undervalued company that still has plenty of growth prospects. EA has demonstrated its ability to deliver profitable games to nearly every platform, including PC and console. The company is also making moves to facilitate growth and innovation as next-gen consoles are beginning to release. This combination leads me to expect that the company will sustain its profitability as well as accelerate growth in the coming years.

Core Business and Industry

(Source: ea.com)

Electronic Arts contains a broad library of successful games that include FIFA, Madden, NHL, Apex Legends, Sims, and Need for Speed. The company’s core lies in EA Sports, which represents a large portion of its business and a main source of its profitability. EA has also expanded its business to live services, which include revenues from subscriptions and esports.

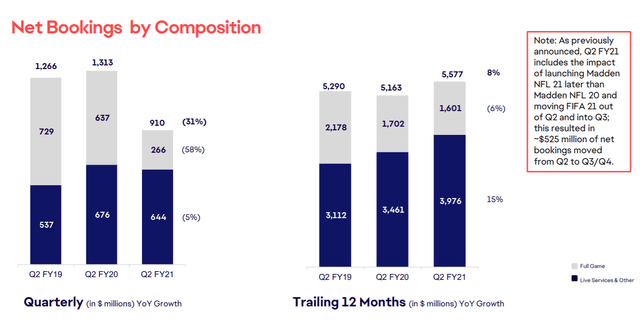

(Source: EA Investor Relations)

EA’s live services have been a main source of growth for the company and have accounted for most of the company’s revenue over the past 12 months. This has driven EA’s revenue growth despite the delayed release of its most lucrative games: Madden NFL 21 and FIFA 21. Electronic Arts’ subscription services have given gamers the chance to play with others in an online setting. This has been especially important during the pandemic, as lockdowns have prevented many from seeing their friends. This provides the best alternative to maintain social interactions. In addition, subscription-based models have become increasingly popular in the tech world, and EA has shown it can thrive with these changes.