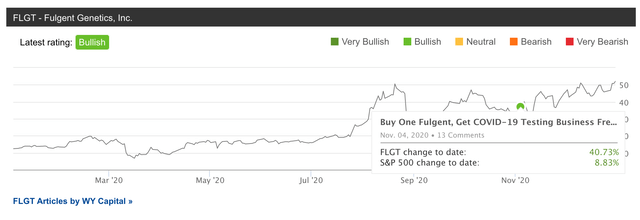

I am very pleased with the returns of Fulgent (NASDAQ:FLGT) since my article in November, especially considering other COVID-19 testing plays haven't done so well. Mask companies, testing companies, etc., have all done very poorly since the vaccine news was announced, yet FLGT continues to outperform.

Source: SeekingAlpha

The question, though, is whether the company can continue to outperform in 2021 even with the rollout. Interestingly enough, my analysis in this article shows that, yes, FLGT is still valued way below intrinsic value.

Core genetic testing

The core genetic testing business is already showing signs of recovery in Q3, growing around 57% sequentially to around $10-11mil. This is far slower than the pace of growth before the pandemic of around 50% YOY but it is faster than the flat YOY growth for Q2 2020.

In the next few quarters, I expect growth to accelerate substantially due to a return to normal combined with a boost from post-pandemic synergies with the COVID-19 business. These synergies can be shown in multiple ways - Firstly, by providing COVID-19 tests to a number of institutions, FLGT has demonstrated the capability to deliver large numbers of high-quality tests in a timely fashion. This allows FLGT to cross-sell its other genetic tests to these institutions alongside its COVID-19 test. Secondly, the large test volumes being delivered gives FLGT leverage to get reimbursement agreements for their broad menu of genetic tests, which are usually paid in cash. Lastly, consumers have become much more aware of FLGT's brand Picture Genetics, which should accelerate momentum for FLGT's DTC offering.

In addition, one often underlooked area is the strong cash position FLGT will have after the pandemic. FLGT has historically been neglected by the market compared to competitor Invitae (NVTA) because NVTA was executing a growth at all costs