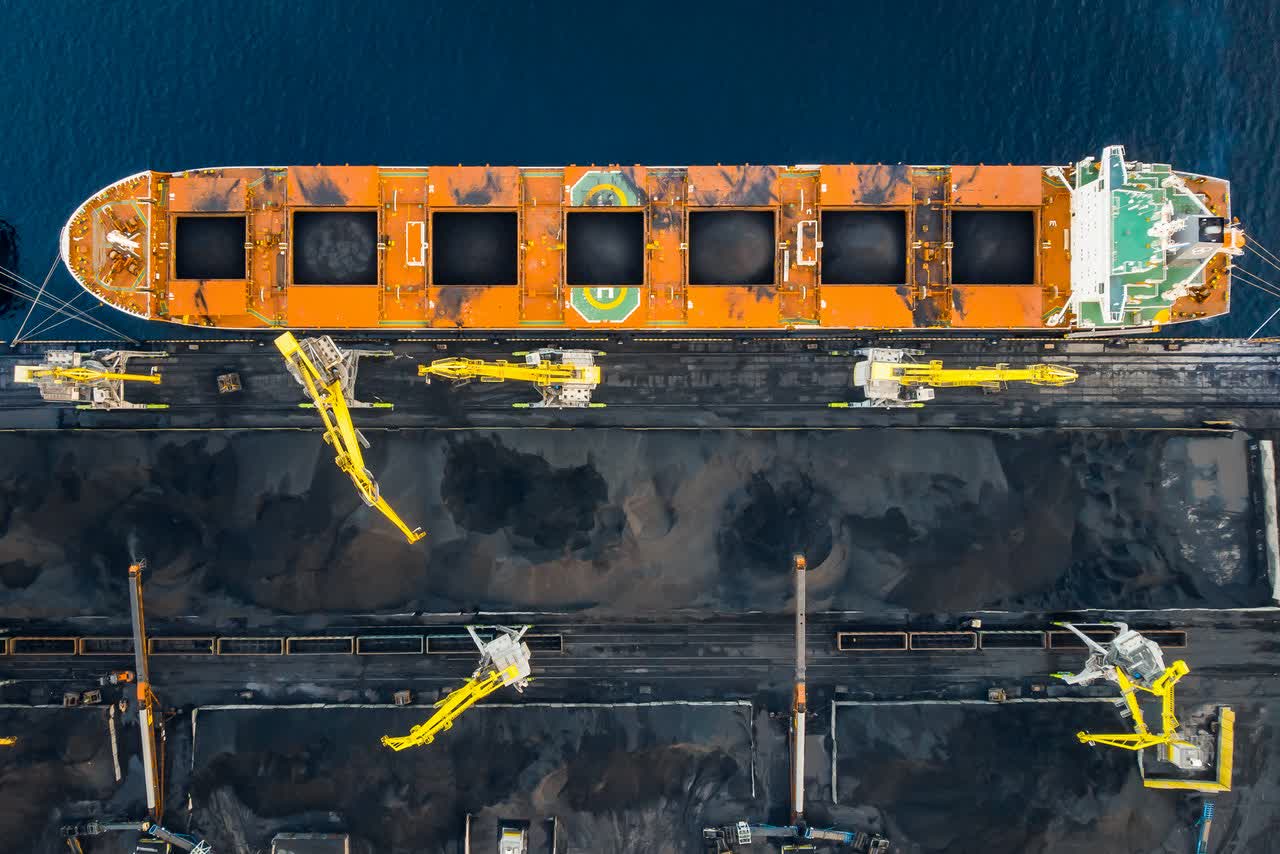

Source: IEA

This article is an update to my June 2020 article and thesis on the company. At the time of that prior article, CONSOL Energy (CEIX) was trading at about the same price it is trading currently of $7/share. This was before the Q2 2020 report, which showed results that were far worse than expected driven by the very large drop in demand due to power plant shutdowns from low electricity demand during Covid lockdowns.

The Q2 report was so bad, the shares struggled for the rest of 2020, trading as low as $3.5/share. A level implying heavy selling pressure and potentially doubts about its business continuity as other coal companies did file for bankruptcy protection.

The main question I asked then was whether the company was set up to survive the coming storm. I concluded it was and now I am more certain of such conclusion. CONSOL is not going away anytime soon and may actually produce very good cash flow in the coming years. I will go through a short list of why I think this is the case:

- Coal prices are recovering.

- Coal demand is set to grow in 2021 in the US.

- World Coal demand will remain stable through 2025.

- No debt maturities for the next three years.

Coal prices recovering:

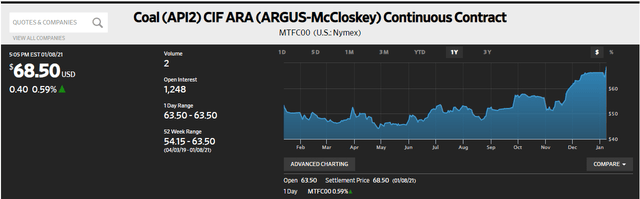

Source: The Wall Street Journal

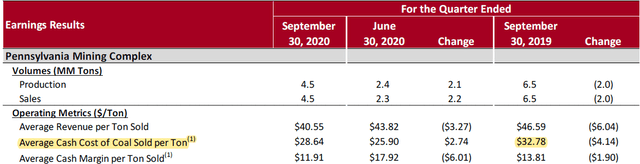

Coal, as measure by API2 index, has recovered from below $50/ton for most of 2020 to almost $70/ton today. As a reminder, CONSOL's cash cost per ton is in the low $30s (I look at September 2019 quarter as a better guide given mines were producing at full capacity, whereas in 2020, there was some curtailment).

Source: company Q3 presentation

Coal demand:

Coal demand dropped significantly in the US during 2020 as demand for electricity was reduced