I don't look to jump over seven-foot bars. I look around for one-foot bars that I can step over. — Warren Buffett

With most of us staying home as much as possible, it isn’t easy to find an industry where demand exceeds supply these days. But given we are at home, one area of high demand is bringing things to our homes, that is transportation and logistics. While most businesses try to deal with declining volumes, transportation companies are focused on finding ways to meet all the demand.

Schneider National, Inc. (NYSE:SNDR) is one of those companies as it has one of the largest for-hire trucking fleets in North America. For the most recent quarter, the company noted demand exceeds capacity in almost every geographic market it operates in. SNDR expects these conditions to persist well beyond the coming months.

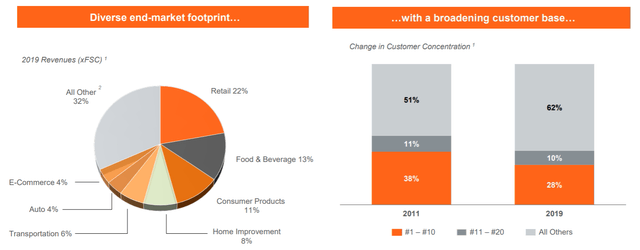

SNDR is a transportation and logistics company offering truckload, intermodal, and logistics solutions. These include long-haul and regional / short-haul deliveries in dry, bulk, temperature-controlled, or other specialty containers. SNDR also offers door-to-door and cross-border services in North America. The company supports a wide variety of industries with a growing portfolio of customers, as shown in the graphs below.

Source: Company materials

Profitability

For the most recent quarter, SNDR notched earnings per share of $0.25, more than double the $0.11 reported in the prior year’s quarter. The Logistics segment saw strong growth from managing loads with third-party capacity as segment revenues grew 20 percent year-over-year. This segment provided roughly one-quarter of SNDR’s revenues in the most recent quarter.

The largest of SNDR’s segments by revenue is the Truckload segment, which saw a decrease in revenues year-over-year given capacity constraints due to driver shortages. However, the segment recorded a sequential improvement, and overall total company revenues were mostly flat from the prior year’s quarter, with lower

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.