Capstone Mining (OTCPK:CSFFF) is no rookie in the copper mining industry. The company was established back in 1987. In 2004, Capstone acquired the Cozamin project, and in 2011, it partnered with Korea Resources Corporation (KORES) to acquire the world-class Santo Domingo project. In 2013, Capstone acquired the Pinto Valley mine. Right now, Capstone Mining enters a growth phase that should see its copper production volumes increase by more than 150% by 2024.

Capstone today

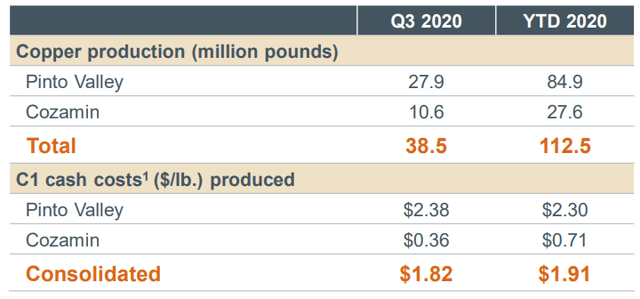

Today, Capstone operates two mines, Cozamin in Mexico and Pinto Valley in Arizona. It is also nearing the construction of the Santo Domingo mine. The company has a strong shareholder structure, with 60% of outstanding shares held by institutional investors. The biggest ones are GRM Investments (23%) and KORES (10%). The 2020 production guidance promised production of 140-155 million lb copper, at a C1 cash cost of $1.85-2/lb. By the end of Q3, Capstone produced 112.5 million lb copper, at a cash cost of $1.91/lb. It means that the guidance was most probably met, but this will be confirmed only later, probably in the middle of February, when the Q4 financial results should be released.

In Q3, Capstone recorded revenues of $130.5 million, by selling 39.8 million lb copper at an average realized price of $3.13/lb. Approximately $6 million were generated by silver by-products. The adjusted EBITDA equaled $51.6 million and operating cash flow equaled $27.7 million. The adjusted net income equaled $9.5 million. Capstone ended the quarter with cash of $56.9 million and debt of $219.9 million. These numbers maybe don't look too impressive, but this should start changing in the near future.

Capstone tomorrow

Capstone is following an aggressive growth path. It plans to increase the production at Cozamin and Pinto Valley, and what is more important, to build the 70%-owned Santo Domingo