(This report was first issued to members of Yield Hunting and in Landlord Investor's model portfolio on December 24th, 2020. All data herein is from that date.)

This is a guest post by Landlord Investor.

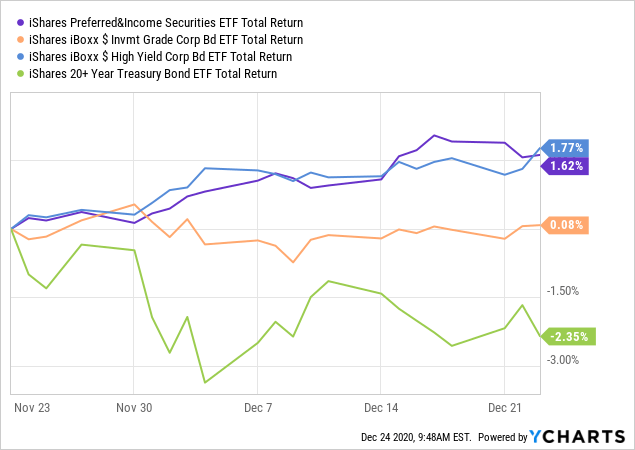

The preferreds market (PFF) has continued marching higher by 1.62% over the past month, nearly matching the performance of high-yield bonds while significantly outperforming IG bonds. PFF is a little more than half investment grade. This impressive performance (on an annualized basis) comes despite weakness in the treasury market (TLT) which lost 2.35% over the past month due to higher rates. That indicates that preferreds performance is the result of spread compression caused by low realized volatility.

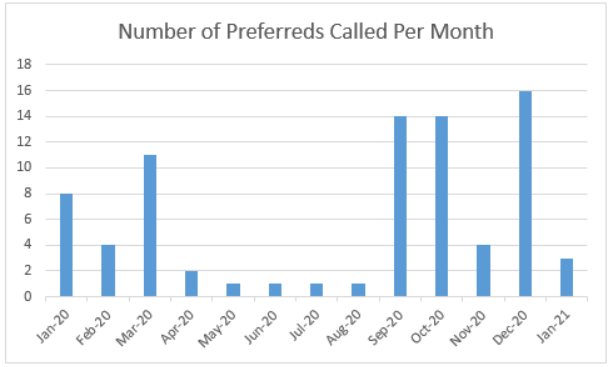

The strong preferreds market has led to a resumption of the high level of calls that was experienced just prior to the pandemic. Call activity could eclipse that level going forward as rates are lower and the economy is forecast to grow at a rapid clip in 2021.

While call risk is real, it's important not to overestimate the risk either. Many investors avoid all callable securities above par even if they are unlikely to be called. Only a small fraction of the hundreds of preferreds and baby bonds get called each month. Unless the issuer is a huge bank like JPMorgan (JPM) or highly rated with a track record of aggressive call activity like Public Storage (PSA), it's unlikely an issuer calls a preferred unless they can save at least 80-100 bps by refinancing it into a lower yielding preferred. Refinance costs are typically 300+ bps. Many good risk/reward opportunities exist with preferreds that could be refinanced 25-65 bps lower but trade only a small amount over stripped par.

Investors should balance five factors when buying prefs/BBs:

- Credit Risk - The risk an issuer goes

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.