NXP Semiconductors (NASDAQ:NXPI) designs and manufactures semiconductors that are used in cars, telecommunication equipment, and mobiles. The technological trends such as electrification and autonomous driving in the automotive industry bode well to NXP's revenue growth. Similarly, but to a lesser extent, is the upgrade to the 5G network.

The company seems undervalued, based on PE and EV to EBITDA ratios. The might be explained by above-average leverage and below-average profitability. Improvements in any of these fronts can support NXP's share price appreciation.

Industry overview

The current narrative fueling the semiconductor industry is about growth, consolidation, and more importantly, the rise of smaller players challenging the technological legacy of larger firms such as Intel (INTC). For example, a leading communication equipment manufacturer recently agreed to replace Intel's flagship 86x technology, which helped the company dominate the industry in the 1980s and 1990s, with Marvell's (MRVL) OCTEON processors, in all its product range. Equipment manufacturers are realizing that they can use the technologies of smaller firms at lower costs, and in many cases, superior results.

I don't claim to know the technical details of how semiconductors work. I understand, they are the small pieces inside our smartphones, laptops, and washing machines, that control the flow of data through logical "on/off" gates, to ensure the proper functioning of these appliances. Any device that has a computer code in it must have a semiconductor, and this includes not only what appears to be a smart device, but even the most mundane such as an alarm clock on a bed table, a hairdryer, or nowadays, a LED light bulb. The revenue growth of semiconductors thus depends on the growth in their end markets, the devices where these microchips live.

NXP's end-markets

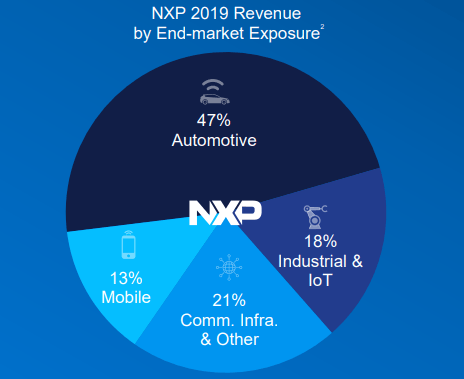

The graph below shows NXP's end markets.

Source: Investors presentation

Automotive (47%)

Automotive makes