Gold plummeted last Friday, dragging silver and their miners’ stocks down with it. That was reminiscent of another brutal down day in early November. While certainly uncommon, sharp selloffs naturally freak out traders crushing any bullish sentiment. Serious gold down days are nearly always driven by heavy speculator selling in super-leveraged gold futures. The risk of that erupting depends on their positioning.

A week ago on Jobs Friday, gold collapsed an ugly 3.5% to $1,847! Those monthly US jobs reports are the most-important economic data in terms of market-moving potential. So there are much-higher odds of big gold swings in the wake of those nonfarm-payrolls numbers. The jobs situation tends to move gold because it affects traders’ perceptions of what the Federal Reserve might do next in terms of monetary easing.

Gold normally reacts to payrolls coming in significantly different than expectations. A big upside surprise in monthly US jobs often leads to gold-futures selling, as that implies the Fed won’t be as aggressive with easing. And a major miss usually ignites sizable gold buying, as traders assume that implies a weaker US economy forcing the Fed’s hand to print more money. So last Friday’s data should’ve ignited a gold surge.

Economists expected US jobs growth to be weak in December, looking for a paltry +50k. But the actual came in much worse at -140k! Normally gold would’ve rallied 1% to 2% on such a rotten number. So its 3.5% plunge that day was definitely an anomaly. Despite happening on a Jobs Friday, that data was only partially responsible. Gold trades overnight around the world and suffered big losses before that report.

The prior afternoon, gold ended the US trading day near $1,915. But overnight in late Asian trading while Americans were asleep, gold plunged sharply from around $1,909 to $1,885. Gold drifted a bit lower in the European session, re-entering US trading at $1,882 that Friday morning. So half of gold’s Jobs-Friday losses had already accrued well before that latest jobs data. That big downside surprise was indeed bullish.

Gold rebounded back up to $1,891 in that release’s immediate wake. But gold-futures speculators were spooked with the psychologically-heavy $1,900 level failing overnight. So they sold that bounce to pummel gold all the way down to $1,830 by early afternoon! While it recovered to $1,847 at the US close, that was still that 3.5% loss. Silver and the main Gold Miners ETF (GDX) plunged 7.0% and 4.8% in sympathy.

While startling sentimentally, those sharp selloffs did not torpedo recent newer uptrends in the precious metals. Gold stocks’ major upleg breakout evident in GDX, which I discussed in last week’s essay written the day before Jobs Friday, stayed intact. Gold, silver, and their miners’ stocks remained in what still look like young bull-market uplegs technically. Their series of higher lows and higher highs survived that rout.

A few days earlier in our weekly newsletter, I warned subscribers a sharp gold selloff remained a real threat. “A snowballing gold-futures-longs mass exodus is still the biggest near-term risk gold faces, so we must stay wary.” If you understand and follow speculators’ collective gold-futures positioning, then sharp gold selloffs won’t scare you into making hasty emotional trading decisions that end up proving poor ones.

Speculators’ gold-futures trading is gold’s dominant short-term driver. Whenever gold sees a big daily swing up or down, it is usually the result of spec gold-futures action. Futures trading is way different from stock trading, because of its extreme inherent leverage. That greatly multiplies the gold-price impact of futures speculators’ capital, enabling it to often become the small tail that wags the far-larger gold-price dog.

Each American COMEX gold-futures contract controls 100 troy ounces of the yellow metal. At $1,850 gold, that’s worth $185,000. But this week speculators are only required to hold $10,000 cash in their accounts for each gold-futures contract they trade. That enables them to run maximum leverage way up at 18.5x. Every $1 they deploy can have the same effect on gold as fully $18.50 bought or sold outright!

And that’s actually pretty low for this wild-west realm. Gold-futures margins get raised when gold prices are volatile, to lower the risks of traders not being able to make good on their contract commitments. For years, maximum gold-futures leverage for speculators ranged from 25x to 35x! With extreme leverage comes extreme risk, forcing gold-futures traders to be ultra-myopic for the time horizons they operate in.

A big gold down day like last Friday’s 3.5% plummeting is a manageable 3.5% loss for investors using no margin. But at 18.5x leverage, that is multiplied to 64.8%! Imagine being long gold futures to the hilt and seeing nearly 2/3rds of your capital deployed obliterated in a matter of hours. When gold starts selling off materially for any reason, gold-futures speculators have to quickly pile on to avoid catastrophic losses.

That’s true regardless of the sparking catalyst. There were a few potential ones late last week leading into Jobs Friday. The US stock markets had just surged to another all-time high, weakening demand for alternative investments lead by gold. Bitcoin, which millennials and some institutional investors view as digital gold, had skyrocketed 35.8% to dazzling record highs in just four trading days stealing the limelight!

And 10-year US Treasury yields were soaring with Democrats taking the Senate and gaining full control of the US government. The prospects of trillions of dollars of more government spending drove a big bond selloff, catapulting 10y yields from 0.91% to 1.11% last week alone! Those higher yields were lighting a fire under the US Dollar Index, which is the main indicator gold-futures speculators watch for trading cues.

I suspect this latter dynamic was what unleashed the gold-futures selling in Asia heading into Jobs Friday. And once it started, it cascaded like usual since traders can’t afford to be wrong for long in exceedingly-unforgiving gold futures. So by the time the dust settled that day, gold had been pummeled that 3.5% lower sucking in silver and their miners’ stocks. Only gold-futures selling can yank gold prices down so fast.

Unfortunately speculators’ gold-futures positioning is only published weekly, late Friday afternoons but just current to preceding Tuesday closes. So when this essay was published, the latest Commitments of Traders report illuminating that Jobs Friday episode still hadn’t been released. But gold can’t plunge so sharply without heavy spec gold-futures selling. Another major indicator helped confirm that last Friday.

Over the longer term, gold’s dominant primary driver is investment flows. Investors control vast pools of capital radically dwarfing what the gold-futures speculators can wield. So while frenzied bursts of super-leveraged gold-futures trading can temporarily overwhelm gold prices, investment is ultimately way more important. Despite that Jobs-Friday plunge, gold’s most-important investment vehicles showed no selling.

Those are the American SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) gold ETFs. The former’s gold-bullion holdings held in trust for its shareholders were dead-flat that day, while the latter’s edged up 0.1%. A couple weeks ago I wrote an essay on recent slowing gold-ETF selling, a very-bullish omen upping the odds a new gold bull upleg is underway. GLD and IAU saw no differential selling as gold dropped 3.5%.

As the fuel that drives sharp gold selloffs is speculator gold-futures positioning, that also governs the risks of those events happening. If these traders’ collective gold-futures long contracts are high, and/or their short contracts are low, a big gold down day could erupt anytime. I’d been warning our subscribers about this mounting risk for weeks before Jobs Friday, as our newsletters analyze every weekly gold-futures report.

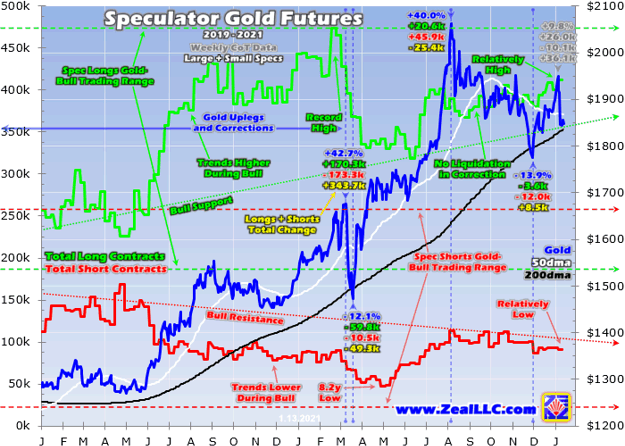

This chart superimposes gold prices over total spec longs and shorts during the past couple years or so. Gold uplegs and corrections are marked, along with the changes in spec longs and shorts over those exact spans. The full trading ranges of spec longs and shorts during this entire secular gold bull since mid-December 2015 are also shown. Speculators’ gold-futures positioning has been excessively-bullish.

In the last CoT report before gold’s Jobs-Friday plummeting, total spec longs were running way up near 411.7k contracts. That is relatively high compared to their gold-bull trading range, which spanned from 186.7k in late December 2015 to 473.2k in mid-February 2020. Normally speculators sell down their long contracts during gold corrections, paring back their leveraged upside bets. But they didn’t during gold’s latest.

That started in early August, after gold had rocketed 40.0% higher out of deeply-oversold stock-panic lows last March. Gold had shot parabolic on enormous investment capital inflows into GLD and IAU, spawning dangerous euphoria. So a healthy correction was in order to rebalance both sentiment and technicals, paving the way for gold’s next bull upleg. I warned about this imminent correction risk in late July.

Indeed gold retreated 13.9% over the next 3.8 months into late November. That proved right in line with this secular bull’s prior corrections which had averaged 14.3% losses over 4.1 months. But despite that selloff largely driven by differential selling of GLD and IAU shares, gold’s decline was gradual enough to avoid spooking gold-futures speculators. So they merely sold 3.6k long contracts during that correction span.

That left their leveraged gold upside bets relatively high, with total spec longs 4/5ths up into their gold-bull trading range leading into Jobs Friday. So whenever the right catalyst came along, with a US dollar rally being the most-likely one, cascading gold-futures selling hammering gold lower was a real risk. And that is almost certainly exactly what happened a week ago, which should be confirmed by this week’s new CoT.

Excessively-bullish upside bets spawn gold-futures-selling overhangs. I think of these like the windblown-snow cornices that crown the high ridges of the Colorado mountains in the winter. Most of the time they do nothing, but all that heavy packed snow has great potential energy. That can be suddenly released in avalanches when just the right conditions of snow consistency and density, temperature, and wind arise.

Like snow cornices at elevation, high spec gold-futures longs aren’t inherently risky. Sometimes they stay high, or gradually shrink with little fanfare like sublimating or melting snow. But when the right catalyst hits at the right time, all that potential gold-futures selling can be suddenly released igniting a snowballing avalanche of selling. That bashes gold sharply lower whenever it happens, both in uplegs and corrections.

My decades of gold-futures research necessary to profitably trade high-potential gold stocks has led me to view 400k+ spec gold-futures longs as the danger zone. The higher those collective upside bets get, the more likely they are going to collapse into cascading selling. And for three CoT weeks in a row before Jobs Friday, total spec longs exceeded 400k at 408.7k, 400.5k, and 411.7k contracts. That demanded caution.

But that static threshold is simplistic within the context of a longer secular gold bull. The more years that gold marches higher on balance, the more bullish everyone gets including gold-futures speculators. They are less inclined to liquidate their longs back down to early-bull levels after gold has established a long track record trending higher. So spec longs’ relevant trading range likely climbs in its own uptrend parallel to gold.

Leading into Jobs Friday, spec longs’ bull support line had risen up near 355k contracts. That left room for about 57k of selling on the right catalyst. Anything over 20k in any single CoT week is huge, forcing gold sharply lower. I can’t wait to see total spec longs when the new CoT report straddling Jobs Friday is finally released late this afternoon. Were those long liquidations large enough to slash that overhang risk?

Total spec shorts work similarly, but in the opposite way. Adding a new gold short has the same gold-price impact as selling an existing long, while buying to cover a short is functionally identical to adding a new long. But spec shorts overall are proportionally less important to gold since there are usually way fewer of them. Ahead of Jobs Friday, total spec shorts of 90.8k contracts were just over 1/5th of total longs.

During this secular gold bull, speculators’ gold-futures shorts have run in a gigantic range between 47.8k in late April 2020 to 256.7k in mid-August 2018. But like longs, the deeper into a gold bull speculators get the less motivated they are to put on leveraged gold-futures shorts. So total spec shorts have seen a declining bull-resistance line in recent years, which was running near 105k contracts before Jobs Friday.

So before $1,900 gold failed overnight in Asian trading late last week prior to the latest monthly jobs read, specs had room to short sell another 14.2k contracts. While they are forced to pile into long liquidations during sharp gold selloffs to mitigate catastrophic losses, adding new shorts is optional. With Fed money printing out of control and government spending soaring, specs likely aren’t too keen on downside gold bets.

So last Friday’s sharp 3.5% gold plummeting hammering the entire precious-metals complex lower was almost certainly the result of a major spec gold-futures-long liquidation. These traders were forced to quickly pare their relatively-high gold-bullish bets, and that selling cascaded. The more traders decide to dump gold-futures longs, the faster gold’s price falls. The lower gold goes, the more traders are forced to sell.

This self-reinforcing vicious circle amplifies gold-futures-driven gold plunges until specs have sold enough to suitably reduce their leveraged downside risks. Then like an avalanche sliding to a halt after all that snow’s kinetic energy is spent, the snowballing gold-futures selling also runs out of momentum. Then gold prices stabilize and the yellow metal resumes whatever trend it was in before that gold-futures selling erupted.

Whether you trade or invest in gold or silver, gold- or gold-stock-ETF shares, or shares in individual gold and silver miners, it is really important to stay abreast of speculators’ collective gold-futures positioning. Watching their bets as a herd is like an early-warning system for big gold surges and plunges, which both silver and their miners’ stocks amplify. It reveals when sharp futures-driven gold moves are most probable.

Knowing such violent gold-price swings are likely before they happen really helps traders keep their own greed and fear in check. Before gold plunged 3.5% out of the blue on Jobs Friday, our subscribers were well aware a gold-futures-selling overhang existed that could be triggered any time. So they didn’t panic sell when it came to pass, with their gold-stock and silver-stock trades protected by loose trailing stop losses.

Despite gold, silver, and GDX plunging 3.5%, 7.0%, and 4.8% that day, no stop losses were tripped in our many new gold-stock and silver-stock trades to ride this sector’s young bull upleg. That now includes 12 trades in our weekly newsletter and 6 in our monthly added since late November. Their unrealized gains continue to gradually grow on balance, despite the periodic gold selloffs inevitable in all bull uplegs.

Knowledge and perspective are absolutely essential to multiplying wealth through stock trading. And specs’ gold-futures trading as a herd can really bully gold prices around when it grows frenzied. That doesn’t last for long since these guys’ capital firepower is relatively small and limited, but the resulting gold swings really affect sentiment and trading decisions. Not watching spec gold-futures positioning is flying blind.

The bottom line is gold’s sharp Jobs-Friday plunge was fueled by cascading gold-futures selling by the speculators. Their collective upside bets were relatively high heading into that day, with total longs above the gold-futures-selling-overhang threshold. So when gold started selling off overnight well ahead of that US jobs report, these traders were forced to liquidate leveraged longs en masse or face catastrophic losses.

The resulting gold plunge suffered no identifiable differential gold investment selling. And that snowballing gold-futures selling quickly exhausted itself, enabling gold prices to stabilize this week. So gold’s young-upleg uptrend in place before that frenzied long liquidation should resume. That portends gold prices climbing again on balance, leading to outsized gains in fundamentally-superior gold-mining stocks.

Copyright 2000-2021 Zeal LLC