GoHealth (NASDAQ:GOCO) had a rough IPO like most do and finished the year down to $10/share after tax-loss selling came in full swing. Additionally, some investors expressed concerns over GOCO's executive compensation package, which was approximately 93% of adjusted EBITDA, and that the health insurance marketplace industry is intensely competitive. While these concerns carry some merit, 2021 and 2022 appear to represent GoHealth's first period of significant growth at scale, which shows promise for long-term shareholders.

High Growth and Improving Margins

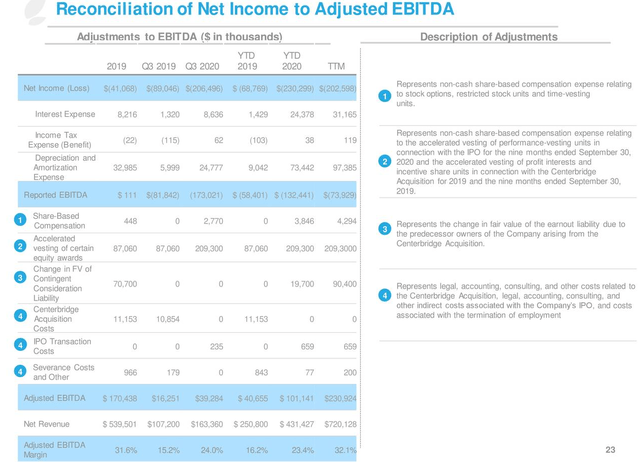

GoHealth appears to have a key advantage relative to the competition by applying AI and machine learning to help match its customers with the best insurance products available on the market. Without going into too much detail, that's a distinct advantage that GOCO has over its peers, including the likes of eHealth, Inc. (EHTH), for example. In 2020, GOCO also reported that it has access to 75% of the entire healthcare insurance market, a significant step up versus 25% in 2019. Additionally, management has bolstered its front-office to 1,500 sales/retention executives and ramped marketing spend in key areas to boost brand awareness and drive customer conversions. For those who have worries that such activity could lead to wasteful spend without healthy returns on revenue, I would suggest looking to the company's improving adjusted EBITDA margins, recently hitting ~32%.

Source: Q3 Earnings Call Presentation

Source: Q3 Earnings Call Presentation

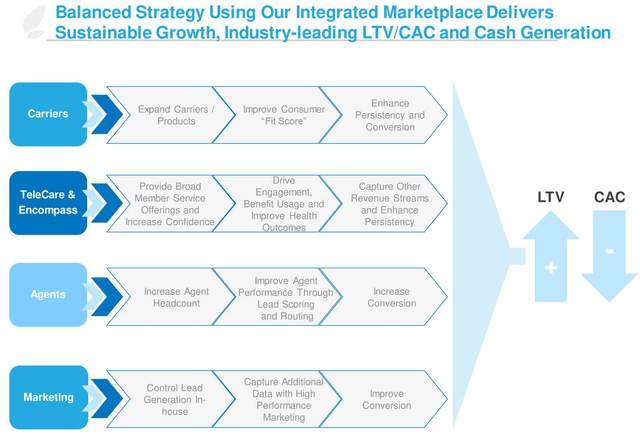

Of course, executive compensation, interest expenses, and D&A are real expenses; however, they will inevitably shrink as a percentage of opex as the business scales and the company already appears to be hitting an inflection point on that front. The company's Q3 investor presentation summarizes key initiatives to drive sustained organic growth over the long-term:

Source: Q3 Earnings Call Presentation

GoHealth appears to have been aggressively driving this collective, integrated structure of acquiring customers for about one