The past few months have seen the Goldman Sachs Physical Gold ETF (BATS:AAAU) tread water with shares unable to hit or surpass the level of highs seen last fall.

Source: TradingView

Despite the recent sideways action in the ETF, I am bullish AAAU. I believe that gold is going to rise and I view AAAU as an effective fund for trading it.

About AAAU

Let’s start this piece off with a discussion of the AAAU ETF. Within the past few months, there has been a transition in the ownership of the fund – in the past it was sponsored by the Western Australian government but in September, Goldman Sachs acquired the ETF.

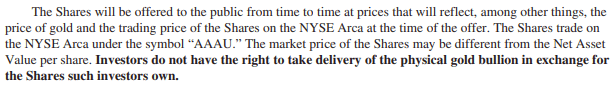

Historically speaking, one of the major appeals of AAAU was its physical convertibility. That is, investors could convert shares directly into physical gold which would be shipped and delivered to them for a fee. Unfortunately, with the change in ownership, the prospectus changed as well:

Source: Goldman Sachs

That’s right, AAAU is no longer an ETF which offers physical deliverability to its shareholders, which was one of the major appeals of the fund. However, this doesn’t necessarily mean that the ETF should be ruled off your investment list. The fund does have a few key things going for it.

First off AAAU has a very low expense ratio compared to the granddaddy gold fund, GLD. GLD currently offers an expense ratio of 0.40% while AAAU’s expense ratio is 0.18%. Additionally, this expense ratio undercuts IAU’s cost of 0.25%. Historically speaking, one of the main appeals of IAU was that it was essentially a GLD alternative with about half the expense. AAAU has now essentially undercut IAU in terms of pricing, making it one of the cheapest gold ETFs to hold.

Another key benefit of AAAU is simple the ownership and custodianship by reputable names. GLD has historically taken criticism for its dealings with HSBC as well as received questions regarding the actual ownership of gold by the fund. AAAU is sponsored by Goldman Sachs and its custodian is JPMorgan – organizations which certainly have a better reputation than GLD’s custodian.

While AAAU no longer has the same level of appeal that it once held, it still is a viable gold ETF with a cheap expense ratio. And on that basis, I believe that it is a good investment. However, prior to completely recommending the fund, we must look at the underlying gold markets to get an idea of where the commodity is likely headed.

Gold Fundamentals

At present, I am bullish gold in both the short and long term. For a short-term metric, I rely heavily on seasonality for understanding where the commodity is likely to travel.

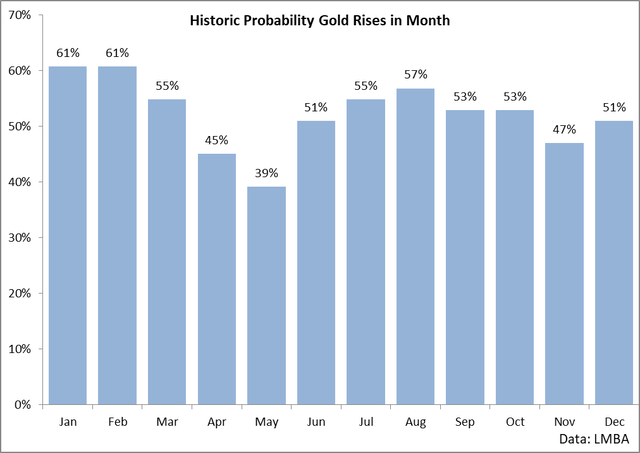

Source: Author’s calculations of LMBA data

In the above chart, I have calculated the historical probability that gold has risen in any given month using data since 1968. What is clearly evident in the data is that gold tends to rise during January and February of each year. It’s too early to say if January will see a gain or not; however, the data is clear in that February tends to rise in 61% of all months.

I believe that this data captures a broad tendency of rebalancing – that is, investors tend to change up exposure to various market factors during the start of the year and this shift of capital generally results in higher prices for gold during January and February.

An additional interesting market tendency is momentum – that is, past returns tend to give a solid indication of how the future will unfold.

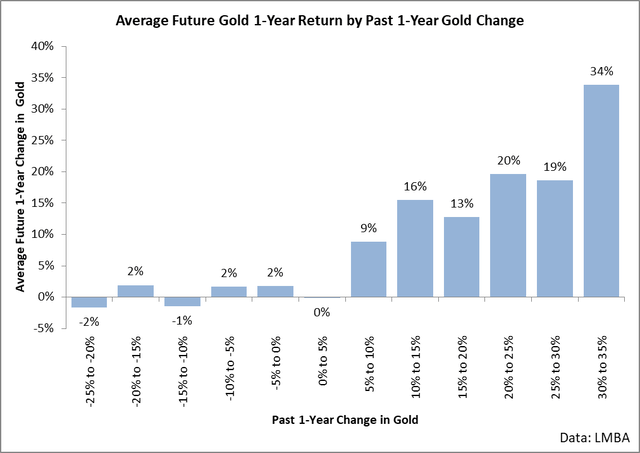

Source: Author’s calculations of LMBA data

As can clearly be seen in the above chart, there is a clear relationship between past changes in gold and future changes in the commodity. This classic momentum effect shows that when gold has been performing well, it pays to buy the commodity looking for further upside. For example, gold has risen by around 19% over the past year – historically speaking, a gold rally of this magnitude tends to carry forward with average one-year returns in the commodity from this point of around 13%. The odds are fairly favorable for the bulls with market data showing that gold has historically risen in 73% of all one-year periods following a price rally similar to what we’ve seen over the past year.

Similar to the prior tendency regarding seasonality, I believe this is fundamentally rooted. Specifically, I believe this tendency captures investors’ proclivity to increase exposure to instruments which have been rising. That is, when gold has been performing well, investors take notice of the commodity and add it to portfolios. This results in rising prices for the commodity as long as the cycle continues.

Another tendency which suggests gold will rally is the recent weakness in the dollar.

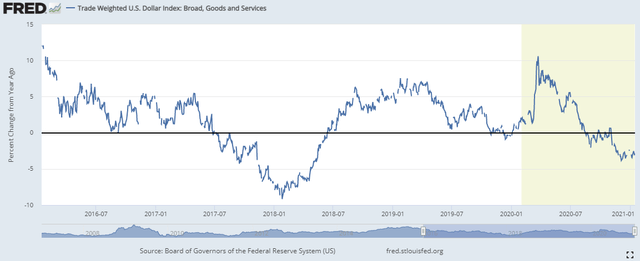

Source: FRED

As can been in the above chart, the dollar has been weakening consistently since the market started easing out of fear mode last March. Over the past month, we have seen the dollar decline at a pace of a little over 3% per year.

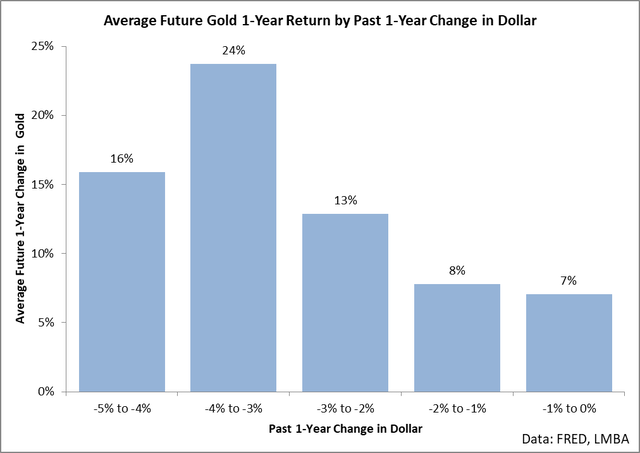

Source: Author’s calculations of FRED and LMBA data

In the above chart, I’ve calculated the average one-year future change in gold given a past change in the dollar. This study helps us understand where gold is likely going travel given a past change in the dollar.

Historically, dollar weakness tends to carry forward into future gold strength. For example, when the dollar has fallen by a similar amount to what we’ve recently seen, gold tends to rally by an average of 24% over the next year with history showing a 72% chance of price rising over the next 12 months.

History can never perfectly predict the future. However, it can give us good guidance around likely probabilities. Given the above clear relationships and tendencies at work in the market, I am bullish gold. I believe that we will see gold rally throughout 2021 and AAAU will be a good way to play the movement.

Conclusion

AAAU has changed ownership which reduces some of the appeal the ETF once held. The fund is now a direct competitor to GLD and IAU, but with a cheaper expense ratio. Gold is likely going to rally over the next year due to seasonality, momentum, and the dollar.