Editor's note: Seeking Alpha is proud to welcome Cameron Wetherby as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Desktop Metal (DM) is a leading 3D printing company poised to benefit from current manufacturing trends. Analysts expect the 3D printing industry to grow at a CAGR of 25% between 2025-2030. Among the different 3D printing processes available today, binder jetting is seen as the one technique that could transform manufacturing. Desktop Metal focuses mainly on this technique, and their Production system is the fastest 3D printer on the market designed for mass production. Analysts expect them to grow revenues at a CAGR of 87% through 2025.

The main risk is Desktop Metal's ability to withstand competition. Rival company ExOne (XONE) is a key competitor that also focuses on binder jet technology and once had the fastest 3D printer available. Other well-known companies with significant resources, such as HP (HPQ), have also entered the space, and the competition continues to rise.

Selective peers in industries currently trade at an EV/Revenue multiple of 9.0x. Based on a future EV/Revenue multiple of 10.0x for 2025 expected revenue, the stock would have a CAGR of 13.3% from current levels. These estimates do not consider any acquisitions or vertical integrations of profit pools, which are priorities for the company. We feel comfortable initiating a position with a long-term investment horizon.

Source: Forbes

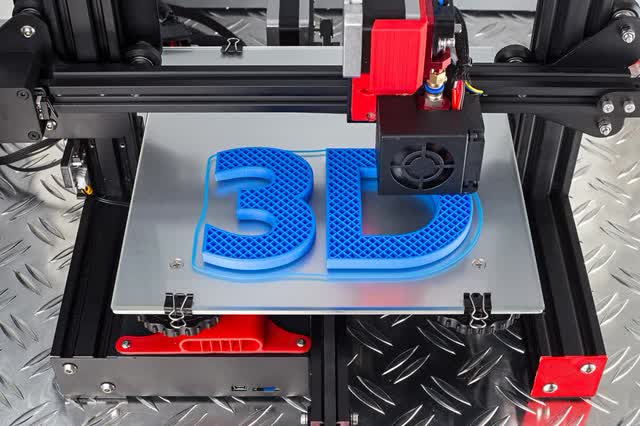

3D Printing Technology

The fourth industrial revolution is upon us as 3D printing (additive manufacturing) has begun transforming the manufacturing process as we know it. 3D printing works by building a product layer by layer, depositing material in specific places based on a computer designed blueprint. Although this technology has been