Investment Thesis

The TJX Companies (NYSE:TJX) grew EPS by an average 14.61% for the three years ended 2019. Analysts' consensus estimates are for EPS to grow on average by 7.68% between end of 2019 and end of 2024. Being almost 100% bricks and mortar, with only ~2% in online sales, TJX would appear more vulnerable than most to the impact of store closures due the pandemic. But this comment from the Q3 earnings call on Nov. 18, 2020 is encouraging,

One of the dynamics that's going on to help offset the COVID cost is the extremely healthy merchandise margin, which the question is when we come out of COVID, will that still be to that degree and it's kind of a, you're in a weird situation where we're taking advantage of coming out of COVID and we're still doing this now as well as we look out what we've placed the opportunities in the marketplace at the mark-up, I think that Scott referred to has just been very advantageous. Do we believe there is some of that opportunity in the future? I believe there is some of it because we will mean more now even more than we did before to many of these vendors because of so many of the brick and mortar, guys going out and we're so branded focused. So if you're a key branded player and you want to deal with a solid retailer who is also again not very visible with the product, right, and it's part of a treasure hunt shopping experience, I believe there will be some benefits still going forward.

So, with much of the competition knocked out of business, growing EPS through end of 2024 at around half the average yearly rate for 2016 to 2019, seems feasible. And at that rate of growth, together with

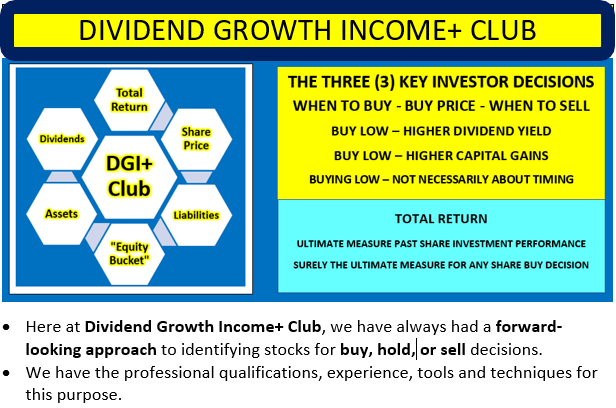

Dividend Growth Income+ Club - Register today for your Free Trial.

Click Triple Treat Offer (1) Your Free 2 Week Trial; (2) 20% Discount New Members; (3) Bespoke reviews for tickers of interest to subscribers.