As I write this BlackBerry (NYSE:BB) is sustaining its price above the recent gap:

(Source: Etrade)

Usually gaps of this size are area gaps and thus fill quickly. However, this current gap was made on significant volume and has been sustained the day after the gap (not falling below the previous day's low). This leads me to believe that we might be seeing a breakaway gap.

I decided to test this theory. I backtested trading gaps of this type over BB's time trading on the public market. While gaps of this type are relatively rare for BB, they do make for good long trades.

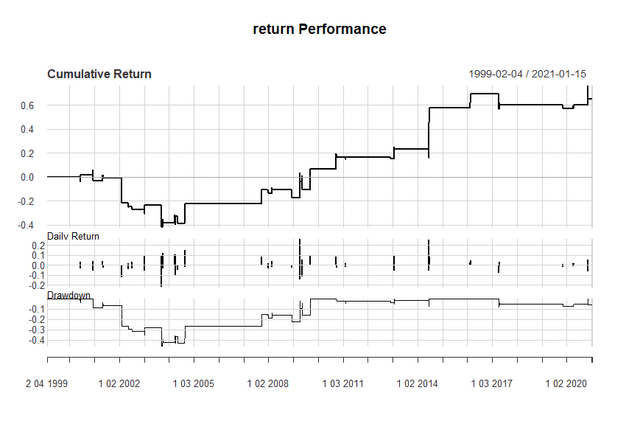

Here is the return performance for buying these gaps (buying BB after the gap) and holding for five days:

(Source: Damon Verial; data from Tiingo)

While gaps of this type were unprofitable shortly after the dot-com bubble, they have been reliably profitable after 2003 or so. Oddly enough, testing this gap type with a candlestick pattern that appears more bullish (green->gap->green instead of green->gap->red) is not profitable. My explanation here is that post-gap BB needs to pull back a bit to signal that the gap isn't an overreaction that can lead to a pump-and-dump; thus this particular gap looks to be part of a sustained uptrend.

Breakouts like this are often seen with caution due to the fear of buying an overbought stock. However, "turtle trading," a strategy in which you buy at new highs and sell at new lows on shorter durations (e.g., buy the 50-day high and sell the 20-day low), actually supports buying BB at this price. Even the RBC downgrade today didn't push BB into the gap, further supporting the idea of a turtle trade on this stock.

On the fundamental side, we have a slew of positive news for BlackBerry. Rarely does a

Exposing Earnings is an earnings-trading newsletter (with live chat). We base our predictions on statistics, probability, and backtests. Trades are recommended with option strategies for the sake of creating high-reward, low-risk plays. We have 89% accuracy for our predictions in 2019.

-Upcoming Earnings Plays: AZO, ORCL, MU, CAMP, LQDT

Check out my methodologies in these four videos.

If you want:

- A definitive answer on which way a stock will go on earnings...

- The probability of the prediction paying off...

- The risk/reward of the play...

- A well-designed options strategy for the play...

...click here to see what Exposing Earnings members are saying.