Price is what you pay, value is what you get. - Warren Buffett

Introduction and profile

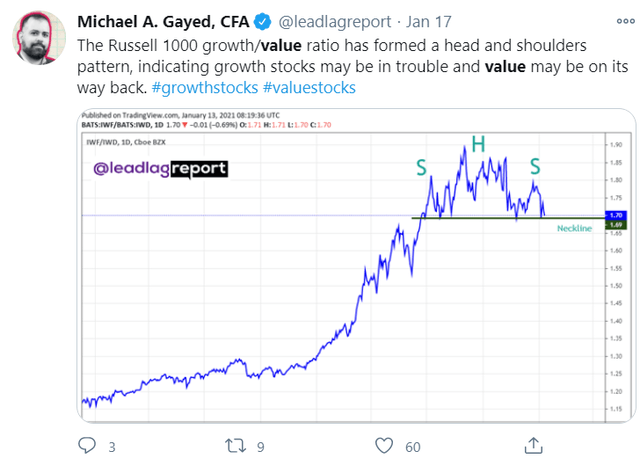

The growth vs. value debate is something that tends to arouse a fierce degree of partisanship amongst various financial commentators, and I often find that there's very little middle ground in these debates. Regardless of which side of the fence you're on, I highlighted last week that the closely watched growth-value ratio on the Russell 1000 is currently in the midst of forming the bearish head-and-shoulders pattern, which portends a further rotation away from growth to value stocks.

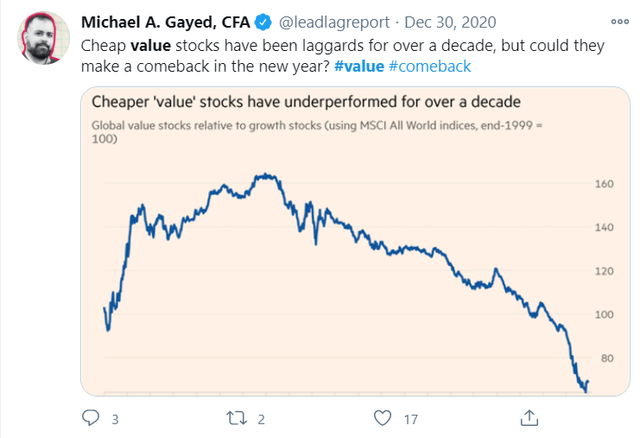

Over a longer time frame of 10 years, also consider that global value stocks, in general, have been beaten down to quite drastic levels and seem more attractive on paper.

If you're looking for some exposure to a basket of US-based value stocks, the iShares Core S&P U.S. Value ETF (NASDAQ:IUSV) is something you may consider adding to your watchlist. It is a stalwart in this arena, having been around for over two decades, more than most, or all the other US value-based ETFs. This passively managed fund tracks the S&P 900 Value index, which is a subset of the S&P 900 index and focuses on stocks that exhibit strong value characteristics. The tilt here is primarily towards large and mid-caps as the S&P 900 index is a function of the S&P500 and the S&P400. One of the standout features of IUSV is its incredibly low expense ratio of only 0.04% which is best-in-class and on par with market leader Vanguard's value offering- VTV. From a yield perspective, IUSV currently offers you a healthy dividend yield of 2.35% which is bang in line with its 4-year average. Besides, over the last 3 years dividend outflows have been increased every year at a solid CAGR of 12%.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.