Perficient (PRFT) has maintained an impressive run since the COVID dip. As it adds new capabilities to its consulting services and solutions, we expect the momentum to be sustained. We believe Perficient is conservatively valued given its improved margins, cash flows, and ample liquidity.

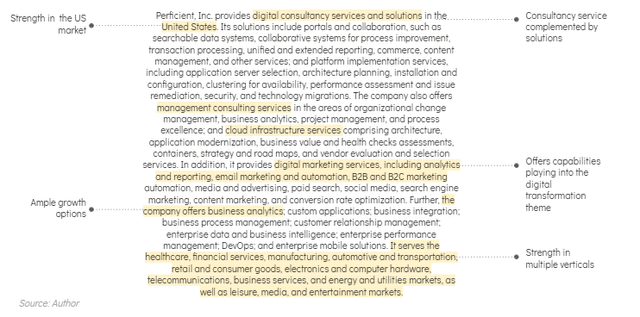

Perficient is an IT service company offering digital consultancy services and solutions. Perficient has increasingly invested in beefing up its capabilities in digital consulting to help clients with their digital transformation projects. The digital transformation trend sits at the heart of Perficient's strategy, and it represents a significant portion of its future growth projections. Perficient's strategy extends beyond the US market into other attractive economies in North America.

Source: Seeking Alpha

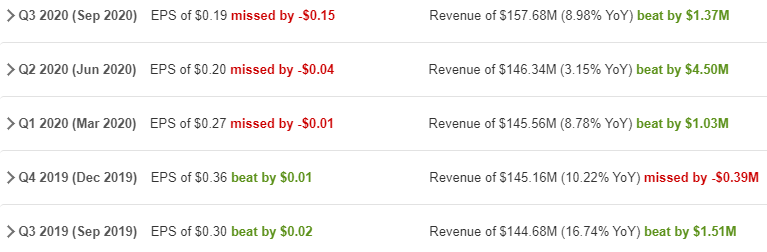

In recent quarters, Perficient has accelerated its growth strategy via acquisitions to extend its market reach, partnership network, and technology capabilities. This has been achieved at a cost to EPS growth. The acquisitions have helped maintain high-single-digit revenue growth. The acquisitions are important as Perficient accelerates its market presence in attractive IT segments. They also complement existing capabilities in verticals where Perficient already has a strong presence.

In fact, we recently closed one of the largest deals in company history, well into eight figures. And this win was with a net new client we weren't even able to meet in person because of the pandemic, and it's typical we'd beat a handful of much larger firms to win the work. - Perficient

Last quarter, Perficient highlighted the growing volume of large deals as customers prioritize digital transformation projects. The positive trends drove the strong Q4 guidance calling for revenue growth of 10% ($156M-$161M) and a significantly improved EPS growth relative to the previous quarter. Perficient is expecting GAAP EPS of $0.36-$0.39 in Q4 compared to GAAP EPS of $0.19 reported in Q3. The EPS guidance also benefits from favorable comps as