We’ve previously encouraged investors to buy Annaly Capital Management (NYSE:NLY) at attractive price-to-book ratios. However, we’ve also encouraged investors to pick up the preferred shares. We're going to update our view on the preferred shares, then update our view on the common shares.

There are currently three series of preferred shares for Annaly Capital Management. We’re listing them below along with our current evaluation:

There were four, however, NLY-D (NLY.PD) was called.

Why is NLY-G less attractive?

There are a few factors that go into setting targets. We don’t intend to provide a full walk-through of the process, but we will share an overview. We want to consider a few factors (especially number 3):

- Call risk creates a ceiling. We won’t go much past $25.00 on a share that could be called soon.

- All else equal, we should demand higher rates of return on shares with higher risk ratings.

- All else equal, a share with more upside can have a lower required rate of return.

- We want to consider the market’s perception of risk because it influences share prices.

- We want to consider recent valuations across similar shares because there is a significant correlation throughout the sector.

Example of point 1: CIM-A (CIM.PA) and CMO-E (CMO.PE) could not qualify for a buy-under target materially above $25.00 (plus dividend accrual).

Example of point 2: The required rate of return on CIM-B is higher than the required rate of return on AGNCO (AGNCO) because CIM-B (CIM.PB) has a higher risk rating.

Example of point 3: The required rate of return is lower for NLY-G than for NLY-I because NLY-G would still offer more upside to call value. The price target for NLY-G is still materially lower than the price target for NLY-I because the future dividends for NLY-G should be materially lower than the future dividends for NLY-I due to the difference in spreads when they are both floating.

Example of point 4: Some preferred shares would warrant a lower risk rating if we only evaluate them based on the fundamentals for that share. If two shares are very similar on all fundamental metrics, but one is exposed to more severe drops during periods of fear, we may set a lower target for the share which has historically fallen harder.

Example of point 5: The valuations across preferred shares from the same mortgage REIT should be very highly correlated. If we recently saw the majority of their preferred shares climb or fall, it provides a hint about the other share. There is also a correlation between preferred shares from different mortgage REITs. We consider that while adjusting targets.

What Holds NLY-G Back?

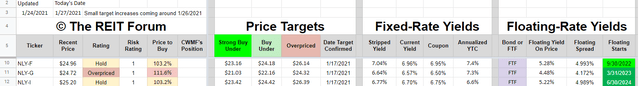

The discount compared to NLY-I and NLY-F looks a bit too small to account for the difference in yield after the shares switch to a floating rate.

Source: The REIT Forum

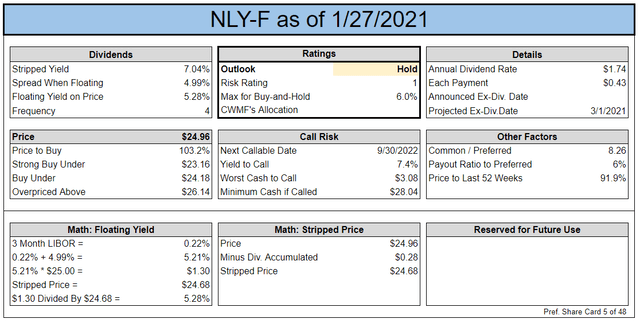

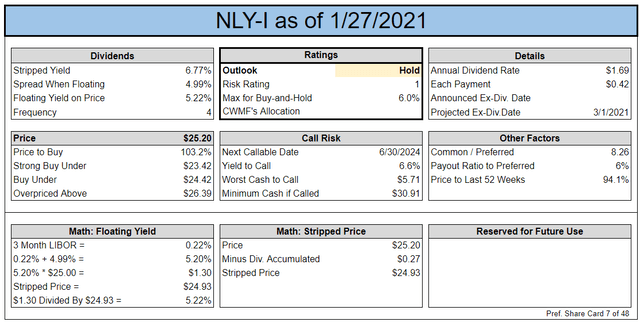

The main difference between the shares shows up in the top left box. The “Spread When Floating” and the “Floating Yield on Price” reflect a significant difference in the rate of dividends investors would expect after shares switch over to a floating rate. You also can see these differences using our preferred share spreadsheet at the REIT Forum:

Source: The REIT Forum

We can see there is a substantial difference in the “Floating Spread” and “Floating Yield on Price,” both on the right-hand side of the image.

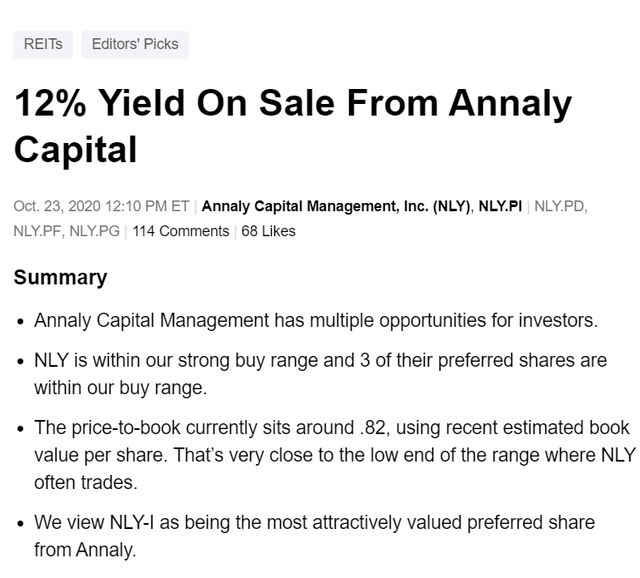

Prior Coverage

Last time we provided a public article on NLY and their preferred shares:

1. NLY was in the strong buy range.

2. The most attractive preferred share was NLY-I.

Source: Seeking Alpha

Why aren’t we being as bullish today?

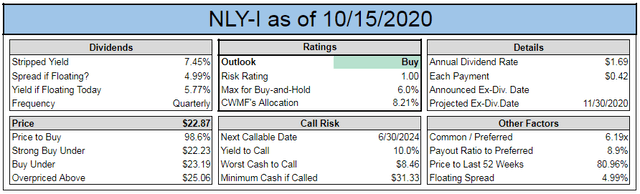

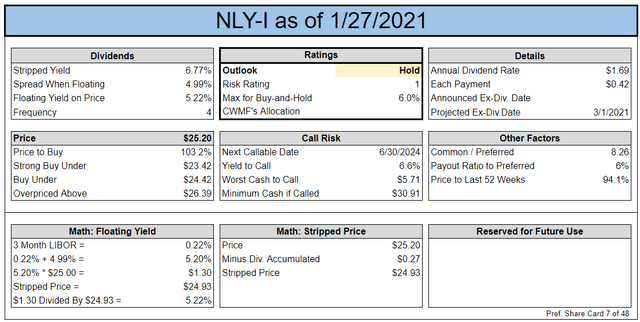

Consider NLY-I’s old index card:

Contrast that with the current index card:

What changed? A higher share price significantly reduced the dividend yield and eliminated the upside to call value. Congratulations to the readers who joined us in taking advantage of the opportunity.

Common Shares

How about the common shares of Annaly Capital Management?

We're still bullish, but now the view is "slightly bullish" or "moderately bullish." This is clearly less bullish than the "strong buy" view we had before. We see moderate upside left in the share price due to a material discount to book value and an attractive dividend yield. This isn't our favorite choice in the sector today, but it isn't a bad one either.

When we covered NLY publicly in October the share price was $7.18. That gave us a price to estimated book value of .82 based on a projected book value of $8.80 as of that time. Today the projected book value is a bit higher, but the share price is about $8.23 (article submitted before the market closed).

Conclusion

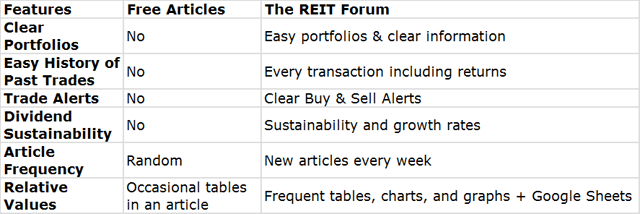

We've evaluated the preferred shares throughout the sector using a combination of risk ratings, future cash flows, technical factors, and potential upside. We've evaluated the common shares using price-to-book value with our frequently updated estimates of book value (rather than trailing book value).

Ratings:

- Neutral on NLY-F, NLY-I

- Bearish on NLY-G

- Slightly bullish on NLY