Editor's note: Seeking Alpha is proud to welcome Edgestocks Research as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

TJX Companies (NYSE:TJX) has strong long-term growth prospects and has proved its mettle even during economic downturns over the past two decades. It faced a major setback last year due to the temporary store closures during lockdowns. However, I believe that the off-price retailer is well-positioned to thrive during these tough times and could continue to grab market share from department stores, which were struggling even before the pandemic due to the rapid rise of online retailers.

TJX stock has risen by only 5% over the past 52 weeks. But, the stock offers an attractive investment opportunity in the retail sector, given the expected recovery in the company's earnings in the fiscal year ahead. Also, I expect the company to enhance shareholder returns by continuing to raise its dividends backed by strong cash flows.

TJX Companies' efficient business model

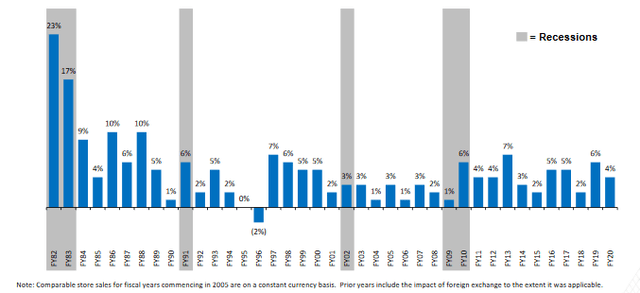

Prior to the onset of COVID-19, TJX Companies displayed its strength by delivering comparable sales growth for 24 consecutive years. Such a track record is commendable as many retailers went bankrupt over the past several years amid recessions and due to the rise of Amazon and other e-commerce retailers.

Source: Company Website

Through its off-price business model, TJX Companies sells merchandise at a discount of 20% to 60% compared to the prices at which department stores or other retailers sell similar items. The company is able to offer such attractive deals to customers due to the opportunistic buying of inventory and efficient expense management. It purchases merchandise at deep discounts by taking advantage of order cancellations, closeouts from manufacturers as well