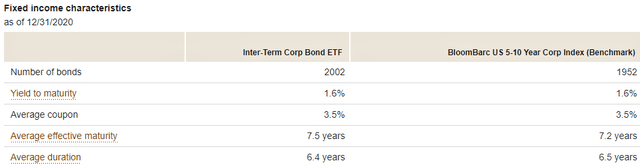

Vanguard Intermediate-Term Corporate Bond Index ETF (NASDAQ:VCIT) aims to provide moderate and sustainable current income to its investors. It invests primarily in investment grade bonds with an average duration of 5 to 10 years. The index it benchmarks to is the Bloomberg Barclays US 5-10 Year Corp Index. VCIT does not match the index 100%, but holds a sample from its underlying securities that replicates the full benchmark in terms of risks and other characteristics like issue quality, duration, callability etc. It appears to do a good job of it.

Source: VCIT

The sector and sub sector exposure closely tracks the index as well. Let us check out the numbers and see if this one yields enough to compensate for the risks brought on by its duration.

Current Holdings

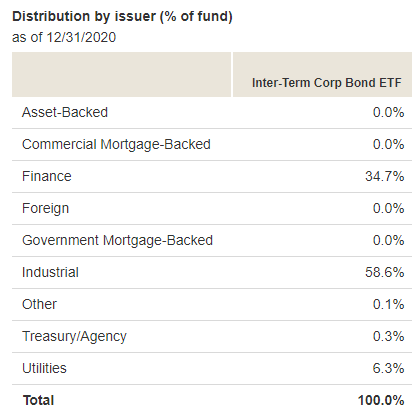

At last count it held 2002 USD denominated bonds, allocated mostly between the industrial and financial sectors, with a little bit of utilities thrown in.

Source: VCIT

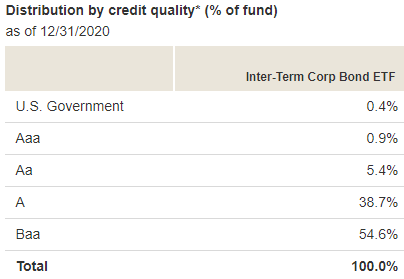

Although its broad mandate is to "primarily" hold investment grade issues, at December 31, 2020, all of its holdings were investment grade.

Source: VCIT

This assuages investors' concerns that the bond issuer may have difficulties honoring their interest and/or principal commitments resulting in the decline in the price of the issue, also known as credit risk. Sometimes, although an ETF has a mandate to hold investment grade bonds, if an issuer gets a downgrade after it has become a part of the portfolio, the ETF lands up with a nominal amount of below investment grade issues until they can offload them safely.

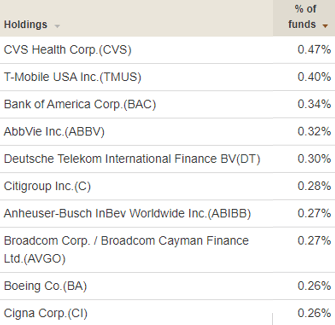

The portfolio is well diversified among its 2000 odd holdings with the top 10 holdings making up only around 3% of the portfolio.

Source: VCIT

Coupon wise, at December 31, 2020, the max was close to 10%, with treasuries bringing up the rear.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.