Coca-Cola Investment Thesis

Coca-Cola outlook based purely on reported non-GAAP results and analysts' consensus EPS estimates -

The Coca-Cola Company (NYSE:KO) grew non-GAAP EPS by an average 3.38% for the three years ended December 2019. Based on analysts' consensus estimates, EPS is projected to grow by ~5.36% average per year from 2019 to 2023. Taking into account the current share price, analysts' consensus EPS estimates, dividend yield, and a range of historical P/E ratios, returns of ~12% to 18% average per year would appear possible, buying at current share price levels and holding through to end of 2023 (see discussion under Table 3 below). But things are not as they seem.

Coca-Cola performance based purely on reported free cash flows -

While finalizing this article, an article by Bill Maurer was published, "Coca-Cola: Dividend Raise Time", which includes the following -

When it comes to dividends, however, the really important metric is free cash flow. No matter how profitable (or not) you are, cash generation is what drives capital returns. In the table below, I've detailed key information regarding the company's financials from the past three years, along with a comparison of the first three quarters of 2019 and 2020.

The table shows free cash flows totaling $25,248 million and dividends totaling $23,331 million for the 3.75 years January 1, 2017 to September 30 2020. It would seem Coca-Cola's free cash flows exceeded dividends by $1,917 million over the 3.75 year period. But things are not as they seem.

Coca-Cola performance and outlook based on funds flowing into and out of Coca-Cola's "equity bucket" shows how things really are -

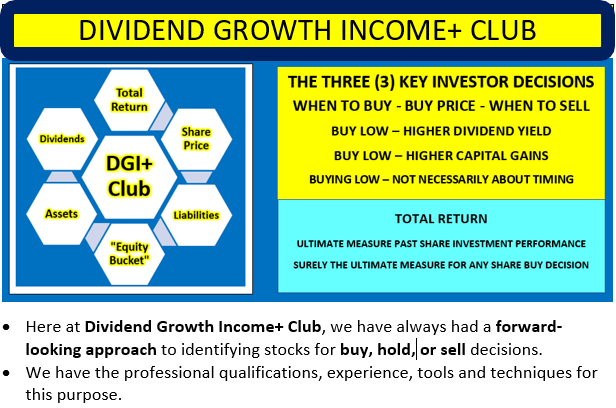

In my analyses, I take the extra step of checking what flows into and increases the contents of the shareholders' "equity bucket", and what flows out of the shareholders' "equity bucket", and for whose

Dividend Growth Income+ Club - Register today for your Free Trial.

Click Triple Treat Offer (1) Your Free 2 Week Trial; (2) 20% Discount New Members; (3) Bespoke reviews for tickers of interest to subscribers.