Digital Turbine (NASDAQ:APPS) is a really special kind of company. It combines great revenue growth figures with huge opportunities left, increasing recurring revenues, a unique position and clever execution that enable it to continue increasing rates, great operational leverage, and large operational cash generation, to name a few highlights.

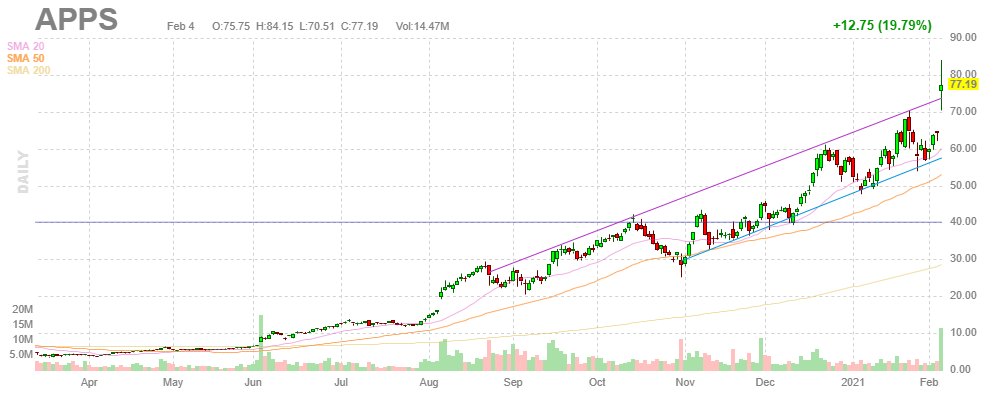

Even before we started this marketplace portfolio we bought it for our previous public portfolio less than a year ago on February 15 2020 for $7.15. And then when we started the SHU Growth Portfolio here on Seeking Alpha we bought it again on August 11, 2020, just a month after the portfolio was started, for $21.64. So far that has worked out pretty well:

Source: FinViz

While the shares are no doubt terribly expensive we think the company isn't done yet, by any means. The company keeps firing from all cylinders. It might be useful reminding what those cylinders are:

- The Ignite footprint on the number of devices

- RPD (revenue per device)

- Content Media

- New products

- International expansion

- New devices (TVs)

Ignite

Ignite is their Application Media platform on which app producers vie for a prominent place. Given that place (the first few screens of a mobile phone) is limited, the economics of this are particularly interesting.

However, the company is still growing a lot simply by installing Ignite on a host of new mobile phones as a result of deals they have in place with OEMs like Samsung and Xiaomi and mobile operators like the US big four and internationally, companies like America Movil and Telefonica.

Well, like last quarter, they had another quarter in which they added 65M phones or 50%+ growth y/y. This is all the more impressive as they only operate in the Android world, and that was actually down with the resurgence of Apple and the particular situation with

If you are interested in similar small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

If you are interested in similar small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

We add real-time buy and sell signals on these, as well as other trading opportunities that we provide in our active chat community. We look at companies with a defensible competitive advantage and the opportunity and/or business models that have the potential to generate considerable operational leverage.