AT&T Inc. (NYSE:T) announced fourth quarter earnings last week and gave investors some much needed guidance on 2021. This earnings release had a little bit of something for all types of investors. In our view, this release shows how AT&T is becoming much more of a media company than just a large telecommunications business. As this shift continues to take place, investors will adjust the company's valuation multiples accordingly, resulting in outsized returns for investors. In the meantime, shareholders are well compensated to wait with a dividend yield above 7% that's supported by strong cash flows from the business.

Introduction

AT&T's earnings release last week provided great insight into how the company has navigated the COVID-19 Pandemic thus far and how management is approaching 2021. While the past year has been a tough one for the company, they are clearly in the midst of transforming the business from a large telecommunications operation to a modern media company. As a result, we continue to look at AT&T as two separate business: The old core business (telecommunications) and the new business (media/content).

Convergence of Telecommunications and Content Providers

Source: VSN: Why Every Broadcaster Needs a Streaming Platform.

The shift for AT&T to become a media company follows the general industry trend that has been developing over the past number of years. As telecommunication services are becoming more of a commodity, there continues to be pressure on margins. For cable and telephone companies to compete and remain profitable, they need to not only own the "pipes," but also part of the content. This is why a number of cable companies own regional sports networks and was one of the big reasons for AT&T acquiring Time Warner.

The Old Business (Communication)

AT&T's core business is the stable Communication division. This represents roughly 80% of the company's revenues and operating income for 2020. In this area AT&T primarily competes with Verizon (VZ) and T-Mobile US (TMUS).

Not surprisingly, more than half of this division's revenues and EBITDA comes from the Mobility segment. A distant second to Mobility is Video, which consists of the company's video offerings (DirecTV, U-Verse, etc.). Rounding out the group is the company's Business Wireline and Broadband segments.

Mobility is our primary focus for the Communications division as it has generally been a source of stability for the company. We were happy to see that the segment's revenues have turned the corner and are now showing notable growth for the quarter and the year. While there has been a decline in the margin for Mobility in the fourth quarter, overall this large segment has been a source of modest earnings gains for the company for 2020. This is despite a temporary shift away from higher margin products due to the Pandemic. Two of the higher margin solutions in mobility that have been impacted by the Pandemic are roaming charges (specifically international roaming) and data charges.

2020 Communications Segment Results

Source: AT&T Inc. Q4 2020 Investor Briefing.

Video has been a more challenged business for the division both on the quarter and the year. This segment continues to lose subscribers due to competition. Unfortunately the loss is more heavily concentrated in AT&T's premium offerings (DirecTV and U-Verse), which lost 617,000 subscribers on the quarter. Comparatively, AT&T Now only lost 27,000 subscribers for the quarter. While this segment is still profitable, it's no wonder that speculation has risen again that AT&T may sell its DirecTV business. The proceeds from this sale could be used to pay down the company's massive debt and invest in the faster growing WarnerMedia Division.

Lastly, the Business Wireline segment also is of interest to us in this report. While we have low expectations for this segment until the Pandemic comes to a close, we are looking for modest declines in this area. While topline declines are modest at 4.1% for the quarter and 3.1% for the year, the EBITDA declines are much larger. We will continue to look for guidance from management in this area as there should be additional levers to pull to reduce the operating costs.

The New Business (WarnerMedia)

AT&T's future growth prospects are predicated on the company's ability to transform into a diversified media company. The "content" division, WarnerMedia, consisted of roughly 20% of the company's revenues and operating income for 2020. This pits the company against a new set of competitors like Netflix (NFLX), Disney (DIS), Amazon (AMZN), and Apple (AAPL). Similarly, these competitors see the content they create and how it's delivered as a component of their future growth. Despite being the future growth driver for AT&T, this division had a very challenging year due to the Pandemic.

Similar to all movie studios, the company's three production groups (Warner Brothers, Turner, and HBO) struggled due to the Pandemic's restrictions. This was a double hit for these businesses for two main reasons:

- New Movie Releases: With the majority of the U.S. and the world in various stages of quarantine for the better part of 2020, movie theaters are on the brink of bankruptcy. When regulations are reduced to allow theaters to open for viewers, the results have been at less than a tenth of pre-Pandemic activity. For example, the five-day weekend around Thanksgiving in 2019 saw 59 movies in theaters and $262.3 million in domestic revenues. In 2020 this was reduced to only 35 movies in theaters and $19.9 million in domestic revenues - a 90%+ decline! This creates a challenge for movie studios as their traditional distribution channel is not effective in the Pandemic-constrained world. This has led to many studios opting to delay the release for a number of movies until the environment is less restrictive.

- Developing New Movies: In addition to not being able to release movies through their normal channels for viewers, the production of new movies and content has also been constrained. Considering that it takes more than 500 people to create a new movie, this makes it very challenging to follow social distancing and quarantine constraints. As a result, many production companies have delayed the start of new projects until we are through the current pandemic.

Overall, AT&T estimates the cost of the Pandemic has been 1.6 billion for the fourth quarter alone. Fortunately, the division has shifted to account for the current Pandemic environment. The biggest change has been the new hybrid model to release films. In this model, the company releases all new major movies concurrently in theaters and on HBOMax. This allows viewers to decide between going to the theater or watching new releases in the safety of their home. What we like about this model is that it has the potential to produce more revenue than the approach to movie releases before the pandemic. Consider Wonder Woman 1984 as an example:

- The movie received mediocre reviews at best, which in normal times would have resulted in an okay box office. I'd prefer to use Justice League as a proxy here as the movie received similar reviews. Justice League grossed $229 million in domestic box office ($429 million internationally). Arguably, Wonder Woman 1984 should have grossed roughly the same in normal times.

- With the hybrid release structure, Wonder Woman 1984 grossed $39 million domestically and $113 million internationally. Overall, it's been one of the best box office releases in the Pandemic stricken environment, but a poor performance compared to normal times.

- Since this was the first of AT&T's hybrid release movies, it's important to follow how this drove new subscribers. We focused on this in our article "Move Aside Netflix - AT&T is Winning the Streaming War with its Hybrid Release Model." During the first few days of the movie's releases, most subscribers watched it on HBO and HBO Max. More importantly, domestic subscribers to HBO and HBO Max grew by 3.5 million in the fourth quarter, roughly half the service's 7 million net subscriber gain for 2020. AT&T's management noted that the subscriber growth for the fourth quarter accelerated into the end of the quarter. We take this as an indication that the hybrid model is successful in driving subscription growth for HBOMax.

- Taking this one step further, let's assume that roughly 2 million of the 3.5 million net subscriber adds for HBOMax was due to the hybrid release model. At a monthly price of $15 per subscriber, this would yield $30 million (2 million subscribers at $15 each) for just the following 30 days. Fortunately, most subscribers do not cancel when their month is up and the service is automatically renewed. If we annualized this number instead, the company would have generated an incremental $360 million from the movie due to the hybrid model. While this is overly simplistic since there are discounts for annual subscriptions, not everyone remains as a subscriber, and some of these subscribers would have come to the service a few months later, it does illustrate the power of the hybrid model.

- Overall, based on our estimates, by using the hybrid model AT&T was able to generate nearly $400 million in revenue for a movie that would have most likely generated close to $200 million in normal times. Even when taking a more conservative approach and cutting our revenues from subscribers estimate in half, the movie would have met its revenue expectations during normal times.

2020 Warner Media Segment Results

Source: AT&T Inc. Q4 2020 Investor Briefing.

What excites us about the WarnerMedia division and AT&T overall is how this division should perform once the Pandemic concludes. Fortunately, with successful rollouts of multiple vaccines, it looks like we are months away from this reality. This should put the division back on track to continue to produce blockbuster movies and award-winning shows that will drive revenue and growth for the company.

Outlook for 2021

In addition to a thorough update on the company's performance for 2020, management provided thoughts on 2021. Overall, we were disappointed with their guidance, as we feel that the company has more potential for the year ahead.

Management's guidance was for fairly anemic revenue growth of 1% to 2% for the year and essentially flat earnings growth. Against this backdrop, management plans to invest heavily into subscriber growth for HBOMax - a platform that is already two years ahead of schedule for the number of subscribers. The company also plans to use excess cash flows to continue to pay down debt at an accelerated rate.

We feel this sets a fairly low bar for the year as a number of factors should translate into higher revenue growth. While it's uncertain when the Pandemic will end, when we return to normal AT&T should benefit in a number of areas. Secondly, the company is following in Netflix's footsteps by heavily investing in their streaming platform. With already strong results from a few weeks of this focus, we would expect this to drive a few points of revenue growth for 2021. Lastly, the company will should continue to find operational efficiencies, which will bring the overall margins back to their historical averages.

Ultimately, we feel that with the low bar management has set for 2021, AT&T is well poised to deliver upside surprise on the year. This could be just the action need to shift investors' views of the company to a growing dominant media business.

Putting it Together (Valuation)

Looking at AT&T overall, we are very bullish on the company's prospects for investors. Given how tough 2020 was for investors, it's not surprising how the company's shares have performed. As we set our views for 2021, we feel that this is a year in which the markets will start to acknowledge AT&T's shift from a telecommunications company to a modern media company.

P/E-Based Valuation

One method that we use to value AT&T is based on its earnings. The popular price to earnings or P/E ratio can readily apply here. For this analysis, we prefer to use a sum-of-the-parts calculation. Since AT&T is clearly two companies, we attribute two P/E multiples to the business to arrive at a fair valuation. For the traditional Communications side of the business, we attribute a P/E multiple of 10x earnings, which is in line with their major competitor Verizon and significantly lower that T-Mobile's multiple. For the media side, we look chose to use a multiple close to Netflix's of 50x earnings. (If we blended the multiple for Netflix, Disney, Amazon, and Apple, the value would be much higher).

2020 Supplemental Segment Reconciliation

Source: AT&T Inc. Q4 2020 Investor Briefing.

Using a split of 80% communications and 20% media, we arrive at a blended P/E/ multiple of 18x earnings for AT&T. Interestingly, when we look at the sector media P/E multiple for AT&T, the value is roughly the same. Given that AT&T has a current P/E multiple at half that level, we have set a price target of $50 per share to bring the company in line with the sector's median value.

AT&T's Current P/E vs. Sector Median

Source: Seeking Alpha.

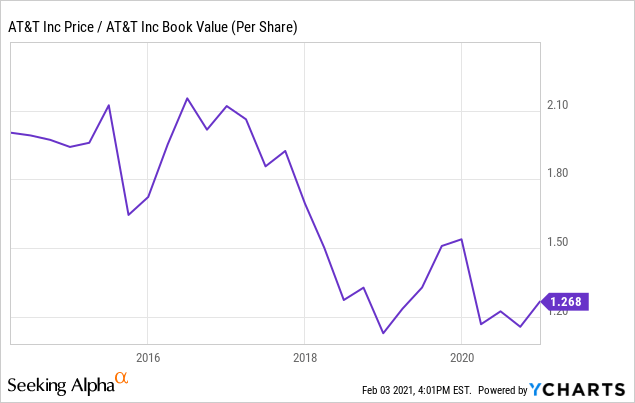

Book Value

Another metric that we use for AT&T is book value per share. Given that the business is asset heavy, a book value based approach also would be prudent. On this level, AT&T is trading near its lowest level in years. This could be due to the large amount of debt on the company's balance sheet, as well as the impact the Pandemic has had on their business. Fortunately, both areas are improving:

- End of Pandemic: As noted earlier, with the end to the Pandemic potentially months away, a number of the business line impacted should see a rebound close to pre-pandemic levels. This means strong gains in both roaming and data fees in Communications and a dramatic increase in movie theater revenues for WarnerMedia.

- Reduction of Debt: Management has continued to focus on using cash flows to pay down debt faster and, when possible, restructure debt into more attractive terms. Additionally, if management ultimately decides to sell the DirecTV business, the proceeds could go a long way in reducing the company's debt.

We feel that the general improvement in conditions, as well as the gains in these two areas would bring the company's valuation based on book value back to the historic multiple of 2x or greater. using this approach, we also arrive at a valuation of nearly $50 per share.

AT&T's Historic Book Value Per Share

Data by YCharts

Data by YCharts

Dividend Approach

Undeniably, AT&T is one of the most popular dividend stocks in the marketplace today. Despite having strong cash flows, a payout ratio in the 50s, and management's continued focus on supporting the dividend, it has one of the highest yields in the marketplace today. Currently, AT&T yields 7.2%, which is notably higher than most of its peers. Comparatively, Verizon, which is a decent proxy for AT&T from a dividend standpoint, yields 4.5% today. If AT&T's share price were to appreciate to the upper $40's, the company would have the same yield as Verizon.

One could argue that this approach highlights the potential for AT&T to cut its dividend to levels that are in line with Verizon's, instead of depending on share price appreciation. While this is a possibility, we find this as unlikely as management continues to prioritize the dividend and their ability to continue to pay current distributions.

Out Price Target for AT&T

By using three separate pricing approaches, we have arrived at or near the same price target for AT&T: $50. While this may seem aggressive compared to the current share price, we feel that this is attainable. Ultimately this price target is dependent on:

- Business lines returning to near pre-Pandemic levels later this year

- Continued support for the dividend and pay down of debt

- Investors shifting their view of the company to be a media investment and not just a telecommunications operation

Risks

Investors in AT&T also should closely evaluate the potential risks that can materially change the way the company delivers on their growth goals.

- Wireless Network - AT&T continues to invest heavily to create a robust 5G network and beyond. In the wireless space, it's a constant scrum among the major carriers to deliver the largest, fastest, and most reliable networks for their customers. This entails a large amount of capital to be spent each year to maintain market position. If AT&T were to make a misstep in this area, the decisions could be costly and could impact their ability to add customers.

- Warner Media - The COVID-19 Pandemic has changed the way we consume movies. While AT&T has positioned the company to deliver blockbuster movies direct to consumers, the revenue per movie might be significantly lower. This could have a largely negative impact as it's very expensive to bring a large scale movie to market. Ultimately, this could translate into lowered success per movie in the future.

- HBO Max - Currently, most hardware providers are allowing HBO Max to be available on their devices. If this were to change, the subscriber base and future subscriber growth could be negatively impacted.

Conclusion

In conclusion, while last week's earnings announcement was not as promising as we were hoping for, we continue to find tremendous upside for the company's shares. As a result, we have listed AT&T as one of the four Dividend Dominators for 2021 from our high dividend equity portfolio. We feel that as the market sentiment shifts, the company will begin to be viewed as a vibrant media business. This in turn should drive share prices much higher. In the meantime, investors are well compensated with a solid 7.2% dividend yield. If you don't already own shares of this company, you should consider adding it to your portfolio today.

One final note: I hope you enjoyed this article and my analysis of the company above. One favor that I ask is that you click the "Follow" button so that you can receive real-time e-mails for the articles that I publish and so I can grow my Seeking Alpha community. I value this as a personal thank you for this article and a vote of support as I share my experience and views in the markets to the broader Seeking Alpha Community.

As well, we are excited to launch the Dividend Armada service in Mid-February. The Armada was created to bring dividend investors "behind the curtain" with a seasoned professional money management team. In addition to sharing our full dividend portfolio and our screening process, Members will be brought into the discussion around the markets and changes to the model portfolio. Through creating a vibrant community of dividend focused investors, we aim to elevate the investing skill of our Armada.

We recently published a new post detailing this service. Click here to learn more and receive Founder subscription pricing.