Thesis

When BlackRock Inc. (NYSE:BLK) came out with earnings in January, the results confirmed what most investors already knew. The firm continued to maintain its dominant position in the asset management space with improving organic revenue growth and strong asset flows going into its signature exchange-traded funds. Its continued market share gains have forced many of its peers into a round of consolidation and management is taking advantage of the widening competitive gap by diversifying the firm's revenue streams. Over the last fiscal year, the firm renewed an emphasis on growing actively managed funds and further developing its Aladdin platform to the point where it's targeting eventually having a third of revenue coming from technology services. The gap with its competitors continues to widen and the premium on the stock is likely to do the same.

Earnings Results

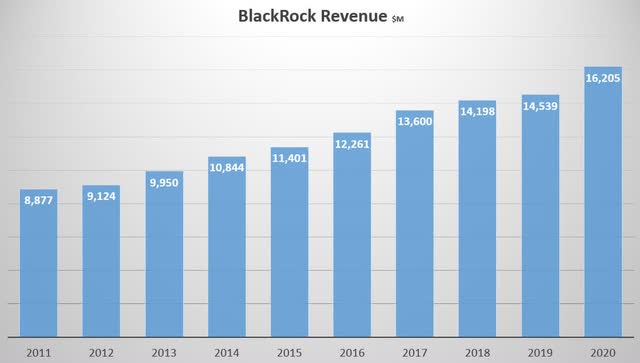

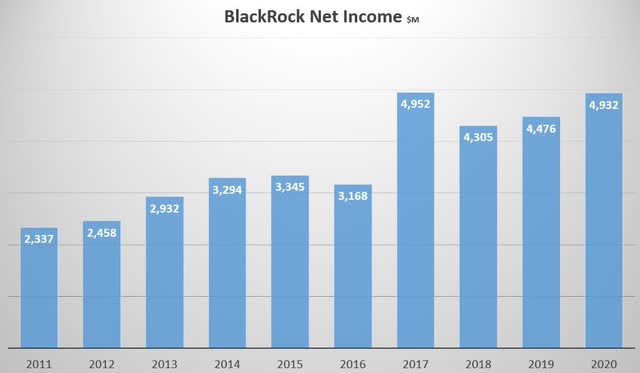

When fourth quarter and full year earnings were released on January 14 they revealed the completion of another strong year by the asset manager. Assets under management ("AUM") grew by 17% over the year to finish at just under $8.7 trillion from the previous year's $7.4 trillion. An organic growth rate of 5% was achieved through net inflows of $391 billion which contributed to an 11% increase in revenue for the year, which went from $14.5 billion in FY19 to $16.2 billion in FY20, and a corresponding 12% increase in diluted EPS, going from $8.29 per share in 2019 to $10.02 per share in 2020. BlackRock's revenues increased for all of the last decade and net income did the same with only a couple of exceptions.

Source: Source: Author, with data from Seeking Alpha

Source: Source: Author, with data from Seeking Alpha

The solid results permitted BlackRock to increase its quarterly dividend by 14%, going from a $3.63 quarterly payment to $4.13, and giving the firm