Investment Thesis

Cincinnati Financial (NASDAQ:CINF) grew EPS by an average 10.10% for the three years ended December 2019. Based on analysts' consensus estimates, EPS is projected to grow by negative 1.44%% average per year from 2019 to 2022. Despite this, taking into account analysts' low and high estimates, and dividend yield, returns of ~8% to 16% average per year are indicated for buying at current share price levels and holding through to end of 2022. Those return levels rely on P/E multiples around historical levels in the mid 20s. The projected negative EPS growth from 2019 to 2022 could cause multiples to contract, reducing returns below the ~8% to 16% indicated above. At the same time, investment income, which exceeds non-GAAP earnings over the last 3.75 years, is not reflected in the P/E multiple, which makes the actual P/E multiple not as high as it might appear. Cincinnati Financial is due to report Q4 and FY 2020 earnings, post market close on Feb. 10. Reported investment earnings, realized and unrealized, could be a counter to any non-GAAP earnings weakness.

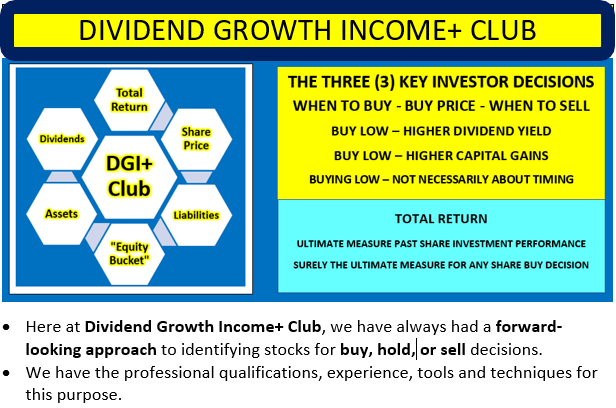

Looking for share market mispricing of stocks

What I'm primarily looking for here are instances of share market mispricing of stocks due to distortions to many of the usual statistics used for screening stocks for buy/hold/sell decisions. The usual metrics do not work when the "E" in P/E is distorted by the impact of COVID-19. And if the P/E ratio is suspect, so too, then, is the PEG ratio similarly affected. I believe the answer is to start with data at the end of 2019, early 2020, pre-COVID-19 and compare to projections out to the end of 2022 or later, when hopefully the impacts of COVID-19 will have largely dissipated. Summarized in Tables 1, 2, and 3 below are the results of compiling and analyzing the data on this basis.

Dividend Growth Income+ Club - Register today for your Free Trial.

Click Triple Treat Offer (1) Your Free 2 Week Trial; (2) 20% Discount New Members; (3) Bespoke reviews for tickers of interest to subscribers.