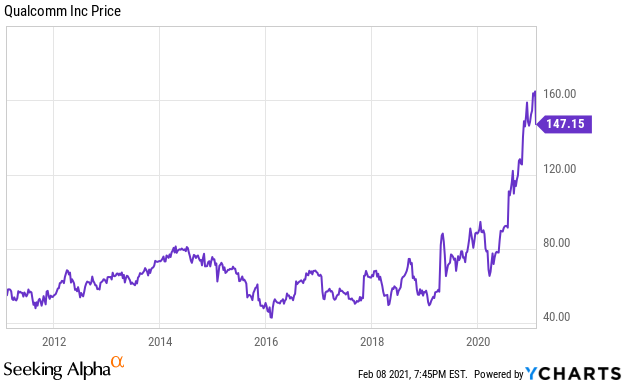

Despite the strong performance over the last year, Qualcomm (NASDAQ:QCOM) shares have a lot more upside potential ahead. Specifically, the continuing wave of 5G connectivity combined with Qualcomm’s significant competitive advantages make the shares attractive. In this report, we review the business, the unique licensing model, the Nuvia acquisition, valuation and risks, and then conclude with our opinion on investing.

Overview:

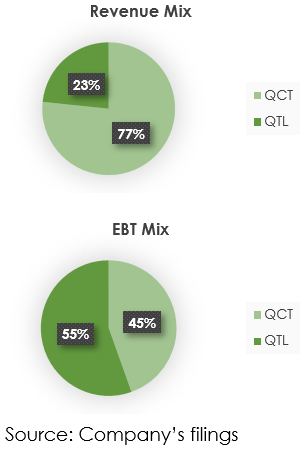

Headquartered in San Diego, California, Qualcomm is engaged in the business of providing wireless technology solutions and intellectual property. The company has 41,000 employees and nearly 13,000 customers across multiple industry verticals and 40+ countries. Qualcomm’s technologies and products are used in mobile phones, smartwatches, laptops, network equipment, automotive telematics and infotainment systems, and other IoT devices. The company’s registered trademarks include Qualcomm, Snapdragon, MSM, Hexagon, and Adreno. Qualcomm operates primarily under two operating segments, Qualcomm CDMA Technologies (“QCT”) and Qualcomm Technology Licensing (“QTL”). QCT accounts for the majority of the company’s revenue (76.6%) while QTL accounts for the majority of the profits (EBT share: 55.5%). More details about the company’s key segments are presented below:

QCT (Qualcomm CDMA Technologies): In this segment, the company sells integrated circuits and system software based on 3G, 4G, 5G or other technologies for use in IoT and other wireless connected devices such as Snapdragon platform for mobile and automotive, Hexagon™ processors, Adreno™ GPUs, etc. It also sells RF front-end (“RFFE”) products used in various IoT devices to reduce power consumption and to improve radio performance. The majority of QCT’s revenue comes from the sale of products used in handsets.

QTL (Qualcomm Technology Licensing): In this segment, Qualcomm derives revenue from royalties or from granting licenses and rights for use of the company’s intellectual property for manufacturing certain wireless products, including products using CDMA2000, WCDMA, CDMA TDD, LTE or OFDMA-based 5G standards and their derivatives. The segment has an