HealthEquity (NASDAQ:HQY) is a leading custodian of Health Savings Accounts (HSA) with leading market share in HSA accounts and assets under management. This article illustrates the company's performance in 2020 and provides commentary on improvements in KPIs that make it a great long-term investment.

Performance in 2020

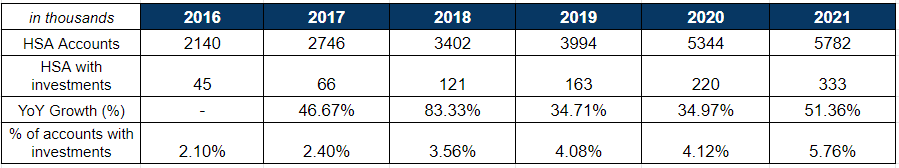

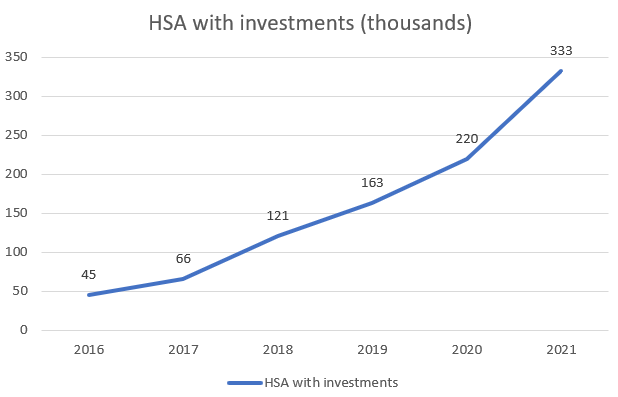

HealthEquity's HSA assets under management grew 24% YoY and the total number of HSA accounts with investments grew 51% YoY to 333k

I am happy to see the growth in HSA accounts with investments. As indicated in my previous articles on the company, this is an untapped potential that has strong potential to add to the bottom line with greater margins.

Data Source: Author's calculation

Source: Author's calculation

Even with such growth in accounts with investments, only 5.7% of total accounts hold investment balance, thus indicating huge potential ahead.

HealthEquity's average account balance grew by 15%. Leadership mentioned that contribution from new members was higher than previous years.

The Consumer Directed Benefits segment of the business faced challenges due to the pandemic. With the majority of the workforce working from home and no significant office re openings, the company reported that 650k commuter accounts remained suspended.

HealthEquity also reported a decline in FSA member enrollment during 2020.

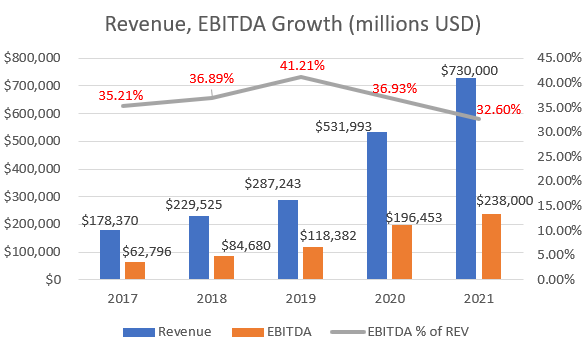

As a result of the pandemic, despite 37% YoY revenue growth and a 21% YoY EBITDA growth, the EBITDA as a percentage of revenue saw decline.

Source: Author's calculation

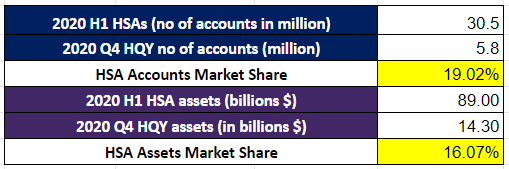

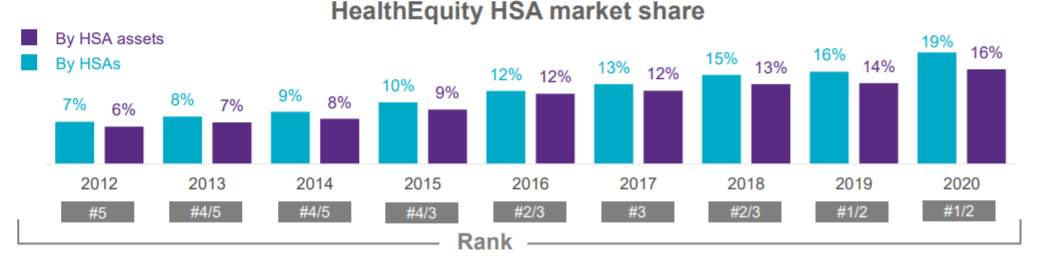

HealthEquity leads the HSA sector with 19% market share in total number of HSA accounts, and 16% market share in total custodial assets.

Source: Author's calculation

Source: Investor Presentation

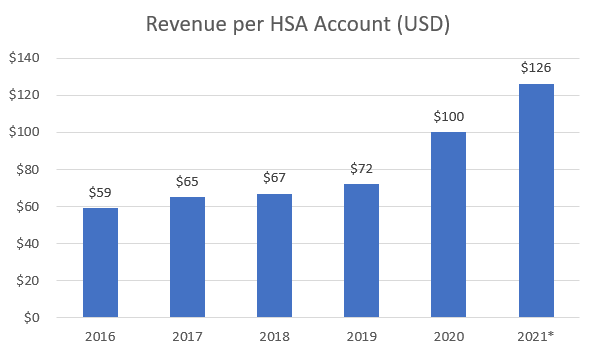

We can also see that the revenue per HSA account has doubled since 2016, and this metric is clearly indicative of growing value for HealthEquity from every account holder.

Source: Author's calculation

Opportunities to grow

There are three